Chinese power sector booming

CHINA - China unveiled a raft of targets for its energy and power sectors, revealing a plan for a rapid increase in power generation but a much slower rise in the country's oil refining capacity over the next five years.

China, already the world's top energy user, faces the challenge of keeping its growing economy fueled while cutting back on its staple fuel, cheap but dirty coal.

Although energy use is certain to grow, the government wants energy consumption to rise much more slowly than the economy overall, and hopes to bolster supplies of cleaner energy sources.

China has already said it will spend 5 trillion yuan US $755 billion on clean energy over the next decade to lift the non-fossil fuel component of its supply to 15 percent of primary energy demand by 2020, up from 8 percent in 2009.

Zhang Ping, the head of the top economic planning body, said the country had met its five-year target to reduce energy consumption per unit of gross domestic product by 20 percent by the end of 2010.

Chinese officials are still deliberating energy intensity targets for the next five years, but media reports have said the figure for 2011-2015 could be 17.3 percent, one of the many targets to be set under a five-year plan, which will be launched by the country's parliament in March.

Power generating capacity is expected to hit 1,440 gigawatts by 2015 and 1,760 GW by 2020, Liu Zhenhua, general manager of the State Grid Corp of China, was quoted as saying by state media.

Zhang Guobao, the head of the National Energy Administration, said generating capacity stood at 950 GW at the end of 2010, so Liu's forecasts imply growth of 52 percent in the next five years and then a further 22 percent rise in the following five years.

Thermal power capacity, which includes coal, oil and gas and accounts for the bulk of China's electricity generation, will rise by 80 GW in 2011 and 260-270 GW by 2015, Zhang Guobao said.

He said by 2015 China should add 38 gigawatts of nuclear power capacity and 140 gigawatts of hydropower capacity. That compares to capacity of about 10 GW and 200 GW respectively at the end of 2010 and signals a much faster roll-out of those power sources than many had expected.

Some media reports had put the 2015 target for total nuclear power capacity at 39 GW and for hydropower at 250 GW.

Zhang did not give a target for wind power, the other big component of alternative energy, but his agency has previously said it should have 90 GW of capacity by 2015.

Although the targets show renewables taking a much bigger share of the overall energy mix, thermal power will continue to be a bigger absolute source of new power generating capacity.

But Zhang also said China had made cuts in coal use over the last five years by replacing outdated thermal power plants with environmentally friendly ones, which saved more than 300 million tonnes of coal, and by pushing clean energy, which saved a further 1.5 billion tonnes of coal.

The government is also trying to make coal work more efficiently by building new power plants in the coal-rich western regions of China and by investing heavily in ultra-high voltage power lines, a new technology which allows the power from coal to be sent over long distances.

It plans to invest more than 500 billion yuan in the technology by 2015, building 40,000 km of UHV lines.

The targets for power supply are much more aggressive than the planned growth in oil refining capacity, which Zhang Guobao said would hit 600 million tonnes, or 12 million bpd, by 2015, with annual refined oil output of 310 million tonnes.

That signals a rise of about 20 percent in refining capacity over five years, less than a Reuters calculation based on estimates from industry officials and local media, which showed China was likely to add more than 3.0 million bpd of new refining capacity between 2011 and 2015.

China's oil demand has hit record highs this year, rising 13.9 percent in November to more than 9.3 million bpd, but the country's top refiner Sinopec Corp expects it to grow 5-6 percent per year over the next five years.

Although refining growth may be modest, it is widely expected to outpace the growth of China's own oil production, making the country more dependent on foreign oil.

Zhang Guobao said China's oil output may hit 190 million tonnes 3.75 million bpd in 2011, barely more than the 185.557 million tonnes produced in the first 11 months of 2010.

Gas production is growing faster, with output likely to exceed 100 billion cubic meters in 2011, Zhang said, compared to 86.74 bcm of gas produced in the first 11 months of 2010.

Gas demand is rising fast and Zhang said 60 million rural households would use gas by 2015.

Related News

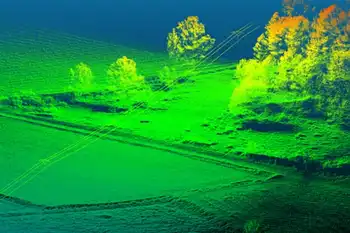

New Photogrammetry Software Optimized for Aerial Drone Photography

Vancouver, BC - Vancouver, BC – Oct. 26, 2016 – New photogrammetry software optimized specifically for photographs taken with drones or unmanned aerial systems (UAS). The new PhotoModeler UAS 2016 software creates 3D models, measurements, and maps from photographs taken with ordinary cameras built-in or mounted on drones. It includes numerous features for optimized operation with drone photos including post processing kinematics (PPK), volume objects, full geographic coordinate systems support, multispectral image support and control point assist.

The new version of PhotoModeler is ideally suited for drone photogrammetry applications including surveying, ground contouring, surface model creation, stock pile volume measurement,…