Ontario's Energy Minister defends low-priced power exports

By

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The provinceÂ’s generating companies and its industrial power customers say the same thing.

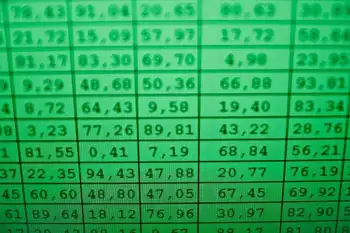

TheyÂ’re responding to analysis by three energy market experts who suggest the current system gives energy traders the opportunity to make millions of dollars selling power into neighbouring markets.

But in an interview with the Toronto Star, Duguid defended current practice. And he said the issue may be moot in a few years, as Ontario will have far less energy available for export.

The issue was raised by Jan Carr, former chair of the Ontario Power Authority, and two consultants who were long-time energy traders, Lucia Tomson and Greg Baden.

The three noted that exported power doesn’t attract an extra fee called the “global adjustment.”

ItÂ’s a fee that makes up the difference between the Ontario market price, and the generally higher prices paid to renewable energy operators and others who hold contracts with the Ontario Power Authority.

Ontario customers pay the global adjustment fee, which used to be trivial, but now is often close to, or equal to, the market price.

Traders can buy Ontario power without paying the global adjustment, then sell it outside the province to take advantage of those markets if prices are higher.

But Duguid says that on days when Ontario has surplus power, it makes sense to export.

Why not, he asks: “You’d be sitting there with your power getting nothing for it . . . you’d waste it. You wouldn’t be able to export and you’d get nothing for it.”

The alternative would be to scale back production at nuclear plants — a slow and costly process — or to let water spill around hydro stations.

Since the power stations have already been built, Duguid says, it makes sense to use their power and recover at least some revenue from their operation.

Slapping the hefty global adjustment fee onto exported power would simply price Ontario power out of the market, leaving it bottled up in Ontario and forcing production cutbacks, he argues.

So has Ontario over-built its power system? Not at all, Duguid says.

The surpluses that now challenge the system wonÂ’t be there in a few years, because many of the nuclear plants, which produce half of OntarioÂ’s power, are in need of mid-life refits.

It will take years to take them off-line, one at a time, and refurbish them, Duguid says.

“For a significant period of time, our system is going to need all the generation we can provide to make up that difference.”

“If we were to slow down generation now, we would be placing the system in the next five to 10 years at great risk.”

Not everyone agrees, least of all the Conservatives, who have been making energy pricing one of their targets in the run-up to this yearÂ’s election.

“There is something wrong here,” says Conservative energy critic John Yakabuski. “The Ontario citizen, be they corporate or personal, is being asked to subsidize the windfall of someone outside of the province. It just shows these guys are so inept when it comes to forging an energy policy, things were completely ignored or failed to be considered.”

But Yakabuski isnÂ’t offering his own prescription.

“We’ve got problems with the global adjustment in general,” he says. “I can’t give you a solution over the phone for something they have failed to deal with over the last few years.”

Peter Tabuns of the New Democratic Party was also critical.

“It’s simply outrageous that Ontario families are getting zapped with high electricity rates, including the HST, while the McGuinty Liberals subsidize electricity consumers in the United States and Quebec,” he said.

Ontario generating companies arenÂ’t worried about export pricing. David Butters, who heads the Association of Power Producers of Ontario, says theyÂ’re an inevitable part of a system that has to have the capacity to meet demand at peak periods.

During periods of lower demand, itÂ’s natural for surplus capacity to develop, and for prices to slide.

But generators still benefit even from the lower prices, he argues.

Butters compares it to a cottage owner renting his property out during the winter months, at off-season rates. At least he gets some income from the low rental rates to pay the property taxes, and buy a canoe for the summer otherwise, during the winter heÂ’d get nothing.

Recovering a portion of their costs on export markets means that generators donÂ’t have to recover them from domestic customers, he notes.

If they were locked into Ontario, generators would have to recover all that money from domestic customers in the form of higher prices, he argues.

Adam White, who heads the Association of Major Power Consumers, agrees that raising the price of exports is wrong, and suggests an alternate strategy.

He says rates should be redesigned so that consumers and businesses have more incentive to use power when both demand and prices are low.

That would reduce surpluses, and allow power generated in Ontario to be used here, he said.

“The advantage of domestic consumption is it adds value in terms of industrial productivity, investment and jobs,” said White.

ItÂ’s not just the energy portion of the bill that should drop when demand is slack, White says. HeÂ’d also like to see consumers get a break during low demand periods on the fixed-rate part of the bill, such as the delivery and debt retirement charges.