Green energy plans are high priority

Republican and Democratic lawmakers, as well as GOP Gov. Jim Gibbons, have focused on renewable energy as a lifeline that will help pull the state out of its harshest economic recession in decades.

More than half a dozen energy bills reflecting different philosophies for attracting the industry to Nevada are being considered. As lawmakers try to direct the policy, they're dealing with dozens of competing lobbyists working to get an edge for their clients in opposing energy sectors.

A final energy compromise is expected to emerge soon, combining measures from both houses as the session's June 1 deadline nears.

The major bills include SB395, sought by Gibbons, which proposes to transform Nevada from a state that spends $9 billion on fuel costs and importing energy to a renewable energy exporter.

As amended, the plan would abate property taxes of renewable energy producers for 10 years. The tax break also would help developers of transmission lines for such projects.

The measure would increase the percentage of electricity that NV Energy must obtain from renewable sources to 25 percent by 2025.

SB358, sought by Senate Majority Leader Steven Horsford, D-North Las Vegas, would streamline rules, foster innovation and employ various incentives to attract large and small-scale renewable energy developers.

Property tax breaks of up to 75 percent would extend for 20 years for renewable energy producers and for 10 years for renewable energy equipment manufacturers.

Unlike Gibbons' bill, SB358 would require companies to hire two-thirds of their workers from within the state. Horsford's bill also would abolish the governor's Energy Office and create a Renewable Energy and Energy Efficiency Authority to oversee the state's renewable energy efforts.

SB358 also would increase the percentage of energy that NV Energy must get from renewable sources to 25 percent by 2025 — and also require that 2 percent come from power generated by small businesses, schools or homeowners with their own renewable energy systems.

AB522, by Assemblywoman Marilyn Kirkpatrick, D-North Las Vegas, would restructure the way the state uses tax abatements to draw renewable energy developers and streamline renewable energy regulation.

Of the three bills, AB522 provides the least generous tax abatements. Renewable energy developments would be eligible for 50 percent abatements on property and sales taxes for five years if they purchase 30 percent of their materials in the state and for two years if they do not.

The key difference in the Assembly bill is that it seeks to establish a fund to help rate-payers lower their energy costs. To that end, the bill would create a small excise tax on renewable energy produced in the state to fund a conservation rebate program and energy assistance program.

Related News

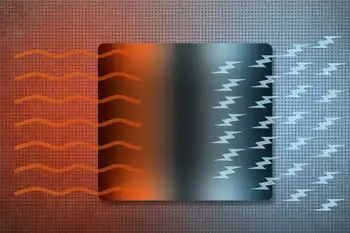

Turning thermal energy into electricity

NEW YORK - With the addition of sensors and enhanced communication tools, providing lightweight, portable power has become even more challenging. Army-funded research demonstrated a new approach to turning thermal energy into electricity that could provide compact and efficient power for Soldiers on future battlefields.

Hot objects radiate light in the form of photons into their surroundings. The emitted photons can be captured by a photovoltaic cell and converted to useful electric energy. This approach to energy conversion is called far-field thermophotovoltaics, or FF-TPVs, and has been under development for many years; however, it suffers from low power density and therefore…