Solar gloom overshadows Q-Cells, Solon

Q-Cells, the world's largest maker of solar cells, slashed its 2009 sales outlook for the third time since December, while German peer Solon, a solar module maker, posted a bigger-than-expected first-quarter net loss.

"In view of the ongoing uncertain market environment due to financing restrictions for larger PV (photovoltaic) systems in particular, it is currently still difficult to give a precise forecast for the full year," Q-Cells said in a statement.

Q-Cells said it now expected 2009 sales to come in between 1.3 billion and 1.6 billion euros (US$1.77-2.18 billion), down from the previous 1.7-2.1 billion euro forecast range.

Massive oversupply of cells, modules and wafer had led Q-Cells — along with the world's No.2 cell maker Sharp Corp — to cut outlooks or jobs earlier this year, while Solon withdrew its 2009 outlook last year.

"The cut in guidance is somewhat negative but no huge negative surprise," DZ Bank Sven Kuerten wrote in a note.

"Due to the relatively good cost control, the fact that short-term financing issues are resolved due to the sale of the REC stake and the good project business we keep our Buy rating unchanged," he added.

Q-Cells posted sales of 224.8 million euros for the first quarter and a net loss of 391.9 million euros, partly linked to writedowns on the sale of its stake in Norway's Renewable Energy Corporation, a move that was widely expected by analysts.

Solon's net loss was 18.5 million euros, missing a consensus of 14 million in a Reuters poll of analysts.

Its stock pared losses but were still down 1.3 percent.

"All in all, reported Q109 results should be taken very negatively by the market especially when considering the recent upmove and the very high likelihood of significant earnings downgrades in due course," Equinet analyst Sebastian Growe wrote in a note.

Solon shares have more than doubled since hitting a 2009 floor on March 9.

"While demand for solar modules has been on the rise again in the second quarter, the power plants business is still suffering from the ongoing critical situation in project finance," it said in a statement.

"Therefore assume that Solon will also finish the second quarter with a loss."

Solon in April said it may have to take an impairment loss of 40 million euros due to funding problems at Silicium de Provence, an affiliated French company.

"The extremely weak operating performance is further increasing the very high liquidity risk of Solon. We see the stock as a very clear 'sell'," wrote DZ Bank's Kuerten.

Related News

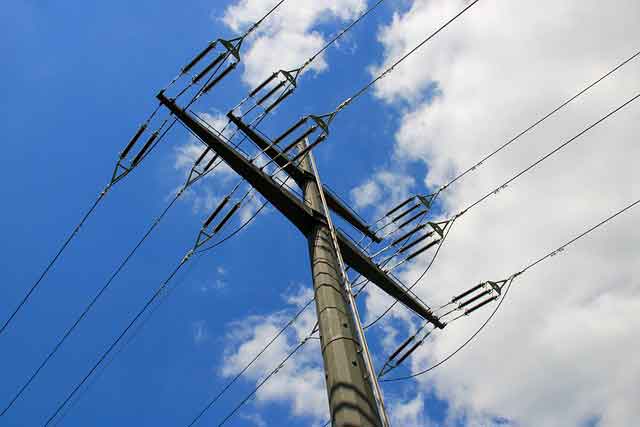

Maritime Link almost a reality, as first power cable reaches Nova Scotia

HALIFAX - The longest sub-sea electricity cable in North America now connects Nova Scotia and Newfoundland and Labrador, according to the company behind the $1.7-billion Maritime Link project.

The first of the project's two high-voltage power transmission cables was anchored at Point Aconi, N.S., on Sunday.

The 170-kilometre long cable across the Cabot Strait will connect the power grids in the two provinces. The link will allow power to flow between the two provinces, and bring to Nova Scotia electricity generated by the massive Muskrat Falls hydroelectric project in Labrador.

Ultimately, the Maritime Link will help Nova Scotia reach the renewable energy…