Texas regulators talk incentives

TEXAS - Changes may be needed to encourage construction of fast-starting power plants to help Texas maintain reliable electric service as older generating units are forced to retire, the state's top utility regulator said.

Texas faces a period of tightening power supplies as stricter federal environmental rules threaten to shut some aging gas and coal-fired power plants and developers say Texas wholesale prices are too low to justify new power-plant construction.

Rules being finalized by the U.S. Environmental Protection Agency will further limit air and water emissions and could force the retirement of more than 8,000 megawatts of natural gas-fired generation and 1,200 MW of coal-fired generation depending on how final rules are written, according to a report from the Electric Reliability Council of Texas ERCOT.

Texas Public Utility Commission Chairman Barry Smitherman, who requested the study from ERCOT, said power-plant developers have typically broken ground on new generation when they see a drop in the region's reserve margin — surplus power needed to help avoid blackouts.

But uncertainty over the effect and timing of the new EPA rules, the uneven economic recovery and the outlook for a long period of low gas prices has complicated the situation, ERCOT officials said.

Smitherman said the retirement of a large number of gas-fired plants may not create operating problems for the Texas grid because units likely to shut do not run frequently now.

However, ERCOT's report said the location of the plants likely to shut — near Houston and Dallas — could create transmission headaches, requiring new power lines or new gas-fired plants that can start quickly when called on.

In ERCOT's deregulated market, generation owners bear the risk of investment and decide when to build new generation, based on wholesale prices and other conditions.

Unlike other markets, Texas does not offer capacity payments through which developers receive financial incentives to plan new power plants.

Quick-start plants, called peakers, generally do not operate enough hours of the year to be profitable under current ERCOT rules.

Smitherman said he wants to find ways to encourage companies to build peakers, which the grid will need to balance growing wind generation and to bolster the reserve margin in times of high demand during hot and cold weather conditions.

"What incentives are needed to get peakers going?" Smitherman said. "We are open to any ideas to give the right price signals."

That could include changes to the way power is scheduled in ERCOT or by allowing for extended scarcity pricing so that peakers can be profitable.

The commissioners also want to see comments from other ERCOT participants about implications of the retirement study.

Related News

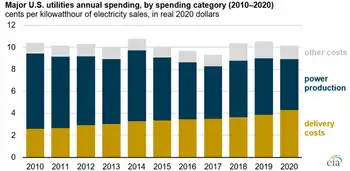

Major U.S. utilities spending more on electricity delivery, less on power production

WASHINGTON - Over the past decade, major utilities in the United States have been spending more on delivering electricity to customers and less on producing that electricity.

After adjusting for inflation, major utilities spent 2.6 cents per kilowatthour (kWh) on electricity delivery in 2010, using 2020 dollars. In comparison, spending on delivery was 65% higher in 2020 at 4.3 cents/kWh. Conversely, utility spending on power production decreased from 6.8 cents/kWh in 2010 (using 2020 dollars) to 4.6 cents/kWh in 2020.

Utility spending on electricity delivery includes the money spent to build, operate, and maintain the electric wires, poles, towers, and meters that…