Coal plant fires up Painesville residents

By The News-Herald

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

An environmental organization, a handful of Painesville residents and at least one councilman disagree and say it could mean increased rates.

During a town hall-style forum, representatives from the Sierra Club informed residents about the proposed coal plant that will be built in southern Ohio.

In 2007, Painesville City Council voted to participate in the construction of the plant, along with 81 other municipalities that are members of American Municipal Power.

Resident Angelo Cimaglio said he was confused about the city's involvement. If council did indeed participate, Cimaglio said he thinks it was the wrong decision to make.

"Why are we a city of 17,000 involved in a deal like this?" said Cimaglio, adding Painesville is small compared to Cleveland, which also is participating.

"I don't know how they sold this to our city fathers."

Councilman Andrew Flock hosted the meeting and voted against signing the contract, which locks Painesville into a 1.3 percent share of the 960 megawatt-hour facility for 50 years. AMP was not invited to the forum.

"I still don't know what price we're going to have to pay for this plant," Flock said. From an initial price of $1.5 billion in 2006, the plant jumped in price to $3.94 billion in 2008, according to the Sierra Club.

"I feel today like I did two years ago. Voting for a 50-year contract was not a good idea," Flock said.

While the market could conceivably drive prices down, AMP's Senior Director of Communications Kent Carson said the whole point of the proposed plant is to offer market stability to its members.

Sierra Club spokesman Nachy Kanfer pointed out that electric usage could in fact go down. With the help of Senate Bill 221, electric rates will cumulatively reduce energy consumption by 22 percent over the next 25 years.

"No one knows what the reality will be like in 50 years, but no matter what, Painesville will be involved in this plant," Kanfer said.

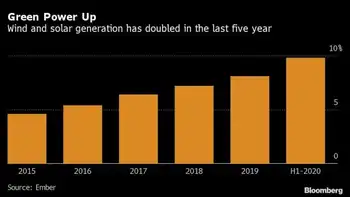

Instead of building coal-fired plants, Kanfer said AMP needs to focus on renewable energy.

AMP received $143.7 million in bonds from the U.S. Treasury Department to use toward renewable energy products, Carson said.

AMP will focus on eight projects in five states, which will use at least one of the following renewable energy sources: hydroelectric, and wind and solar energies, as well as harnessing methane gas from landfills, Carson said.

In Bowling Green, AMP operates a wind farm.

Carson added that AMP does not focus all of its resources on coal.

"We understand the need for diversification. We understand the need to support renewable energy sources," said Carson, adding that there should be a balance.

AMP's annual conference is under way this week in Cleveland, and Kanfer said it offers members a unique opportunity to voice their concerns about the proposed plant.

If enough communities are against the project, AMP would likely shut it down.

"It's not set in stone. AMP would you tell you they serve their members," Kanfer said.

Carson agreed that they would respond to their members' wishes, but he advised against pulling out of the project.

During the conference, Kanfer suspects that AMP's members could vote on a final notice to proceed on the project. Carson added that he is not aware of any votes taking place.

With an alleged vote going on, city resident Sandy Miller said she's more concerned that no one seems to care.

"I can't believe our council people would sign this," Miller said.

"I've gone door-to-door and the people don't even know about this."