ChalcoÂ’s Xiao seeks coal, hydro assets to cut costs

BEIJING, CHINA - Aluminum Corp. of China Ltd., the nationÂ’s biggest producer of the metal, is seeking to buy coal mines and build power stations to reduce output costs.

The company may also secure hydropower supplies for its smelters, Chairman Xiao Yaqing, 49, said in a Bloomberg television interview in Hong Kong. Chalco has bought minority stakes in two coal mines in Gansu and Henan provinces, and will buy more when valuations are more “rational,” Xiao said.

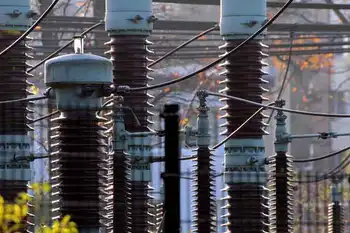

ChinaÂ’s largest aluminum producers slashed output by more than a tenth from August because of a shortage of electricity, which accounts for as much as 40 percent of costs. Rio Tinto Group last year bought Alcan Inc. to secure hydropower supplies in Canada for aluminum production.

“We have been looking for opportunities to obtain coal and hydropower resources to ensure energy supply,” Xiao said. “We can work with local companies” to secure hydropower supplies in western provinces such as Qinghai and Gansu, he said.

Chalco, as the Beijing-based company is known, fell 4 percent to [HK]$6.81 at 12:28 p.m. local time. In Shanghai trading, it dropped 0.3 percent to 9.78 yuan at the 11:30 a.m. break.

Energy coal prices in China jumped 41 percent in the first- half from a year ago period after the government closed small mines and demand from utilities surged. China is fighting a sixth year of power shortage and has raised electricity charges in the second half of the year.

“If coal prices keep rising this fast, it could be cheaper to use nuclear to generate power,” Xiao said. “It’s a right direction for China to develop nuclear power.”

China is turning to alternative energy to cut reliance on polluting coal, which generates almost 80 percent of the nationÂ’s electricity. Nuclear-capacity will rise to at least 60 gigawatts by the end of next decade, according to Wang Yonggan, secretary of the China Electricity Council.

Chalco posted a 65 percent drop in first-half profit on rising coal, electricity and bauxite costs. It plans to double bauxite mine supplies to obtain half of the raw material it needs from its own mines in 2009 to help cut purchasing costs. Cost cutting is a priority in the second half, the company said.

“I am very certain to say that the majority of the aluminum producers will suffer in second half, and many will quit the business and pursue more profitable business,” Xiao said. Smelters in China will cut output and delay new capacity, he said.

A reduction in ChinaÂ’s aluminum smelting capacity may support prices of the metal used in planes, cars and beverages cans. The metal price jumped to a record in July when ChinaÂ’s 20 largest aluminum smelters first said they will cut output by 10 percent from August.

“I am sure, if the economy is not too bad, the aluminum industry may have a chance of recovering as early as the second half of the year,” Xiao said.

Related News

Can the Electricity Industry Seize Its Resilience Moment?

WASHINGTON - When operators of Duke Energy's control room in Raleigh, North Carolina wait for a hurricane, the mood is often calm in the hours leading up to the storm.

“Things are usually fairly quiet before the activity starts,” said Mark Goettsch, the systems operations manager at Duke. “We’re anxiously awaiting the first operation and the first event. Once that begins, you get into storm mode.”

Then begins a “frenzied pace” that can last for days — like when Hurricane Florence parked over Duke’s service territory in September.

When an event like Florence hits, all eyes are on transmission and distribution. Where it’s…