California OKs carbon fee on utilities, industry

By Associated Press

NFPA 70e Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The money raised by the California Air Resources Board, which voted 9-0, is intended to pay for the bureaucratic expenses of carrying out the state's 2006 global warming law, which requires greenhouse gas emissions statewide to be reduced by 25 percent over the next decade.

"It's never pleasant to be in the position of asking consumers to pay," chairwoman Mary Nichols said at the board's meeting in the Southern California city of Diamond Bar. "While we asking for investments here, these are investments being made as our economy begins to come back from the worst recession since the Great Depression."

The fee will be imposed at the end of 2010 and raise $63.1 million annually during its first three years. The amount will level off at $36.2 million in the fifth year.

Oil companies, manufacturers and utilities complained regulators had unfairly singled them out, leveling the fee on just 350 businesses in the state. Some business leaders also questioned the timing of the fee, which is being imposed while California endures a 12.2 percent unemployment rate, the highest on record.

"Given the economic climate, we believe it is extremely unwise to ask businesses to pay more government fees," said Jacque McMillan, a member of the Valley Industry Commerce Association, which represents businesses in the San Fernando Valley.

Republican gubernatorial candidate Meg Whitman earlier this week drew the ire of Gov. Arnold Schwarzenegger when she described the 2006 law he signed as a "job-killing" regulation. She said would suspend it if elected governor until its effects on the economy are better understood.

Part of the fee would cover the salaries of 174 people hired to implement the law since Schwarzenegger signed it.

About 350 businesses in California that make, sell or import gasoline, diesel, natural gas and coal would be charged roughly 15 cents for every ton of carbon dioxide that they and their customers emit into the atmosphere.

The average refinery would pay about $4.7 million and the average cement plant would pay about $150,000 a year, said Jon Costantino, manager of the climate change planning section at the air board. Cement plants would be subject to the fee because the chemical process they use to make cement produces greenhouse gases.

The charge would drop to 9 cents per ton of carbon dioxide in 2014 because loans approved in past years by the Legislature to initially run the program would be paid.

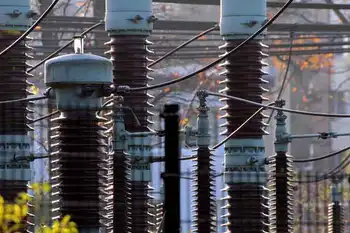

Regulators say the industries asked to pay the fee represent the starting point for roughly 85 percent of California's greenhouse gas emissions. For example, refineries process the fuel that California drivers put into their cars, and utility plants generate the electricity used to cool and heat the homes of the state's 38 million people.

The approach won the endorsement of environmentalists and public health groups who have long blamed industry for making products that pollute the air and sicken residents.

"California taxpayers have already borne the burden of this economy," said Bill Haller, a volunteer with the Sierra Club of California. "It's time for the polluter to pay for the pollution. They created it, they profited from it, and they should pay for it."

Oil companies and several utilities argued the fee unfairly holds them accountable not just for their own emissions but also for those generated by people who use their products. They also warned that regulators were proposing a fee that violates federal commerce laws by assessing a state fee on gasoline and electricity exports.

"There will be potential federal court challenges on the Commerce Clause because you're assessing fees on fuels going to other states — Nevada, Arizona and Texas," said Catherine Reheis-Boyd, chief operating officer at the Western States Petroleum Association.

Regulators say industry could pass along the fee to consumers by raising their prices. For example, a family restaurant would see an increase of about $17 a year in its electricity and natural gas costs. The extra cost to each Californian to fuel a car that gets 30 miles per gallon would be about 80 cents a year.

A few local government entities have adopted similar fees. Last year, air regulators in the San Francisco Bay area imposed a 4.4-cent-per-ton carbon fee on businesses that emit greenhouse gasses. In 2006, voters in Boulder, Colo., imposed a carbon tax on their own energy use.