Electric vehicle owners can get paid to sell electricity back to the grid

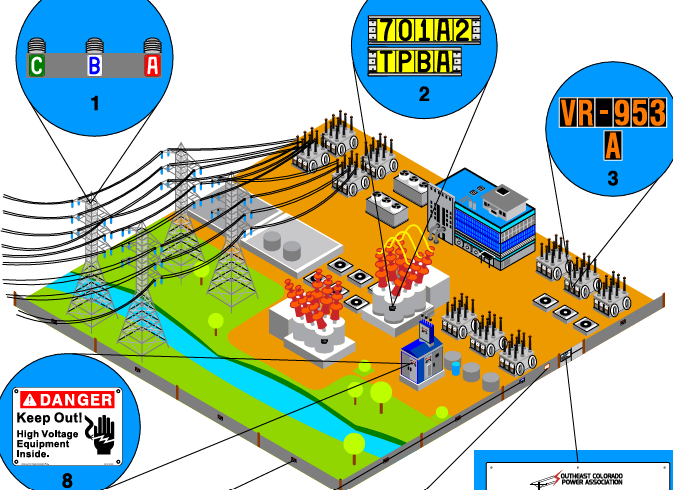

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Ontario EV V2G Pilots enable bi-directional charging, backup power, and grid services with IESO, Toronto Hydro, and Hydro One, linking energy storage, solar, blockchain apps, and demand response incentives for smarter electrification.

Key Points

Ontario EV V2G pilots test bidirectional charging and backup power to support grid services with apps and incentives.

✅ Tests Nissan Leaf V2H backup with Hydro One and Peak Power.

✅ Integrates solar, storage, blockchain apps via Sky Energy and partners.

✅ Pilots demand response apps in Toronto and Waterloo utilities.

Electric vehicle owners in Ontario may one day be able to use the electricity in their EVs instead of loud diesel or gas generators to provide emergency power during blackouts. They could potentially also sell back energy to the grid when needed. Both are key areas of focus for new pilot projects announced this week by Ontario’s electricity grid operator and partners that include Toronto Hydro and Ontario Hydro.

Three projects announced this week will test the bi-directional power capabilities of current EVs and the grid, all partially funded by the Independent Electricity System Operator (IESO) of Ontario, with their announcement in Toronto also attended by Ontario Energy Minister Todd Smith.

The first project is with Hydro One Networks and Peak Power, which will use up to 10 privately owned Nissan Leafs to test what is needed technically to support owners using their cars for vehicle-to-building charging during power outages. It will also study what type of financial incentives will convince EV owners to provide backup power for other users, and therefore the grid.

A second pilot program with solar specialist Sky Energy and engineering firm Hero Energy will study EVs, energy storage, and solar panels to further examine how consumers with potentially more power to offer the grid could do it securely, in part using blockchain technology. York University and Volta Research are other partners in the program, which has already produced an app that can help drivers choose when and how much power to provide the grid — if any.

The third program is with local utilities in Toronto and Waterloo, Ont., and will test a secure digital app that helps EV drivers see the current demands on the grid through improved grid coordination mechanisms, and potentially price an incentive to EV drivers not to charge their vehicles for a few hours. Drivers could also be actively further paid to provide some of the charge currently in their vehicle back to the grid.

It all adds up to $2.7 million in program funding from IESO ($1.1 million) and the associated partners.

“An EV charged in Ontario produces roughly three per cent of emissions of a gas fuelled car,” said IESO’s Carla Nell, vice-president of corporate relations and innovation at the announcement near Peak Power chargers in downtown Toronto. “We know that Ontario consumers are buying EVs, and expected to increase tenfold — so we have to support electrification.”

If these types of programs sound familiar, it may be because utilities in Ontario have been testing such vehicle-to-grid technologies soon after affordable EVs became available in the fall of 2011. One such program was run by PowerStream, now the called Alectra, and headed by Neetika Sathe, who is now Alectra’s vice-president of its Green Energy and Technology (GRE&T) Centre in Guelph, Ont.

The difference between now and those tests in the mid-2010s is that the upcoming wave of EV sales can be clearly seen on the horizon, and California's grid stability work shows how EVs can play a larger role.

“We can see the tsunami now,” she said, noting that cost parity between EVs and gas vehicles is likely four or five years away — without government incentives, she stressed. “Now it’s not a question of if, it’s a question of when — and that when has received much more clarity on it.”

Sathe sees a benefit in studying all these types of bi-directional power-flowing scenarios, but notes that they are future scenarios for years in the future, especially since bi-directional charging equipment — and the vehicles with this capability — are pricey, and largely still not here. What she believes is much closer is the ability to automatically communicate what the grid needs with EV drivers, as Nova Scotia Power pilots integration, and how they could possibly help. For a price, of course.

“If I can set up a system that says ‘oh, the grid is stressed, can you not charge for the next two hours? And here’s what we’ll offer to you for that,’ that’s closer to low-hanging fruit,” she said, noting that Alectra is currently testing out such systems. “Think of it the same way as offering your car for Uber, or a room on Airbnb.”