Electricity subsidies to pulp and paper mills to continue, despite NB Power's rising debt

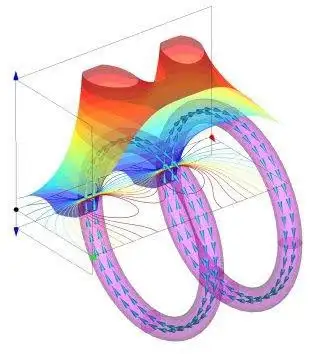

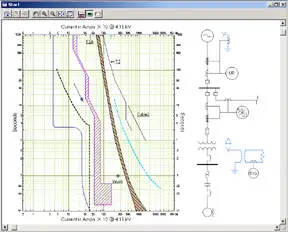

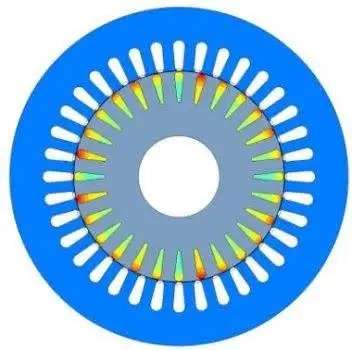

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

NB Power Pulp and Paper Subsidies lower electricity rates for six New Brunswick mills using firm power benchmarks and interruptible discounts, while government mandates, utility debt, ratepayer impacts, and competitiveness pressures shape provincial energy policy.

Key Points

Provincial mandates that buy down firm electricity rates for six mills to a national average, despite NB Power's debt.

✅ Mandated buy-down to match national firm electricity rates

✅ Ignores large non-firm interruptible power discounts

✅ Raises equity concerns amid NB Power debt and rate pressure

An effort to fix NB Power's struggling finances that is supposed to involve a look at "all options" will not include a review of the policy that requires the utility to subsidize electricity prices for six New Brunswick pulp and paper mills, according to the Department of Natural Resources and Energy Development.

The program is meant "to enable New Brunswick's pulp and paper companies have access to competitive priced electricity," said the department's communications officer Nick Brown in an email Monday

"Keeping our large industries competitive with other Canadian jurisdictions, amid Nova Scotia rate hike opposition debates elsewhere, is important," he wrote, knocking down the idea the subsidy program might be scrutinized for shortcomings like other NB Power expenses.

Figures released last week show NB Power paid out $9.7 million in rate subsidies to the mills under the program in the fiscal year ended in March 2021, even though the utility was losing $4 million for the year and falling deeper into debt, amid separate concerns about old meter issues affecting households.

Subsidies went to three mills owned by J.D. Irving Ltd. including two in Saint John and one in Lake Utopia, two owned by the AV group in Nackawic and Atholville and the Twin Rivers pulp mill in Edmundston.

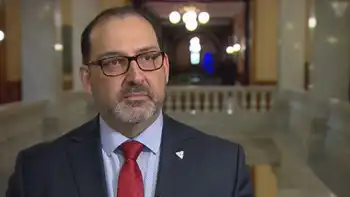

The New Brunswick government has made NB Power subsidize pulp and paper mills like Twin Rivers Paper Company since 2012, and is requiring the program to continue despite financial problems at the utility. (CBC)

It was NB Power's second year in a row of financial losses, while it is supposed to pay down $500 million of its $4.9 billion debt load in the next five years to prepare for the refurbishment of the Mactaquac dam, a burden comparable to customers in Newfoundland paying for Muskrat Falls elsewhere under separate policies, under a directive issued by the province

NB Power president Keith Cronkhite said he was "very disappointed" with debt increasing last year instead of falling and senior vice president and chief financial officer Darren Murphy said everything would be under the microscope this year to turn the utility's finances around.

"We need to do better," said Murphy on Thursday

"We need to step back and make sure we're considering all options, including approaches like Newfoundland's ratepayer shield agreement on megaproject overruns, to achieve that objective because the objective is quickly closing in on us."

However, reviewing the subsidy program for the six pulp and paper mills is apparently off limits.

The subsidy program requires NB Power to buy down the cost of "firm" electricity bought by pulp and paper mills to a national average that is calculated by the Department of Natural Resources and Energy Development.

Last year the province declared the price mills in New Brunswick pay to be an average of 7.536 cents per kilowatt hour (kwh). It is higher than rates in five other provinces that have mills, which the province points to as justification for the subsidies, even as Nova Scotia's 14% rate hike approval highlights broader upward pressure, although the true significance of that difference is not entirely clear.

In British Columbia, the large forest products company Paper Excellence operates five pulp and paper mills which are charged 17.2 per cent less for firm electricity than the six mills in New Brunswick.

The Paper Excellence Paper Mill in Port Alberni, B.C. pays lower electricity prices than mills in New Brunswick, a benefit largely offset by higher property taxes. It's a factor New Brunswick does not count in calculating subsidies NB Power must pay. (Paper Excellence)

However, local property taxes on the five BC mills are a combined $7.8 million higher than the six New Brunswick plants, negating much of that difference.

The province's subsidy formula does not account for differences like that or for the fact New Brunswick mills buy a high percentage of their electricity at cheap non-firm prices.

Not counting the subsidies, NB Power already sells high volumes of what it calls interruptible and surplus power to industry at deep discounts on the understanding it can be cut off and redeployed elsewhere on short notice when needed.

Actual interruptions in service are rare. Last year there were none, but NB Power sold 837 million kilowatt hours of the discounted power to industry at an average price of 4.9 cents per kwh.

NB Power does not disclose how much of the $22 million or more in savings went to the six mills, but the price was 35 per cent below NB Power's posted rate for the plants and rivaled firm prices big mills receive anywhere in Canada, including Quebec.

Asked why the subsidy program ignores large amounts of discounted interruptible power used by New Brunswick mills in making comparisons between provinces, Brown said regulations governing the program require a comparison of firm prices only.

"The New Brunswick average rate is based on NB Power's published large industrial rate for firm energy, as required by the Electricity from Renewable Resources regulation," he wrote.

The subsidy program itself was imposed on NB Power by the province in 2012 to aid companies suffering after years of poor markets for forest products following the 2008 financial collapse and recession.

Providing subsidies has cost NB Power $100 million so far and has continued even as markets for pulp products improved significantly and NB Power's own finances worsened.

Report warned against subsidies

NB Power has never directly criticized the program, but in a matter currently in front the of the New Brunswick Energy and Utilities Board looking at how NB Power might restructure its rates, including proposals such as seasonal rates that could prompt backlash, an independent consultant hired by the utility suggested rate subsidies to large export oriented manufacturing facilities, like pulp and paper mills, is generally a poor idea.

"We do not recommend offering subsidies to exporters," says the report by Christensen Associates Energy Consulting of Madison, Wis.

"There are two serious economic problems with subsidizing exports. The first is that the benefits may be less than the costs. The second problem is that subsidies tend to last forever, even if the circumstances that initially justified the subsidies have disappeared."

The Christensen report did not directly assess the merits of the current subsidy for pulp and paper mills but it addressed the issue because it said in the design of new rates "one NB Power business customer has raised the possibility that their electricity-intensive business ought to be granted subsidies because of the potential to generate extra benefits for the Province through increases in their exports"

That, said Christensen, rarely benefits the public.

"The direct costs of the subsidies are the subsidies themselves, a part of which ends up in the pockets of out-of-province consumers of the exported goods," said the report.

"But there are also indirect costs due to the fact that the subsidies are financed through higher electricity prices, which means that other electricity customers have less money to spend on services provided by local businesses, thus putting a drag on the local economy."

The province does not agree.

Asked whether it has any studies or cost-benefit reviews that show the subsidy program is a net benefit to New Brunswick, the department cited none but maintained it is an important initiative, even as elsewhere governments have offered electricity bill credit relief to ratepayers.

"The program was designed to give large industrial businesses the ability to compete on a level energy field," wrote Brown.