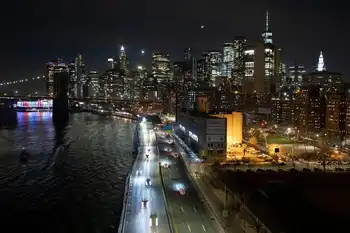

Texas lawmakers propose electricity market bailout after winter storm

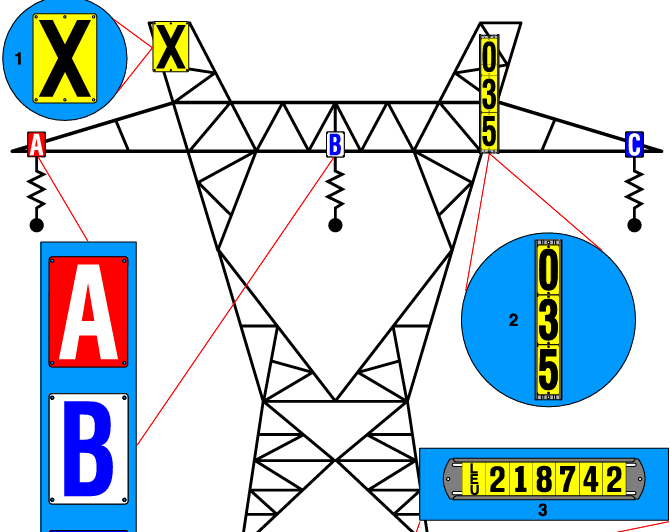

NFPA 70b Training - Electrical Maintenance

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Texas Electricity Market Bailout proposes securitization bonds and ERCOT-backed fees after Winter Storm Uri, spreading costs via ratepayer charges on power bills to stabilize generators, co-ops, and retailers and avert bankruptcies and investor flight.

Key Points

State plan to securitize storm debts via ERCOT fees, adding bill charges to stabilize Texas power firms.

✅ Securitization bonds finance unpaid ancillary services and energy costs

✅ ERCOT fee spreads Winter Storm Uri debts across ratepayers statewide

✅ Aims to prevent bankruptcies, preserve grid reliability, reassure investors

An approximately $2.5 billion plan to bail out Texas’ distressed electricity market from the financial crisis caused by Winter Storm Uri in February has been approved by the Texas House.

The legislation would impose a fee — likely for the next decade or longer — on electricity companies, which would then get passed on to residential and business customers in their power bills, even as some utilities waived certain fees earlier in the crisis.

House lawmakers sent House Bill 4492 to the Senate on Thursday after a 129-15 vote. A similar bill is advancing in the Senate.

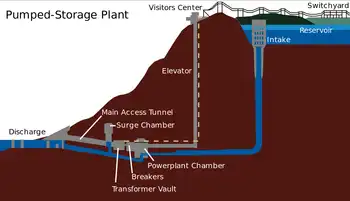

Some of the state’s electricity providers and generators are financially underwater in the aftermath of the February power outages, which left millions without power and killed more than 100 people. Electricity companies had to buy whatever power was available at the maximum rate allowed by Texas regulations — $9,000 per megawatt hour — during the week of the storm (the average price for power in 2020 was $22 per megawatt hour). Natural gas fuel prices also spiked more than 700% during the storm.

Several companies are nearing default on their bills to the Electric Reliability Council of Texas, which manages the Texas power grid that covers most of the state and facilitates financial transactions in it.

Rural electric cooperatives were especially hard hit; Brazos Electric Power Cooperative, which supplies electricity to 1.5 million customers, filed for bankruptcy citing a $1.8 billion debt to ERCOT.

State Rep. Chris Paddie, R-Marshall, the bill’s author, said a second bailout bill will be necessary during the current legislative session for severely distressed electric cooperatives.

“This is a financial crisis, and it’s a big one,” James Schaefer, a senior managing director at Guggenheim Partners, an investment bank, told lawmakers at a House State Affairs Committee hearing in early April. He warned that more bankruptcies would cause higher costs to customers and hurt the state’s image in the eyes of investors.

“You’ve got to free the system,” Schaefer said. “It’s horrible that a bunch of folks have to pay, but it’s a system-wide failure. If you let a bunch of folks crash, it’s not a good look for your state.”

If approved by the Senate and Gov. Greg Abbott, a newly-created Texas Electric Securitization Corp. would use the money raised from the fees for bonds to help pay the companies’ debts, including costs for ancillary services, a financial product that helps ensure power is continuously generated and improve electricity reliability across the grid.

Paddie told his colleagues Wednesday that he could not yet estimate how long the new fee would be imposed, but during committee hearings lawmakers estimated it’s likely to be at least a decade. Several other bills to spread out the costs of the winter storm and consider market reforms are also moving through the Legislature.

ERCOT’s independent market monitor recommended in March that energy sold during that period be repriced at a lower rate, which would have allowed ERCOT to claw back about $4.2 billion in payments to power generators, but the Public Utility Commission declined to do so, even as a court ruling on plant obligations in emergencies drew scrutiny among market participants.

Instead, lawmakers are pushing for bailouts that several energy experts have said is needed, both to ensure distressed companies don’t pass enormous costs on to their customers and to prevent electricity investors and companies from leaving the state if it’s viewed as too risky to continue doing business.

Becky Klein, an energy consultant in Austin and former chair of the Public Utility Commission who played a key role in de-regulating Texas’ electricity market two decades ago, said during a retail electricity panel hosted by Integrate that legislation is necessary to provide “some kind of backstop during a crazy market crisis like this to show the financial market that we’re willing to provide some relief.”

Still, some lawmakers are concerned with how they will win public support, including potential voter-approved funding measures, for bills to bail out the state’s electricity market.

“I have to go back to Laredo and say, ‘I know you didn’t have electricity for several days, but now I’m going to make you pay a little more for the next 20 years,’” state Rep. Richard Peña Raymond, D-Laredo, said during an early April discussion on the plan in the House State Affairs Committee. He said he voted for the bill because it’s in the best interest of the state.

Paddie, during the same committee hearing, acknowledged that “none of us want to increase fees or taxes.” However, he said, “We have to deal with the reality set before us.”