Washington State Ferries' Hybrid-Electric Upgrade

NFPA 70b Training - Electrical Maintenance

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Washington State Hybrid-Electric Ferries advance green maritime transit with battery-diesel propulsion, lower emissions, and fleet modernization, integrating charging infrastructure and reliable operations across WSF routes to meet climate goals and reduce fuel consumption.

Key Points

New WSF vessels using diesel-battery propulsion to cut emissions, improve efficiency, and sustain reliable ferry service.

✅ Hybrid diesel-battery propulsion reduces fuel use and CO2

✅ Larger vessels with efficient batteries and charging upgrades

✅ Compatible with WSF docks, maintenance, and safety standards

Washington State is embarking on an ambitious update to its ferry fleet, introducing hybrid-electric boats that represent a significant leap toward greener and more sustainable transportation. The state’s updated plans reflect a commitment to reducing carbon emissions and enhancing environmental stewardship while maintaining the efficiency and reliability of its vital ferry services.

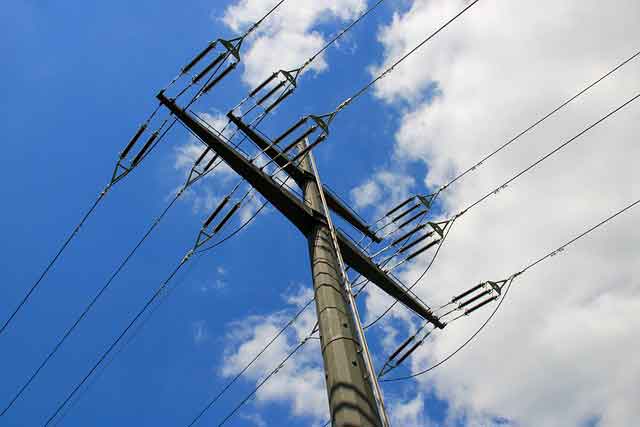

The Washington State Ferries (WSF) system, one of the largest in the world, has long been a critical component of the state’s transportation network, linking various islands and coastal communities with the mainland. Traditionally powered by diesel engines, the ferries are responsible for significant greenhouse gas emissions. In response to growing environmental concerns and legislative pressure, WSF is now turning to hybrid-electric technology similar to battery-electric high-speed ferries seen elsewhere to modernize its fleet and reduce its carbon footprint.

The updated plans for the hybrid-electric boats build on earlier efforts to introduce cleaner technologies into the ferry system. The new designs incorporate advanced hybrid-electric propulsion systems that combine traditional diesel engines with electric batteries. This hybrid approach allows the ferries to operate on electric power during certain segments of their routes, reducing reliance on diesel fuel and cutting emissions as electric ships on the B.C. coast have demonstrated during similar operations.

One of the key features of the updated plans is the inclusion of larger and more capable hybrid-electric ferries, echoing BC Ferries hybrid ships now entering service in the region. These vessels are designed to handle the demanding operational requirements of the Washington State Ferries system while significantly reducing environmental impact. The new boats will be equipped with state-of-the-art battery systems that can store and utilize electric power more efficiently, leading to improved fuel economy and lower overall emissions.

The transition to hybrid-electric ferries is driven by both environmental and economic considerations. On the environmental side, the move aligns with Washington State’s broader goals to combat climate change and reduce greenhouse gas emissions, including programs like electric vehicle rebate program that encourage cleaner travel across the state. The state has set ambitious targets for reducing carbon emissions across various sectors, and upgrading the ferry fleet is a crucial component of achieving these goals.

From an economic perspective, hybrid-electric ferries offer the potential for long-term cost savings. Although the initial investment in new technology can be substantial, with financing models like CIB support for B.C. electric ferries helping spur adoption and reduce barriers for agencies, the reduced fuel consumption and lower maintenance costs associated with hybrid-electric systems are expected to lead to significant savings over the lifespan of the vessels. Additionally, the introduction of greener technology aligns with public expectations for more sustainable transportation options.

The updated plans also emphasize the importance of integrating hybrid-electric technology with existing infrastructure. Washington State Ferries is working to ensure that the new vessels are compatible with current docking facilities and maintenance practices. This involves updating docking systems, as seen with Kootenay Lake electric-ready ferry preparations, to accommodate the specific needs of hybrid-electric ferries and training personnel to handle the new technology.

Public response to the hybrid-electric ferry initiative has been largely positive, with many residents and environmental advocates expressing support for the move towards greener transportation. The new boats are seen as a tangible step toward reducing the environmental impact of one of the state’s most iconic transportation services. The project also highlights Washington State’s commitment to innovation and leadership in sustainable transportation, alongside global examples like Berlin's electric flying ferry that push the envelope in maritime transit.

However, the transition to hybrid-electric ferries is not without its challenges. Implementing new technology requires careful planning and coordination, including addressing potential technical issues and ensuring that the vessels meet all safety and operational standards. Additionally, there may be logistical challenges associated with integrating the new ferries into the existing fleet and managing the transition without disrupting service.

Despite these challenges, the updated plans for hybrid-electric boats represent a significant advancement in Washington State’s efforts to modernize its transportation system. The initiative reflects a growing trend among transportation agencies to embrace sustainable technologies and address the environmental impact of traditional transportation methods.

In summary, Washington State’s updated plans for hybrid-electric ferries mark a crucial step towards a more sustainable and environmentally friendly transportation network. By incorporating advanced hybrid-electric technology, the state aims to reduce carbon emissions, improve fuel efficiency, and align with its broader climate goals. While challenges remain, the initiative demonstrates a commitment to innovation and underscores the importance of transitioning to greener technologies in the quest for a more sustainable future.