Epcor Earns $1.4B

Edmonton, AB. -- -

City reaps bonus in higher dividends as power demand exceeds forecast

Edmonton, AB. -- Unexpected demand for electricity from Epcor's three main power plants boosted the Edmonton company's revenue by 40 per cent in 2000 to $1.4 billion.For Epcor's sole shareholder, the City of Edmonton, that was welcome news. Epcor paid a dividend to the city of $109.5 million, compared with $70.5 million in 1999. Epcor's net income also rose from $117 million in 1999 to $149 million last year."The bottom line is that the lion's share of the increase in earnings was from generation," Brian Vaasjo, Epcor chief financial officer, said last week. Epcor operates the Genesee, Clover Bar and Rossdale plants.The province's demand for power was very close to supply, and the failure last fall of a major turbine at the Wabamun power plant has compounded the problem."That brought our units more into play," Vaasjo said.Clover Bar produced 85 per cent more electricity than originally planned. Rossdale's production was more than double the forecast.Epcor made a commitment last year to share half of the windfall coming from that production. Vaasjo said the kitty to be shared will amount to about $72 million.The Energy and Utility Board must now decide how the money will be returned to Epcor's 600,000 industrial, commercial and residential customers.It could be in the form of a one-time cheque, a reduction in some future bills or it could be applied to 2002 rates.Epcor's operating and capital costs in 2000 also soared to $518.1 million from $319.5 million in 1999. The company's debt rose by about $500 million and now totals $1.8 billion."We've been very clear," Vaasjo said. "As we move from a regulated environment to deregulation, there are increased risks."For $110 million, Epcor bought the retail customers that used to belong to TransAlta. It spent $353.9 million to buy power in last August's wholesale electricity auction. And the price of natural gas -- the fuel used in Clover Bar and Rossdale -- rose by $2 per gigajoule to an annual average of $5.50.On the other hand, Epcor got bigger, Vaasjo said. The company entered the era of deregulation on Jan. 1, 2001, with $750 million in assets it had not previously held, including part ownership in the 416-megawatt power plant at Nova Chemicals' Joffre site.Edmonton Mayor Bill Smith said he is pleased with Epcor's performance. But he recognizes the growing risks: "It is a still a volatile industry." It will need to make future investments to remain a strong company, he added.

Related News

New Photogrammetry Software Optimized for Aerial Drone Photography

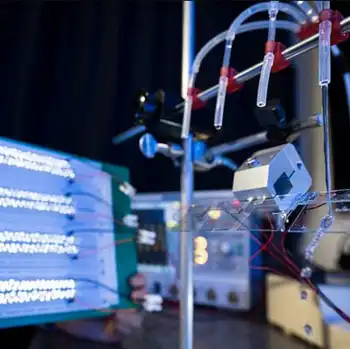

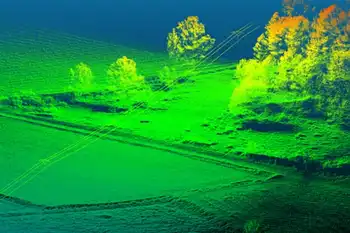

Vancouver, BC - Vancouver, BC – Oct. 26, 2016 – New photogrammetry software optimized specifically for photographs taken with drones or unmanned aerial systems (UAS). The new PhotoModeler UAS 2016 software creates 3D models, measurements, and maps from photographs taken with ordinary cameras built-in or mounted on drones. It includes numerous features for optimized operation with drone photos including post processing kinematics (PPK), volume objects, full geographic coordinate systems support, multispectral image support and control point assist.

The new version of PhotoModeler is ideally suited for drone photogrammetry applications including surveying, ground contouring, surface model creation, stock pile volume measurement,…