TransAlta eyes options to cut emissions from coal

ALBERTA - TransAlta Corp is preparing for regulations forcing drastic emission cuts from coalfired power by studying switching away from the fuel at some plants and using technology to deal with the carbon at others, its chief executive said.

TransAlta, Canadas largest publicly traded electricity generator, is plotting its strategy as Canadian and U.S. governments lay the groundwork for tighter regulations on greenhouse gas emissions, CEO Steve Snyder said after the company reported a 60 percent jump in firstquarter profit.

The company runs 70 power stations, and its five coalfired ones are among its largest. It has two more under development.

We have sites that would be excellent to permit for potential gas plants. We have plants at various ages, some of which are excellent candidates for life extension with new technologies, Snyder told analysts. So I think well keep all those options open and pursue all of them as we go forward.

A day earlier, TransAlta signed a memorandum of understanding with Washington State to examine ways to cut carbon emissions from the Centralia coalfired power plant in half by 2025. TransAlta will look at switching to other fuels, such as natural gas or renewables, at the facility, which provides 10 percent of Washingtons electricity.

It is also mindful of remarks by Canadian Environment Minister Jim Prentice, who said that Ottawa may make natural gas the new standard as coal plants reach the end of their usefulness.

A year ago, when Prentice first made comments targeting coalfired plants, Snyder said federal rules phasing them out would hurt Alberta and not necessarily cut emissions sharply. The company is now looking for solutions to reduce carbon while making sure the lights stay on, he said.

Plans for Centralia reflect the lack of viable nearby coal supplies or opportunities in the region for carbon capture and storage, he said.

In Alberta, where TransAlta is currently planning a carboncapture project, there appear to be more options. However, the company is not rushing to any one alternative.

Snyder said he doesnt want to make too big a commitment to any one option right away. That could come back to haunt availability, supply and reliability 10, 15 years out. So I think everyone is on a measured, steady pace right now. I think thats constructive.

Despite weak power prices in the first quarter — and a lack of wind, which hampered TransAltas wind farms — the company earned $67 million US $66 million, or 31 Canadian cents a share, up from a yearearlier $42 million, or 21 Canadian cents a share.

Earnings had been forecast at 30 Canadian cents a share, the average of analysts estimates compiled by Thomson Reuters.

The jump was due to better reliability and production, it said. Fleet availability rose to 91.4 percent, up from 86.4 percent, because of fewer outages at the Keephills, Sundance and Wabamun plants in Alberta.

Revenue in the quarter was $723 million, down 4 percent from $756 million in the first quarter of 2009.

Related News

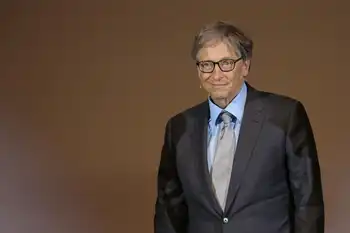

Bill Gates’ Nuclear Startup Unveils Mini-Reactor Design Including Molten Salt Energy Storage

SAN FRANCISCO - Nuclear power is the Immovable Object of generation sources. It can take days just to bring a nuclear plant completely online, rendering it useless as a tool to manage the fluctuations in the supply and demand on a modern energy grid.

Now a firm launched by Bill Gates in 2006, TerraPower, in partnership with GE Hitachi Nuclear Energy, believes it has found a way to make the infamously unwieldy energy source a great deal nimbler — and for an affordable price.

The new design, announced by TerraPower on August 27th, is a combination of a "sodium-cooled fast reactor"…