Power Brokers Say New Ontario Power Market Date Not Firm Enough

CALGARY - -- Power brokers called on Ontario to set a firm date for its electricity market opening - and stick to it, after provincial agencies pointed to a March 1, 2002, deadline this week.

The new timetable - the fourth adjusting of dates since 1999 - will increase costs for established firms and could further erode interest of potential investors, energy representatives said Friday.

"Our major concern is the historical pattern of delays that we've had with Ontario market opening," Ron Milnthorp, president of Enron Canada said.

"We can't invest capital on a conditional basis, and, therefore, we need an unconditional market opening."

Earlier this year, Enron Canada put a C$200-million power plant project for southwestern Ontario on hold after Premier Mike Harris set back an expected May market opening indefinitely.

The revamped market readiness testing schedule released by the Independent Electricity Market Operator and the Ontario Energy Board Tuesday extends retail and wholesale testing to December and February, and includes fines of up to C$10,000 a day for late completion.

"We are doing out best to meet what we think is a realistic deadline," IMO spokesman Kevin Dove said.

Milnthorp said Enron Canada now is more optimistic the government will stick to a spring 2002 date.

Technical difficulties were blamed in setting back deregulation from May to this November, and from fall of 2000.

Critics also say the California crisis, which saw electricity prices skyrocket in that state, caused the Ontario government to delay deregulation to placate nervous consumers. The uncertainty has cost an estimated C$3 billion from proposed power plants being put on hold, "Any further delay will have severe implications on investor confidence in the market," TransAlta (T.TA) spokesman Adam White warned from Toronto.

This summer TransAlta (T.TA), Canada's largest investor-owned power generator, said it would defer any new investment in Ontario because of market uncertainty.

Work on the corporation's C$400-million Sarnia cogeneration plant continued, however, and it will start producing power in spring of 2002. The latest market delay just means TransAlta won't have the benefit of watching the market and trading in it before commissioning the plant, White said.

Smaller retail distributors are being blamed in part for the delay because of difficulties setting up new billing and accounting systems.

Toronto Hydro has offered to help other retailers set up their systems to get deregulation up and running.

"Every day we don't have market-opening date, we have money going out," spokesman Stephen Andrews said. "It is a significant cost in terms of opportunity."

Final approval for market opening will have to be given by the provincial government, which so far has refused to set a firm date.

Related News

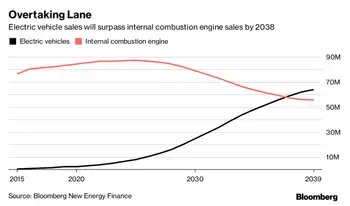

Parked Electric Cars Earn $1,530 From Europe's Power Grids

PARIS - Electric car owners are earning as much as $1,530 a year just by parking their vehicle and feeding excess power back into the grid.

Trials in Denmark carried out by Nissan and Italy’s biggest utility Enel Spa showed how batteries inside electric cars could help balance supply and demand at times and provide a new revenue stream for those who own the vehicles.

Technology linking vehicles to the grid marks another challenge for utilities already struggling to integrate wind and solar power into their distribution system. As the use of plug-in cars spreads, grid managers will have to pay…