Seven arrested in suspected carbon tax fraud

LONDON, ENGLAND - The British tax office arrested seven people in London in a suspected 38 million pounds (US$62.6 million) value-added tax fraud in the European market in carbon allowances, it said.

Officers from Her MajestyÂ’s Revenues and Customs (HMRC) searched 27 properties around London and arrested six men and one woman in early morning raids, the HMRC said in a statement.

"Those arrested are believed to be part of an organized crime group operating a network of companies trading large volumes of high-value carbon credits," it said.

"It is thought that the proceeds of this crime have then been used to finance lavish lifestyles and the purchase of prestige vehicles."

The HMRC said further arrests were likely but it could not give the names of those arrested or the companies involved, nor could it estimate the total scale of the suspected fraud or say if it was isolated to Britain.

Under the $90 billion European Union carbon emissions trading market, companies trade permits called EU Allowances that allow them to emit climate-warming greenhouse gases.

Britain said last month it would make carbon trading exempt from value-added tax (VAT) in response to a suspected trading scam called carousel fraud.

Through carousel fraud, also called missing trader fraud, fraudsters import goods VAT-free from other countries, then sell the goods to domestic buyers, charging them VAT. The sellers then disappear without paying the tax to the government.

France and the Netherlands have also taken similar measures in the past two months after rumors of fraudulent trade circled emissions exchanges in those countries.

Investment bank and broker sources told Reuters they were concerned that they may have to foot the unpaid tax bill, or possibly face legal action for having traded with fraudsters unknowingly.

"As well as further arrests, we can expect VAT assessments to now be issued (and) HMRC may seek to recover missing VAT from parties unwittingly caught up in the fraud," said Sarah Donald of law firm Dundas & Wilson.

HMRC estimates it lost between 2-3 billion pounds in potential tax revenues between 2005-2006 due to carousel fraud.

Related News

Revenue from Energy Storage for Microgrids to Total More Than $22 Billion in the Next Decade

NEW YORK - A new report from Navigant Research examines the global market for energy storage for microgrids (ESMG), providing an analysis of trends and market dynamics, with forecasts for capacity and revenue that extend through 2026.

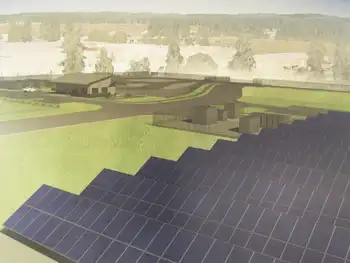

Interest in energy storage-enabled microgrids is growing alongside an increase in solar PV and wind deployments. Although not required for microgrids to operate, energy storage systems (ESSs) have emerged as an increasingly valuable component of distributed energy networks because of their ability to effectively integrate renewable generation.

“There are several key drivers resulting in the growth of energy storage-enabled microgrids globally, including the desire to…