Enron costs CIBC $80M

- CIBC's dealings with disgraced Enron Corp. came home to roost recently as the bank was hit with an $80 million (U.S.) penalty.

The payment settles allegations by the U.S. stock market watchdog that the bank helped the energy company mislead investors.

As well, financial regulators in Canada and the United States required Canadian Imperial Bank of Commerce to stop doing the types of financing transactions it handled for Enron, and to submit to more scrutiny.

"They have put CIBC on a short leash,'' said Per Mokkelbost, a corporate finance professor at the University of Toronto's Rotman School of Management. In addition, the U.S. Department of Justice has alleged that "CIBC and its personnel have violated federal criminal law" and "aided and abetted" Enron in questionable transactions.

But the bank is not being prosecuted because it has agreed to stop doing Enron-style financings for three years and has appointed a monitor to oversee this, said a letter from the justice department's Enron task force chief, Leslie Caldwell.

Two former CIBC executives have also agreed to pay a total of $623,000 (U.S.) in penalties to the U.S. Securities and Exchange Commission. A third former executive, Ian Schottlaender of CIBC's New York operation, is fighting allegations of wrongdoing.

The hardest hit executive is Daniel Ferguson of Toronto, an executive vice-president who left the bank earlier this month. He has agreed to pay $563,000 in penalties. Mark Wolf, formerly of CIBC's Houston office, agreed to pay $60,000.

None could be reached for comment.

CIBC is the first Canadian bank hit in the SEC's wide-ranging investigation of the December, 2001 Enron collapse, one of several corporate failures that shook investor confidence and sent stock markets plummeting.

"It is a bit of a black eye for the financial system in Canada," said Mokkelbost.

Royal Bank and Toronto-Dominion Bank have also been named by U.S. court-appointed examiners for "aiding and abetting" the Enron debacle, in which financings were set up to look like sales of assets to hide the company's heavy borrowing. Enron went bankrupt two years ago this month because of its debt, inflated profits and accounting hocus-pocus.

TD and Royal have denied any knowledge of Enron's accounting fraud and said they did nothing wrong. CIBC reached its settlement without admitting or denying the SEC's allegations.

Officials at the SEC would not comment when asked if any other Canadian banks are under investigation. Spokespersons for Royal and TD said they were unaware of any probes.

CIBC chief executive John Hunkin has said he is pleased the settlement agreement is "closing an unpleasant and painful chapter in our company's history."

The bank has already put into place some of the changes required by Canada's Office of the Superintendent of Financial Institutions and the U.S. Federal Reserve to make sure Enron-style structured financing transactions don't happen again, Hunkin added in a conference call with reporters and analysts.

"We have moved well beyond the events of three years ago... CIBC is now on the path it needs to be."

After the bank suffered heavily from corporate loan losses in 2002, Hunkin reduced corporate lending in favour of earning more profits from branch banking operations, which provide a more stable earnings stream.

The Enron-style structured finance transactions will be wound down over the coming months and lost revenues will cost the bank about 10 cents per share in earnings, said chief financial officer Tom Woods. The bank had earnings per share of $5.21 in its most recent fiscal year.

Earlier this year, CIBC set up a reserve fund of $109 million (Cdn.) to handle any Enron liabilities — an amount that is equal to the $80 million (U.S.) payment wired by the bank to the SEC recently.

No further reserves will be set aside, despite the class-action lawsuits CIBC is facing from disgruntled investors, because the bank has insurance to cover any awards.

"These suits are without merit," Hunkin said.

The $80 million penalty includes $37.5 million in profits CIBC made from Enron, a penalty of the same amount and $5 million in interest.

While the fine pales in comparison to CIBC's profits of slightly more than $2 billion in the fiscal year ended Oct. 31, "you cannot look at the money only,'' said Mokkelbost.

"It is their reputation.''

The penalties paid by CIBC and its executives will go into an interest-bearing fund for benefits of the Enron fraud, which cost investors $25 billion as the share price collapsed — including the life savings of many ordinary Enron employees.

The fund has now raised $400 million, including payouts of $80 million from Merrill Lynch, $101 million from Citibank Corp. and $135 million from JP Morgan Chase, said Linda Chatman Thomsen, deputy director of enforcement for the SEC.

That makes the CIBC tied for third-largest penalty issued by the American stock market watchdog.

The SEC alleged that the CIBC helped Enron "mislead its investors through a series of complex structured finance transactions over a period of several years preceding Enron's bankruptcy."

Between June, 1998, and October 2001, the CIBC and Enron set up 34 financings as asset sales for the purposes of accounting and financial reporting, "allowing Enron to hide from investors and rating agencies the true extent of its borrowings," the SEC said.

Enron used these "disguised loans" to increase earnings by $1 billion and avoid disclosing more than $2.6 billion in debt.

"Today's action demonstrates that neither financial institutions nor their executives can hide behind the technical complexities of structured transactions to avoid responsibility for contributing to fraudulent accounting and manipulated financial results,'' said Steve Cutler, director of enforcement for the SEC.

Related News

Ford's Washington Meeting: Energy Tariffs and Trade Tensions with U.S

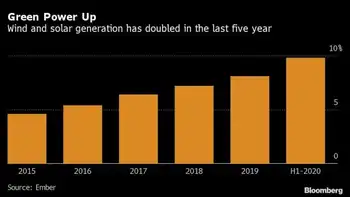

WASHINGTON DC - Ontario Premier Doug Ford's recent high-stakes diplomatic trip to Washington, D.C., underscores the delicate trade tensions between Canada and the United States, particularly concerning energy exports. Ford's potential use of tariffs or even halting U.S. energy supplies remains a powerful leverage tool, one that could either de-escalate or intensify the ongoing trade conflict between the two neighboring nations.

The meeting in Washington follows a turbulent series of events that began with Ontario's imposition of a 25% surcharge on energy exports to the U.S. This move came in retaliation to what Ontario perceived as unfair treatment in trade…