BC Hydro battles U.S. poacher

VANCOUVER, BRITISH COLUMBIA - Efforts by a Wall Street financial giant to poach employees and business from a lucrative government-owned energy trading operation in Vancouver are proving expensive for British Columbia taxpayers.

BC Hydro subsidiary corporation Powerex has lost 10 energy trading team members in a continuing employee raid by New York-based financial services firm Morgan Stanley, according to an internal memo obtained by The Vancouver Sun.

A memo to employees from Peter Sherk, head of AmericaÂ’s power and gas for Morgan Stanley, indicates that the company has recruited top traders Murray Margolis and Ali Yazdi, and eight others with varying experience.

Ex-Powerex head trader Margolis began working for Morgan Stanley on February 15 while Yazdi “was first on board” when the company launched its raid on Powerex last December.

Margolis made $663,243 as top-salaried Powerex employee in fiscal 2009 while Yazdi made $412,685. The duo could make several multiples of those amounts with the private sector firm because of significantly higher bonus opportunities.

If theyÂ’d stuck with Powerex, they would have received raises, as well.

Powerex has beefed up annual compensation packages as a result of the raid. It is offering its top three traders up to $900,000 per year in salary and bonuses — $240,000 to $760,000 per year more than the Crown corporation was paying the 10 employees who left.

Powerex is defending the pay increases as necessary to retain the pool of institutional knowledge that the Crown corporation has built up since it began wheeling and dealing with Canadian and U.S. traders on the western electricity market 15 years ago.

“Powerex has always been a leader in our marketplace in moving physical power and gas. Since about 2002, our income has been about $1.5 billion in total for BC Hydro ratepayers and B.C. taxpayers,” Powerex boss Teresa Conway said in an interview.

“So it’s quite natural that a financial institution like Morgan Stanley would want to tap into that expertise and the talent we have, to increase profits for an American company.

“Morgan Stanley and many financial institutions in the U.S. are in the power trading and marketing business and have been in it for a number of years so they are really going after some of the value that we extract from trading.”

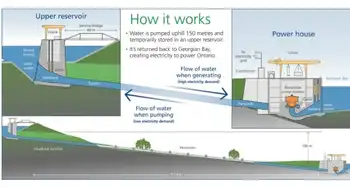

Powerex is one of about 250 utilities and trading companies active in the western market. It is one of the most successful because it has something most don’t — exclusive access to BC Hydro’s vast network of generating stations and storage reservoirs.

Powerex buys power at cheap rates when rival hydroelectric utilities are running at capacity during spring freshet, and at night when coal-fired generating plants see their daytime electricity demand subside.

HydroÂ’s reservoirs, by contrast, have enough storage capacity to scale back electricity production whenever market power prices are low, and open up when market prices are high.

That natural market advantage keeps B.C. electricity rates low in relation to other jurisdictions — and allows Powerex to jump on opportunities to make money when the market price jumps.

Powerex also trades natural gas, and it has contracts with both power producers and utilities operating exclusively within the U.S. for electricity delivery services.

It has also initiated a renewable energy service that should boom as states such as California mandate a growing portion of electricity be derived from green sources.

Morgan Stanley wonÂ’t have access to BC HydroÂ’s resources, but itÂ’s expected to make a move on other Powerex contracts and services in the United States by capitalizing on the extensive contacts and trading knowledge of its new recruits.

The renewable energy business, in particular, offers significant growth opportunities.

“Our goal is to build the most successful franchise in the gas and power business,” Peter Sherk says in a memo to Morgan Stanley trading staff. “Building this west team with individuals who have unparalleled market knowledge and customer relationships is a major step toward achieving this result.”

In a telephone interview, Sherk said the company remains in a North America-wide hunt for additional recruits for the Vancouver office.

“The response to the news of that we are opening this office has been tremendous,” Sherk said. “I’ve had calls from people across the U.S. and Canada who are interested in being part of this effort and living in Vancouver. We are pleased to have already built a team of incredibly skilled people and look forward to adding more people to the group that come from a diverse base of experience.”

Sherk would not comment on a rumour that Morgan Stanley opened the Vancouver office because it could not convince coveted Powerex staff to move to New York.

Conway, meanwhile, said she is confident that Powerex has developed enough internal expertise to overcome the defections. She also suggested that thereÂ’s no guarantee Morgan Stanley will persist with its venture.

“Morgan Stanley is one of the financial institutions that received a U.S. federal bailout last year,” Conway said. “It’s a different employment opportunity. The banks have a reputation for being in the market one day or one year and, with things changing very quickly, exiting the marketplace.

“It’s a different employment prospect than it is working for Powerex.”

Senior Powerex trader Mike Goodenough isnÂ’t too concerned about the defections.

“We have been competing with Morgan Stanley for years and I think we’ve been doing it quite successfully,” Goodenough said during a recent tour of the Crown corporation’s trading floor.

“Even though from an American standpoint we might look like a sleepy Canadian utility we’ve actually spent a number of years ensuring that we are first-call now at anyplace in the western United States for power.

“People in Las Vegas for example will think first of us to trade with them before they will think of their neighbours sometimes, just because we are able to react and [quickly] give them our bid offer spread, our ability to transact down there.

“Our expertise in this area is probably the deepest of anybody.”

He said Powerex has a reputation with customers as reliable and quick to respond.

“It’s a combination not only of our transmission portfolios and our system flexibility, but also the depth of our experience and the systems of trading that we’ve developed. It has really given us an edge.

“For government jobs, it’s probably the most fun job there is.”

Related News

South Africa's Eskom could buy less power from wind farms during lockdown

JOHANNESBURG - South African state utility Eskom has told independent wind farms that it could buy less of their power in the coming days, as electricity demand has plummeted during a lockdown aimed at curbing the spread of the coronavirus.

Eskom, which is mired in a financial crisis and has struggled to keep the lights on in the past year, said on Tuesday that power demand had dropped by more than 7,500 megawatts since the lockdown started on Friday and that it had taken offline some of its own generators.

The utility supplements its generating capacity, which is mainly derived from coal,…