Power sector is “hobbled”, says expert

By Victoria Times Colonist

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Pierre Guimond, in Victoria to address a Greater Victoria Chamber of Commerce luncheon, said the North American electricity sector "is being hobbled by a lack of infrastructure investment at a time when it is asked to take on a more expansive mandate."

"Right now energy is being discussed as the lifeblood of the economy... and the electricity grid that serves us so well was built for a [Canadian] population of about 20 million. We're now pushing something like 35 million," Guimond said. And the demand for electricity to fuel our gadgets, an Internet economy and lifestyle choices like electric cars is only going to grow.

"It's time to make some decisions that previous generations had to make," Guimond said.

"In other words: it's our time, it's our turn."

The bulk of the Canadian electricity grid, and in particular the B.C. portion, was built between 1950 and 1980, with very little of any consequence being added to that since.

To deal with increased demand, Guimond said since the early 1990s North America has engaged in electricity wheeling — moving electricity over long distances to suit demand — instead of building new generation. "Over the last 20 years there's been very little building done as demand slowly caught up to oversupply," said Guimond with a nod to the engineers who originally overbuilt the system to accommodate expected growth. "That over-supply is now gone and we are now face to face with the prospect that we have to build to meet demand and build to strengthen the system because it's aging."

But that kind of infrastructure overhaul comes at a heavy price.

The CEA has been told by the International Energy Agency and Conference Board of Canada that this country will have to spend between $240 billion and $298 billion over the next 20 years to improve its electricity infrastructure to meet demand growth.

Guimond sees that price tag as an investment.

"Even with price hikes which are sure to happen [to pay for new infrastructure] electricity is still a bargain, and the price of electricity is still very much an investment in the future," he said.

"The aging infrastructure is an opportunity to renew, replace and build capacity to ensure reliability, supply and affordability," he said. "It's also an opportunity to strengthen our economy and if we act soon and act well we can really bolster the backbone of the Canadian economy."

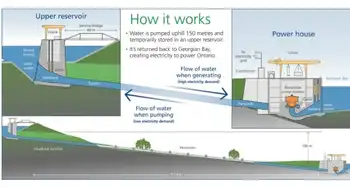

Guimond acknowledged that emerging and alternative power supplies like solar, wind and wave play an important role in meeting new demand on the system, but he said the bottom line is countries must play to their strengths and Canada has water and gravity in its favour — that means turbines and dams.

"There's a place for everything on the grid, and we need everything, but big, strong turbines and big machines are still the backbone — they make solar and wind and other variable generation possible to integrate onto the grid," he said.

Guimond noted the entire system is in a transitional phase, including customers demanding more control over their use of power and how much they pay for it.

He said the much talked about smart grid, which begins with smart meters to help customers optimize their power use and how they pay for it, is a start to helping secure the reliability of supply.

But he remains adamant that changes like that are just a start, and that sooner rather than later this country is going to have to dig deep to pay for new generation.