EV Opportunity for Utilities spans EV charging infrastructure, grid modernization, demand response, time-of-use rates, and customer engagement, enabling predictable load growth, flexible charging, and stronger utility branding amid electrification and resilience challenges.

Key Points

It is the strategy to leverage EV adoption for load growth, grid flexibility, and branded charging services.

✅ Monetizes EV load via TOU rates, managed charging, and V2G.

✅ Uses rate-based infrastructure to expand equitable charging access.

✅ Enhances resilience and DER integration through smart grid upgrades.

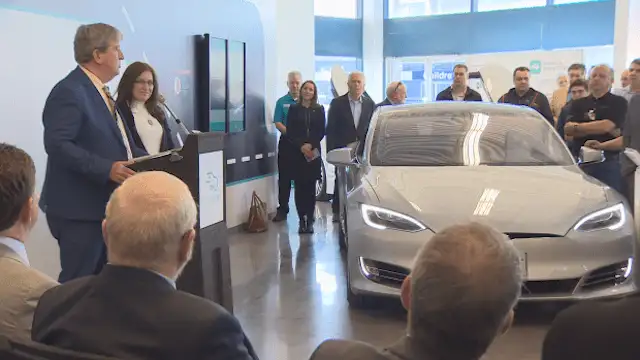

Tesla recently announced delivery of the first 30 production units of its Model 3 electric vehicle (EV). EV technology has generated plenty of buzz in the electric utility industry over the past decade and, with last week’s announcement, it would appear that projections of a significant market presence for EVs could give way to rapid growth.

Tesla’s announcement could not have come at a more critical time for utilities, which face unprecedented challenges. For the past 15 years, utilities have been grappling with increasingly frequent “100-year storms,” including hurricanes, snowstorms and windstorms, underscoring the reality that the grid’s aging infrastructure is not fit to withstand increasingly extreme weather, along with other threats, such as cyber attacks.

Coupled with flat or declining load growth, changing regulations, increasing customer demand, and new technology penetration, these challenges have given the electric utility industry good reason to describe its future as “threatened.” These trends, each exacerbating the others, mean essentially that utilities can no longer rely on traditional ways of doing business.

EVs have significant potential to help relieve the industry’s pessimistic outlook. This article will explore what EV growth could mean for utilities and how they can begin establishing critical foundations today to help ensure their ability to exploit this opportunity.

The opportunity

At the Bloomberg New Energy Finance (BNEF) Global Summit 2017, BNEF Advisory Board Chairman Michael Liebreich announced the group’s prediction that electric vehicles will comprise 35-47 percent of new vehicle sales globally by 2040.

U.S. utilities have good reason to be optimistic about this potential new revenue source, as EV-driven demand growth could be substantial according to federal lab analyses. If all 236 million gas-powered cars in the U.S. — average miles driven per year: 12,000 — were replaced with electric vehicles, which travel an average of 100 miles on 34 kWh, they would require 956 billion kWh each year. At a national average cost of $0.12 / kWh, the incremental energy sold by utilities in the U.S. would bring in around $115 billion per year in new revenues. A variety of factors could increase or decrease this number, but it still represents an attractive opportunity for the utility sector.

Capturing this burgeoning market is not simply a matter of increased demand; it will also require utilities to be predictable, adaptable and brandable. Moreover, while the aggregate increase in demand might be only 3-4 percent, demand can come as a flexible and adaptable load through targeted programming. Also, if utilities target the appropriate customer groups, they can brand themselves as the providers of choice for EV charging. The power of stronger branding, in a sector that’s experiencing significant third-party encroachment, could be critical to the ongoing financial health of U.S. utilities.

Many utilities are already keenly aware of the EV opportunity and are speeding down this road (no pun intended) as part of their plans for utility business model reinvention. Following are several questions to be asked when evaluating the EV opportunity.

Is the EV opportunity feasible with today’s existing grid?

According to a study conducted by the U.S. Department of Energy’s Pacific Northwest National Laboratory, the grid is already capable of supporting more than 150 million pure electric vehicles, even as electric cars could challenge state grids in the years ahead, a number equal to at least 63 percent of all gas-powered cars on the road today. This is significant, considering that a single EV plugged into a Level 2 charger can double a home’s peak electricity demand. Assuming all 236 million car owners eventually convert to EVs, utilities will need to increase grid capacity. However, today’s grid already has the capacity to accommodate the most optimistic prediction of 35-47 percent EV penetration by 2040, which is great news.

Should the EV opportunity be owned by utilities?

There’s significant ongoing debate among regulators and consumer advocacy groups as to whether utilities should own the EV charging infrastructure, with fights for control over charging reflecting broader market concerns today. Those who are opposed to this believe that the utilities will have an unfair pricing advantage that will inhibit competition. Similarly, if the infrastructure is incorporated into the rate base, those who do not own electric vehicles would be subsidizing the cost for those who do.

If the country is going to meet the future demands of electric cars, the charging infrastructure and power grid will need help, and electric utilities are in the best position to address the problem, as states like California explore EVs for grid stability through utility-led initiatives that can scale. By rate basing the charging infrastructure, utilities can provide charging services to a wider range of customers. This would not favor one economic group over another, which many fear would happen if the private sector were to control the EV charging market.

If you build it, will they come?

At this point, we can conclude that growth in EV market penetration is a tremendous opportunity for utilities, one that’s most advantageous to electricity customers if utilities own some, if not all, of the charging infrastructure. The question is, if you build it, will they come — and what are the consequences if they don’t?

With any new technology, there’s always a debate centered around adoption timing — in this case, whether to build the infrastructure ahead of demand for EV or wait for adoption to spike. Either choice could have disastrous consequences if not considered properly. If utilities wait for the adoption to spike, their lack of EV charging infrastructure could stunt the growth of the EV sector and leave an opening for third-party providers. Moreover, waiting too long will inhibit GHG emissions reduction efforts and generally complicate EV technology adoption. On the other hand, building too soon could lead to costly stranded assets. Both problems are rooted in the inability to control adoption timing, and, until recently, utilities didn’t have the means or the savvy to influence adoption directly.

How should utilities prepare for the EV?

Beyond the challenges of developing the hardware, partnerships and operational programs to accommodate EV, including leveraging energy storage and mobile chargers for added flexibility, influencing the adoption of the infrastructure will be a large part of the challenge. A compelling solution to this problem is to develop an engaged customer base.

A more engaged customer base will enable utilities to brand themselves as preferred EV infrastructure providers and, similarly, empower them to influence the adoption rate. There are five key factors in any sector that influence innovation adoption:

Relative advantage – how improved an innovation is over the previous generation.

Compatibility – the level of compatibility an innovation has with an individual’s life.

Complexity – if the innovation is to difficult to use, individuals will not likely adopt it.

Trialability – how easily an innovation can be experimented with as it’s being adopted.

Observability – the extent that an innovation is visible to others.

Although much of EV adoption will depend on the private vehicle sector influencing these five factors, there’s a huge opportunity for utilities to control the compatibility, complexity and observability of the EV. According to “The New Energy Consumer: Unleashing Business Value in a Digital World,” utilities can influence customers’ EV adoption through digital customer engagement. Studies show that digitally engaged customers:

have stronger interest and greater likelihood to be early EV adopters;

are 16 percent more likely to purchase home-based electric vehicle charging stations and installation services;

are 17 percent more likely to sign up for financing for home-based electric vehicle charging stations; and

increase the adoption of consumer-focused programs.

These findings suggest that if utilities are going to seize the full potential of the EV opportunity, they must start engaging customers now so they can appropriately influence the timing and branding of EV charging assets.

How can utilities engage consumers in preparation?

If utilities establish the groundwork to engage customers effectively, they can reduce the risks of waiting for an adoption spike and of building and investing in the asset too soon. To improve customer engagement, utilities need to:

Change their customer conversations from bills, kWh, and outages, to personalized, interesting topics, communicated at appropriate intervals and via appropriate communication channels, to gain customers’ attention.

Establish their roles as trusted advisors by presenting useful, personalized recommendations that benefit customers. These tips should change dynamically with changing customer behavior, or they risk becoming stagnant and redundant, thereby causing customers to lose interest.

Convert the perception of the utility as a monopolistic, inflexible entity to a desirable, consumer-oriented brand through appropriate EV marketing.

It’s critical to understand that this type of engagement strategy doesn’t even have to provide EV-specific messaging at first. It can start by engaging customers through topics that are relevant and unique, through established or evolving customer-facing programs, such as EE, BDR, TOU, HER.

As lines of communication open up between utility and users, utilities can begin to understand their customers’ energy habits on a more granular level. This intelligence can be used by business analysts to help educate program developers on the optimal EV program timing. For example, as customers become interested in services in which EV owners typically enlist, utilities can target them for EV program marketing. As the number of these customers grows, the window for program development opens, and their levels of interest can be used to inform program and marketing timelines.

While all this may seem like an added nuisance to an EV asset development strategy, there’s significant risk of losing this new asset to third-party providers. This is a much greater burden to utilities than spending the time to properly own the EV opportunity.

Related News