Maryland Reveals 2017 Investment Plans For Green Jobs, Renewables

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Maryland 2017 Environmental Agenda drives green jobs, renewable energy, electric vehicles, and clean water commerce, leveraging SEIF funds, EARN workforce training, and the Green Energy Institute to spur innovation, private investment, and sustainable economic growth.

Key Points

A $65M plan to grow green jobs, renewables, EVs, and clean water commerce while spurring innovation and investment.

✅ $3M into EARN to train 1,500 workers for solar, wind, hydro jobs

✅ $7.5M to launch Green Energy Institute for commercialization

✅ $41M SEIF backing for Tier 1 renewable projects statewide

Gov. Larry Hogan, R-Md., has announced the state’s 2017 environmental agenda, which includes initiatives to grow jobs in green industries, invest in renewable energy resources, even as California grid reliability challenges show ongoing fossil dependence, promote the use of electric vehicles and promote clean water commerce.

Hogan’s 2017 Environmental Package is designed to protect Maryland’s natural resources while fostering economic and job growth, according to a press release from his administration.

In total, the proposals outlined by Hogan represent nearly $65 million of investment in Maryland’s environment, aligning with broader clean energy funding trends nationwide, the release says.

In addition to these targeted proposals, $41 million will be invested in Tier 1 renewable projects through the Strategic Energy Investment Fund, as recent reports of renewable facilities pollution issues underscore the need for strong enforcement in the sector. These funds will be a part of the $44 million Exelon must pay in liquidated damages to the State of Maryland as a condition of the February 2012 merger between Exelon and Constellation Energy Group.

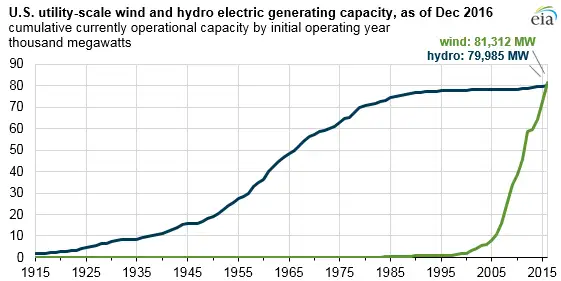

One of these initiatives is a $3 million targeted investment in Maryland’s EARN Program, which will train 1,500 workers for jobs in the solar, wind, hydroelectric and other green industries, echoing Pennsylvania clean energy jobs growth reported recently. This proposal would be Maryland’s first significant investment in workforce training for green jobs, the administration says.

In addition, Hogan has announced $7.5 million in funding to create the Green Energy Institute, a collaboration between the University of Maryland Energy Research Center and the Maryland Clean Energy Center. The mission of the Green Energy Institute will be to develop and attract private investment, complementing federal efforts to revitalize coal communities through clean energy projects, and commercialize clean energy innovations in the state.

“The proposals in our package are innovative, forward-thinking solutions to ensure that Maryland continues to lead the way to safeguard our environment,” states the governor. “I look forward to working with legislators to get these common-sense measures passed. We owe it to the next generation to continue to find cost-effective ways to protect Maryland’s environment and stimulate economic growth.”