Nova Scotia Power increases use of biomass for generating electricity

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Nova Scotia Biomass Electricity Policy increases dispatchable renewable generation from Port Hawkesbury and Brooklyn Energy, raising MWh output while critics cite clearcutting, carbon emissions, high costs to ratepayers, and delays replacing Muskrat Falls hydro.

Key Points

Policy directing utilities to maximize biomass power as dispatchable renewable supply during hydro delays.

✅ Port Hawkesbury biomass output up 35% year over year

✅ Brooklyn Energy used as dispatchable renewable supply

✅ Critics cite clearcutting, emissions, high ratepayer costs

A boiler owned by Nova Scotia Power on the grounds of the Port Hawkesbury paper plant, whose discount power rate request has drawn attention, is burning 35% more woody biomass this year than last.

The year-to-date figures show 126,810 megawatt hours (MWh) of electricity was generated over the first nine months of 2021 compared to 93,934 MWh for the same period in 2020 and 65,891 MWh in 2019.

The information is contained in monthly fuel cost reports Nova Scotia Power must make to the Utility and Review Board, which regulates how much consumers ultimately pay for electricity and has received a call for major grid changes in Nova Scotia.

Burning biomass — which includes everything from low-grade pulpwood to bark, shavings, and wood chip waste from sawmills — for the purpose of generating electricity is only about 22% efficient, even as some coal stations have switched to biomass abroad. Nova Scotia Power’s boiler at Port Hawkesbury supplies about 3% of the total electricity used in the province.

Citizens concerned about climate change have for years opposed the government classifying biomass as “renewable energy” and have echoed calls to reduce biomass use for electricity, because clearcutting, which releases carbon from the ground, remains the dominant form of harvesting on Crown and private land. That’s despite ongoing work to begin implementing 2018 recommendations from Professor Bill Lahey to move toward a more ecological approach.

In May 2020, after it became obvious renewable hydroelectricity from Muskrat Falls was going to be delayed yet again, the McNeil government passed an Order-in-Council extending until December 2022 the deadline to generate 40% of electricity from renewable sources as it moved to increase wind and solar projects across Nova Scotia.

To help with the shortfall, Nova Scotia Power was told to “maximize” its use of biomass at both the facility it owns in Port Hawkesbury and another one in Brooklyn owned by its parent company, Emera.

In a letter to Nova Scotia Power dated May 15, then-Energy Minister Derek Mombourquette, amid debate over independent energy planning, added: “Nova Scotia Power shall also maximize the use of dispatchable renewable electricity from its own facilities, as well as those of renewable electricity power producers in Nova Scotia (excluding COMFIT generation sources).”

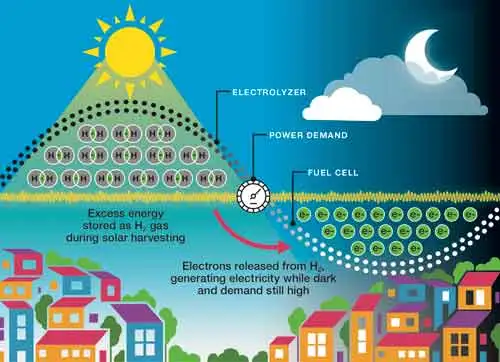

By definition, “dispatchable” excludes wind and hydro sources, which are not available 24/7, though a new attempt to harness the Bay of Fundy's tides is underway. Nova Scotia Power claims the only “dispatchable renewable electricity power producer” in the province is Brooklyn Energy, the 35 MW biomass plant near Liverpool.

The government capped at $7 million a year how much electricity Nova Scotia Power could buy from its affiliate company. Critics of the deal — such as auditors hired by the regulator and the province’s consumer advocate — say electricity generated by Brooklyn is the most expensive power and question why the province would burden ratepayers with its purchase.

The answer became apparent in September 2020 when then-Intergovernmental Affairs Minister Kelliann Dean appeared before the legislature’s standing committee on Natural Resources and Economic Development to praise the Order-in-Council for helping rescue the forestry industry four months after the closure of the Northern Pulp mill.

“The change to Renewable Energy Standards (May,2020) is enabling Nova Scotia Power to generate more electricity from wood chips and sawmill residuals by operating two biomass plants at capacity until electricity from Muskrat Falls comes onstream,” she said. “We are using all the policy levers at our disposal to support the sector.”

Nova Scotia Power is not required to report to the UARB how much electricity is being produced or how much biomass is being burned at Brooklyn Energy. The company pleads “commercial confidentiality” when asked by The Halifax Examiner.

Nova Scotia Power does report how much it spends each month to buy power from independent producers — a small group which includes Brooklyn but excludes all wind farms. That dollar amount has also increased over the past year — from $15.9 million for 10 months ending October 2020 compared to $23.3 million for 10 months ending October 2021. Unfortunately, the lack of transparency makes it impossible to know exactly how much of that increase is attributable to purchasing more biomass.

Radio silence

The current Minister of Natural Resources and Renewable Energy ,Tory Rushton, has the authority to reduce the amount of biomass being burned to generate electricity and by extension, the rate of clearcutting.

With a stroke of the pen, the PC government of Tim Houston could issue another Order-in-Council capping the amount of metric tonnes that could be used in the boilers, or, direct Nova Scotia Power to use biomass only when it is the most economical fuel choice.

But so far, Rushton has not responded to the Halifax Examiner’s question about whether he intends to make any change to stop “maximizing” the use of biomass to produce electricity.

The Examiner isn’t the only one pushing the Minister for answers to difficult issues. At noon today, Citizens opposed to a controversial clearcut on Crown land near Rocky Point Lake in Digby County will stage a demonstration outside the Department of Natural Resources and Renewable Energy on Hollis Street. The protest led by members of Extinction Rebellion and the Healthy Forest Coalition is to pressure the government to take action to protect the habitat of the mainland moose, an endangered species that ranges overs the Crown land currently being cut by the Westfor consortium.