Harbour Air's electric aircraft a high-flying example of research investment

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Harbour Air Electric Aircraft Project advances zero-emission aviation with CleanBC Go Electric ARC funding, converting seaplanes to battery-electric power, cutting emissions, enabling commercial passenger service, and creating skilled clean-tech jobs through R&D and electrification.

Key Points

Harbour Air's project electrifies seaplanes with CleanBC ARC support to enable zero-emission flights and cut emissions.

✅ $1.6M CleanBC ARC funds seaplane electrification retrofit

✅ Target: passenger-ready, zero-emission commercial service

✅ Creates 21 full-time clean-tech jobs in British Columbia

B.C.’s Harbour Air Seaplanes is building on its work in clean technology to decarbonize aviation, part of an aviation revolution underway, and create new jobs with support from the CleanBC Go Electric Advanced Research and Commercialization (ARC) program.

”Harbour Air is decarbonizing aviation and elevating the company to new altitudes as a clean-technology leader in B.C.'s transportation sector,” said Bruce Ralston, Minister of Energy, Mines and Low Carbon Innovation. “With support from our CleanBC Go Electric ARC program, Harbour Air's project not only supports our emission-reduction goals, but also creates good-paying clean-tech jobs, exemplifying the opportunities in the low-carbon economy.”

Harbour Air is receiving almost $1.6 million from the CleanBC Go Electric ARC program for its aircraft electrification project. The funding supports Harbour Air’s conversion of an existing aircraft to be fully electric-powered and builds on its successful December 2019 flight of the world’s first all-electric commercial aircraft, and subsequent first point-to-point electric flight milestones.

That flight marked the start of the third era in aviation: the electric age. Harbour Air is working on a new design of the electric motor installation and battery systems to gain efficiencies that will allow carrying commercial passengers, as it eyes first electric passenger flights in 2023. Approximately 21 full-time jobs will be created and sustained by the project.

“CleanBC is helping accelerate world-leading clean technology and innovation at Harbour Air that supports good jobs for people in our communities,” said George Heyman, Minister of Environment and Climate Change Strategy. “Once proven, the technology supports a switch from fossil fuels to advanced electric technology, and will provide a clean transportation option, such as electric ferries, that reduces pollution and shows the way forward for others in the sector.”

Harbour Air is a leader in clean-technology adoption. The company has also purchased a fully electric, zero-emission passenger shuttle bus to pick up and drop off passengers between Harbour Air’s downtown Vancouver and Richmond locations, and the Vancouver International Airport, where new EV chargers support travellers.

“It is great to see the Province stepping up to support innovation,” said Greg McDougall, Harbour Air CEO and ePlane test pilot. “This type of funding confirms the importance of encouraging companies in all sectors to focus on what they can be doing to look at more sustainable practices. We will use these resources to continue to develop and lead the transportation industry around the world in all-electric aviation.”

In total, $8.18 million is being distributed to 18 projects from the second round of CleanBC Go Electric ARC program funding. Recipients include Damon Motors and IRDI System, both based on the Lower Mainland. The 15 other successful projects will be announced this year.

The CleanBC Go Electric ARC program supports the electric vehicle (EV) sector in B.C., which leads the country in going electric, by providing reliable and targeted support for research and development, commercialization and demonstration of B.C.-based EV technologies, services and products.

“This project is a great example of the type of leading-edge innovation and tech advancements happening in our province,” said Brenda Bailey, Parliamentary Secretary for Technology and Innovation. “By further supporting the development of the first all-electric commercial aircraft, we are solidifying our position as world leaders in innovation and using technology to change what is possible.”

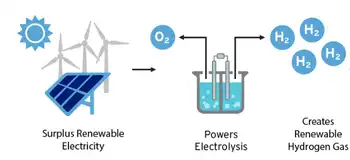

The CleanBC Roadmap to 2030 is B.C.’s plan to expand and accelerate climate action, including a major hydrogen project, building on the province’s natural advantages – abundant, clean electricity, high-value natural resources and a highly skilled workforce. It sets a path for increased collaboration to build a British Columbia that works for everyone.