Powering Towards Net Zero: The UK Grid's Transformation Challenge

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

UK Electricity Grid Investment underpins net zero, reinforcing transmission and distribution networks to integrate wind, solar, EV charging, and heat pumps, while Ofgem balances investor returns, debt risks, price controls, resilience, and consumer bills.

Key Points

Capital to reinforce grids for net zero, integrating wind, solar, EVs and heat pumps while balancing returns and bills.

✅ 170bn-210bn GBP by 2050 to reinforce cables, pylons, capacity.

✅ Ofgem to add investability metric while protecting consumers.

✅ Integrates wind, solar, EVs, heat pumps; manages grid resilience.

Prime Minister Sunak's recent upgrade to his home's electricity grid, designed to power his heated swimming pool, serves as a microcosm of a much larger challenge facing the UK: transforming the nation's entire electricity network for net zero emissions, amid Europe's electrification push across the continent.

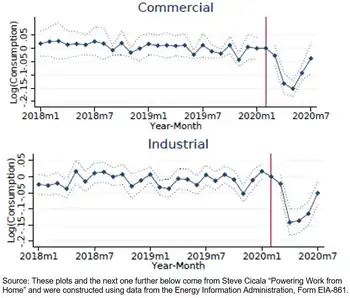

This transition requires a monumental £170bn-£210bn investment by 2050, earmarked for reinforcing and expanding onshore cables and pylons that deliver electricity from power stations to homes and businesses. This overhaul is crucial to accommodate the planned switch from fossil fuels to clean energy sources - wind and solar farms - powering homes with electric cars, as EV demand on the grid rises, and heat pumps.

The UK government's Climate Change Committee warns of potentially doubled electricity demand by 2050, the target date for net zero, even though managing EV charging can ease local peaks. This translates to a significant financial burden for companies like National Grid, SSE, and Scottish Power who own the main transmission networks and some regional distribution networks.

Balancing investor needs for returns and ensuring affordable energy bills for consumers presents a delicate tightrope act for regulators like Ofgem. The National Audit Office criticized Ofgem in 2020 for allowing network owners excessive returns, prompting concerns about potential bill hikes, especially after lessons from 2021 reshaped market dynamics.

Think-tank Common Wealth reported that distribution networks paid out a staggering £3.6bn to their owners between 2017 and 2021, raising questions about the balance between profitability and affordability, amid UK EV affordability concerns among consumers.

However, Ofgem acknowledges the need for substantial investment to finance network upgrades, repairs, and the clean energy transition. To this end, they are considering incorporating an "investability" metric, recognizing how big battery rule changes can erode confidence elsewhere, in the next price controls for transmission networks, ensuring these entities remain attractive for equity fundraising without overburdening consumers.

This proposal, while welcomed by the industry, has drawn criticism from consumer advocacy groups like Citizens Advice, who fear it could contribute to unfairly high bills. With energy bills already hitting record highs, public trust in the net-zero transition hinges on ensuring affordability.

High debt levels and potential credit rating downgrades further complicate the picture, potentially impacting companies' ability to raise investment funds. Ofgem is exploring measures to address this, such as stricter debt structure reporting requirements for regional distribution companies.

Lawrence Slade, CEO of the Energy Networks Association, emphasizes the critical role of investment in achieving net zero. He highlights the need for "bold" policies and regulations that balance ambitious goals with investor confidence and ensure efficient resource allocation, drawing on B.C.'s power supply challenges as a cautionary example.

The challenge lies in striking a delicate balance between attracting investment, ensuring network resilience, and maintaining affordable energy bills. As Andy Manning from Citizens Advice warns, "Without public confidence, net zero won't be delivered."

The UK's journey to net zero hinges on navigating this complex landscape. By carefully calibrating regulations, fostering investor confidence, and prioritizing affordability, the country can ensure its electricity grid is not just robust enough to power heated swimming pools, but also a thriving green economy for all.