How utilities can keep the lights on

By Tiziano Bruno

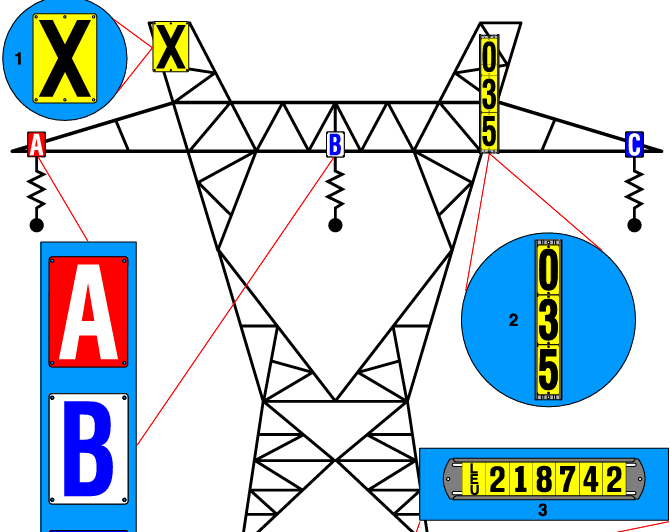

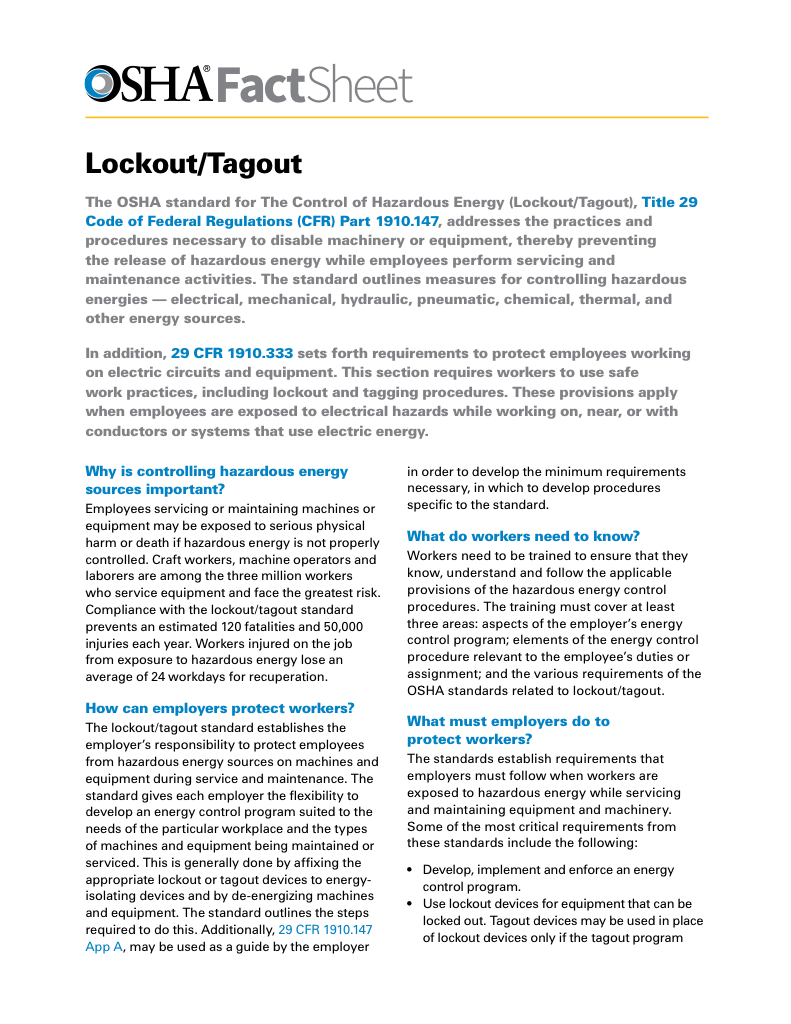

Download Our OSHA FS3529 Fact Sheet – Lockout/Tagout Safety Procedures

- Learn how to disable machines and isolate energy sources safely

- Follow OSHA guidelines for developing energy control programs

- Protect workers with proper lockout devices and annual inspections

How utilities can keep the lights on? Strengthen grid resilience with smart grid upgrades, demand response, distributed energy resources, predictive maintenance, cybersecurity, and enhance outage management, load forecasting, and renewable integration to ensure reliability.

How Utilities Can Keep the Lights On?

By modernizing the grid, diversifying supply, and optimizing demand with smart systems to ensure reliable service.

✅ Implement demand response, DRMS, and AMI to balance peak loads

✅ Deploy microgrids and battery storage for outage resilience

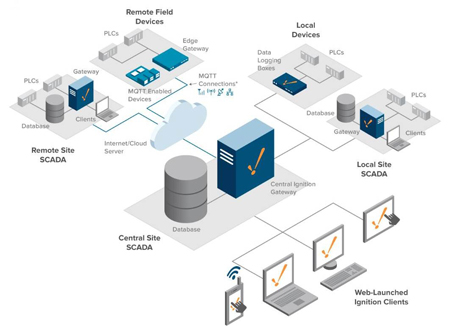

✅ Use predictive maintenance, SCADA, and analytics to cut downtime

Utilities worldwide have been on a roller-coaster ride, and an often painful one, over the past decade. Despite the sharp growth in global demand for electricity, many utilities have lost value or posted below-average returns. A McKinsey analysis of 50 major publicly listed utilities from Asia, Europe, and North America showed average total cumulative returns to shareholders of about 1 percent from July 2007 to July 2017, compared with 55 percent for the MSCI World Index.

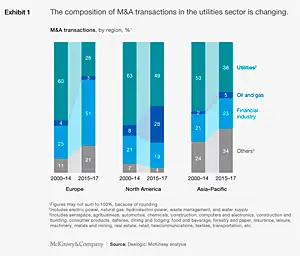

Utilities with high exposure to merchant revenues did even worse. Two reasons stand out. First, the collapse of merchant conventional generation eroded profits in Europe and the United States, and the growth in other sectors, such as renewables and transmission and distribution (T&D), was not enough to compensate. Second, utilities worldwide are losing market share to entrants from new sectors, such as the financial industry and the oil and gas industry (Exhibit 1). In the next decade, we expect electricity demand to increase faster than any other kind of energy, due to economic growth in Africa, Asia, and Latin America, and the electrification of final energy demand, specifically in transportation and heating. Massive new investments will be needed to keep up.

In the next decade, we expect electricity demand to increase faster than any other kind of energy, due to economic growth in Africa, Asia, and Latin America, and the electrification of final energy demand, specifically in transportation and heating. Massive new investments will be needed to keep up.

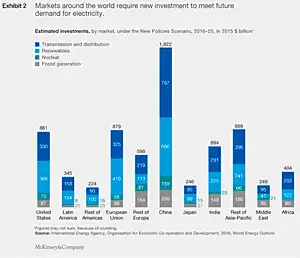

The International Energy Agency (IEA) estimates that from 2016 to 2025, there will be $7.2 trillion in investment in the power sector (Exhibit 2), almost $1.0 trillion more than in the previous decade.

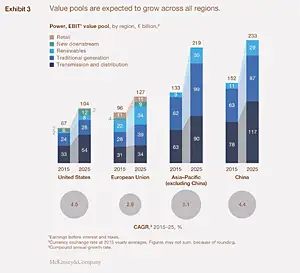

This could help utilities to improve their performance and create value—and in fact this may be happening for some large utilities. At the same time, though, competition could intensify as the number of new entrants increases and as previously closed markets, such as Japan, Mexico, and Saudi Arabia, open up. For readers tracking liberalization trends, see electricity deregulation resources to understand how policy shifts reshape market entry dynamics.  We have developed a model that estimates the value pools available to all players in the utility sector, including power generation, networks, renewables, and downstream products and services (for insights generated by the model and not addressed in the main text, see sidebar below, “Other insights from our model”). For the Asia–Pacific region, China, Europe, and the United States, we estimate that power value pools will increase more than 4 percent a year to 2025. That adds up to an overall increase of €235 billion between 2015 and 2025 (Exhibit 3).

We have developed a model that estimates the value pools available to all players in the utility sector, including power generation, networks, renewables, and downstream products and services (for insights generated by the model and not addressed in the main text, see sidebar below, “Other insights from our model”). For the Asia–Pacific region, China, Europe, and the United States, we estimate that power value pools will increase more than 4 percent a year to 2025. That adds up to an overall increase of €235 billion between 2015 and 2025 (Exhibit 3).

In this article, we explore how the industry is likely to change and then suggest what companies could do to adapt.

Electricity Today T&D Magazine Subscribe for FREE

- Timely insights from industry experts

- Practical solutions T&D engineers

- Free access to every issue

Understanding the future: Industry implications

For the future to be different, and better, more of the same is not likely to be an effective strategy. Conditions are changing fundamentally, and fast. Utilities, then, must also change—more speedily and more skillfully than many have proved capable of.

To negotiate this territory, it is useful to have a sense of the trends that are likely to shape the sector. Here are five important ones.

The revenue model for all generation technologies will converge to long-term contracts. Volatility will decrease, but profit margins will not necessarily increase. Over the past five years, overcapacity and low wholesale prices in mature power markets led to severe pressure, and in some cases, market collapse, in purely merchant power generation. The amount of impairments on thermal-generation assets in Europe alone reached €12 billion in 2015. New generation capacity will be difficult to finance under a pure merchant revenue model, in which prices are set by the variable cost of the marginal technology. The recent bloodbath of merchant generation, greater regulatory risk, and the growth of renewable-energy sources, which have zero marginal cost, mean that future prices are uncertain. Long-term fixed prices, either via power purchase agreements or capacity mechanisms, are the most likely new revenue models. In fact, the share of new generation capacity carrying full-price risk has already declined, and we believe it will continue to do so.

However, reduced top-line volatility will not necessarily translate to greater bottom-line results. Most of the projected increase in value pools to 2025 comes from new capacity coming online. The new contracts are awarded after competitive reverse auctions, open to all kinds of competitors. This is likely to continue to drive down the price of winning bids and therefore returns. We have already seen the impact on new renewable capacity. If prices converge further and faster due to greater competition, the pace of technology cost improvement might not be fast enough to offset radically lower revenues. Returns will therefore continue to be under pressure. Some research indicates that the return on equity of large listed clean-energy companies has deteriorated over the past five years.

Transmission and distribution players have a major growth opportunity—and also face major challenges. In the decade to 2025, according to the IEA’s World Energy Outlook, global investments in T&D will approach $3.0 trillion, much more than in fossil generation ($1.1 trillion). This represents a major growth opportunity. In addition, electricity-distribution networks offer interesting synergies with high-speed telecommunications infrastructure, such as fiber to the home and 5G networks. This is already occurring in some European markets. Yet project pipelines can be slowed by costly interconnection delays that compound capex and scheduling risk.

However, there are challenges. First, over the past decade regulation has been benevolent to most T&D players. The spread between financing costs and regulated returns has widened, as the former have collapsed and the latter have been generally flat. However, regional differences remain, as observed for instance in some European countries. In addition, regulation of T&D has not been as effective as in generation with respect to aligning performance to best practices. A McKinsey benchmarking of power-distribution costs in five regions (Australia, Eastern Europe, Latin America, Southeast Asia, and Western Europe) found that the best performers can serve a single point of consumption at a quarter of the cost of the worst. Even in Western Europe, which has efficient players, the gap between the best and the average is almost 100 percent (Exhibit 4).  There are at least two questions: When will policy makers raise their expectations of network operators to provide lower costs and better reliability and safety? And how will regulators address the impact of distributed generation on the grid? In many jurisdictions, contingency planning now highlights critical energy storage as a tool for resiliency and peak support.

There are at least two questions: When will policy makers raise their expectations of network operators to provide lower costs and better reliability and safety? And how will regulators address the impact of distributed generation on the grid? In many jurisdictions, contingency planning now highlights critical energy storage as a tool for resiliency and peak support.

Finally, new energy developments are introducing more complexity: from one-way to bidirectional energy flows, from centralized to decentralized production, and from a centralized to a localized approach to circuits. This will require the adoption of sophisticated software and hardware grid-modernization capabilities. To ground these changes in technical context, consult electric power systems fundamentals for an overview of grid architecture and operation.

From a global standpoint, retail competition is still limited, and where it does exist, profit margins for suppliers have been thin. Long-term profitability in pure commodity retail will be very challenging; retail of other services and products could be profitable, although it is still unproven and will take time.

There are therefore different ways to pursue profitability. For nonresidential segments, a pure commodity play will not be sufficient and suppliers shall seek higher gross margins, for example, by offering new products and services to their existing customers, thus gaining share of wallet. For residential segments, profitability is at risk due to the combination of new competition and regulatory pressure to lower costs to consumers. Suppliers can focus on the bottom line to achieve cost-to-serve levels of €10 per customer or less. Advanced analytics applications for churn prevention and credit management, and the digitization of core user and internal processes, will play a major role.

If margins become unsustainable, retailers might be forced back to a regulated or quasi-regulated business model.

Growth from new businesses or from downstream are unlikely to transform into profits for utilities in the short term. The adoption of distributed technologies and new services has been slower than expected in many markets; only a handful of American states, for example, have reached 2,000 megawatts or more of installed solar capacity or 150 megawatts of storage. Power companies are finding it difficult to extract value from these technologies for three reasons. First, increasing deployment depends to a significant degree on supportive regulation, such as incentives, tax rebates, and favorable rate structures with regard to grid access and energy compensation. Second, providers are struggling to find a sustainable operating model, given high customer-acquisition costs and the number of potential services. Third, there is strong competition from players with diverse backgrounds and skills, including equipment manufacturers, digital companies, telecoms, and start-ups. Even so, scaling programs in several markets are documenting growth in utility-scale energy storage that may alter peak management strategies.

Accordingly, power companies that are considering major investments in distributed generation and new services need to accept that this is a long-term proposition. They should also think about where they have a competitive advantage and how to extend their value proposition along the retail chain.

Interest rates and regulation will be instrumental much more than in the past. In the long term, market forces in large part will determine who wins or loses. The most efficient players will win the capacity auctions and thrive in T&D and retail. That said, interest rates and regulation dynamics will drive industry changes.

In many mature markets, interest rates are low and could therefore be poised to rise. This has several implications. First, it raises the price of new-build capacity, which may destroy the economics of some new projects. Second, it could squeeze margins in regulated networks where remunerated weighted average cost of capital may not be allowed to increase. Third, it lowers attractiveness of energy assets for financial players once excess liquidity can be deployed at similar returns on alternative asset classes, such as treasury bonds.

Regarding regulation, governments can shape the generation mix by choosing which technologies get long-term fixed-price contracts. Similarly, decisions on the end-user tariff structure will determine the scale of downstream opportunities, and regulation will frame the retail environment.

How utilities can prosper

Utilities are facing another decade of massive change, characterized by both substantial risks and considerable opportunities. To convert growth in industry volumes into growth in profits, there are four principles for success.

Get scale. Digitization, industry convergence, market liberalization, and new entrants mean that the barriers to entry are lower than ever. In this context, scale becomes a competitive advantage. Renewables and retail, with their fixed-cost structure, are two areas where scale and competitiveness go hand in hand. In T&D, too, scale will increasingly matter, because regulators will become more demanding with respect to efficiency, and infrastructure ownership will be auctioned off. But scale will mean different things for different players. Only a few companies can become genuinely global, for example. For others, local or regional leadership may be enough to create competitive advantage. In order to get scale, utilities will have to review their capital deployment and be ready to realize significant divestments. Consolidation may be another approach.

Eventually, geographic diversification might become a better option to get scale versus vertical integration, to hedge regulatory risks.

Embrace new technologies. Making good economic use of technology will be important in determining winners and losers, particularly in networks. Applications of advanced analytics to asset management could mean major improvements in cost effectiveness in operations; there is a sizeable efficiency potential to capture via technology. Utilities can strengthen these efforts by applying smart grid data analytics to prioritize investments and reduce failure risk. In fact, this has already happened: we have seen 15 to 25 percent maintenance and replacement cost savings for transformers and circuit breakers and 10 to 20 percent maintenance and replacement cost savings for overhead lines and underground cables. Complementary programs in transformer condition monitoring can sustain these gains through proactive diagnostics and lifecycle planning. Utilities should adopt similar technologies as soon as possible, because they could become mainstream in just a few years.

Focus on regulatory management. In the past, the large share of merchant revenues and profits required utilities to understand future commodity prices. In the future, the dominance of top-down regulation means that anticipating regulation, and possibly helping to shape it, will become the name of the game. Effective regulatory strategy means asking broad questions: What is the cheapest supply mix? Are tariffs and incentives sustainable and fair? It will also be essential to communicate with key stakeholders. Effective regulatory management, then, will be a priority and will require developing new capabilities, such as active institutional advocacy.

Explore adjacencies. The utility industry has never faced so many big disruptions at once. A corollary, then, is that this is a good time to launch new business models. For example, developers might decide to sell an increasing share of ownership to financial players that can offer a lower cost of capital. This is already happening in the renewables sector, and could extend to infrastructure. In another example, T&D players might decide to expand their role within the telecom infrastructure, on the basis of operational synergies. To gain a material share of the value pool coming from the electrification of transportation and new downstream opportunities, utilities might also want to consider new fields, such as insurance and consumer credit. So far, it has to be said, little of this is happening.

The utility industry is entering a period of uncertainty mixed with possibility—of value waiting to be captured, and considerable competition for it. To prosper, utilities must act decisively or face significant and possibly existential risks.

Test Your Knowledge About Smart Grid!

Think you know Smart Grid? Take our quick, interactive quiz and test your knowledge in minutes.

- Instantly see your results and score

- Identify strengths and areas for improvement

- Challenge yourself on real-world electrical topics

Tiziano Bruno is an associate partner in McKinsey’s Milan office, David Frankel is a partner in the Los Angeles office, Sébastien Léger is a partner in the Paris office, and Antonio Volpin is a senior partner in the Singapore office.