Toshiba eyes Gates nuclear alliance, chip plant

TOKYO, JAPAN - Toshiba Corp is in talks with a company backed by Microsoft Chairman Bill Gates to jointly develop advanced nuclear reactors, the Japanese electronics maker said, helping send its shares higher.

Toshiba, the world's No.3 microchip maker behind Intel Corp and Samsung Electronics Co, also said it would restart plans to build a factory to make NAND-type flash memory chips to meet recovering sales.

These developments in the firm's two main earnings pillars — nuclear and chip operations — come at a time when electronics makers worldwide are trying to put the global downturn behind them and seek fresh growth, especially in emerging markets.

Toshiba, which owns U.S. nuclear firm Westinghouse, said it was in preliminary talks with the Gates-backed firm TerraPower to develop so-called traveling-wave reactors (TWRs), which are designed to use depleted uranium as fuel and thought to hold the promise of running up to 100 years without refueling.

That compares with conventional light-water reactors, which require refueling once every several years.

Small-sized reactors like the TWR would make a good fit for emerging markets, said Deutsche Securities analyst Takeo Miyamoto.

"If you put a regular reactor like the one used in Japan in some emerging nations, that could sometimes create overcapacity and make it difficult to back that reactor up when you take the unit off line for maintenance," Miyamoto said.

"There would be demand for this type of reactor in newly developing countries," he said.

Toshiba is led by Norio Sasaki, who took the reins at the company last June after rising through the ranks in its power generation division, where he spearheaded the firm's acquisition of Westinghouse in 2006.

The Nikkei daily, which first reported the news earlier, said Gates could invest several hundred billion yen (several billion dollars) of his own money in the project, with commercialization likely to take more than 10 years.

Toshiba spokesman Keisuke Ohmori said the talks with TerraPower are at an early stage and nothing has been decided.

Shares of Toshiba rose as much as 4.9 percent before closing up 3.6 percent at 466 yen, outperforming the benchmark Nikkei average, which fell 0.5 percent.

Toshiba, which is developing its own mini nuclear reactors designed to operate continuously for 30 years, anticipates that about 80 percent of the technologies used in the reactor under development can be applied to TWRs, the Nikkei said.

One hurdle for commercialization of TWRs is the development of materials that can withstand nuclear reactions for such long periods of time, the paper said.

Separately, Toshiba said it had decided to start construction of its fifth NAND flash memory plant in Mie, central Japan, in July in reaction to a recovery in demand, driven in part by the growing popularity of smartphones.

Production is slated for early 2011.

Toshiba said it has not yet decided on the scale of the investment or output capacity. The Nikkei reported last month that the company would spend about 800 billion yen (US $8.9 billion) on the plant.

Toshiba had originally planned to start building the factory in the spring of 2009 and for it to be completed this year, but it put the project on hold due to the industrywide slump.

Rival Samsung and SanDisk Corp, Toshiba's partner in the NAND business, have also recently become more upbeat on the chip market.

"The flash memory industry is in an extremely tight spot right now, and makers simply cannot catch up with demand, as Apple gobbles up the bulk of the supply," said Kazutaka Oshima, president of Rakuten Investment Management.

"The supply shortfall is such that some makers even have to buy semiconductors from other makers from the spot market to satisfy their supply obligations."

NAND flash memory chips, which can retain data even after electricity has been turned off, is used to store music, pictures and video clips in a wide range of electronics including digital cameras and mobile phones.

Related News

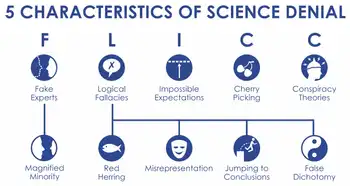

$1 billion per year is being spent to support climate change denial

PARIS - Orson Johnson says there is no scientific consensus on climate change. He’s wrong. A 2015 study by Drexel University’s Robert Brulle found that nearly $1 billion per year is being spent to support climate change denial. Electric utilities, fossil fuel and transportation sectors outspent environmental and renewable energy sectors by more than 10-to-1. It is virtually the same strategy that tobacco companies used to deny the dangers of tobacco smoke, spending hundreds of millions of dollars to delay recognition of harm from tobacco smoke for decades. These are the same debunked sources Johnson quotes in his commentary.

The authors…