NS Power reducing capital spending plans for 2013

Halifax, NS - - Nova Scotia Power is reducing its request for capital spending to the Nova Scotia Utility and Review Board. The utility filed the reduced capital plan today as part of the Annual Capital Expenditure ACE Plan regulatory process. The changes reflect the positive results of major capital initiatives over the last few years and will help address rate pressure for customers.

“The last few years saw significant capital investment associated with our key priorities – adding more renewable energy to the system and investing in system reliability,” said Bob Hanf, President and CEO of Nova Scotia Power. “With both of these initiatives now seeing measurable results, the timing of a reduction in our capital investments is appropriate.”

Each fall, Nova Scotia Power submits its capital spending plan for approval. The plan seeks approval for capital projects that allow the utility to build new equipment such as renewable energy projects, maintain the transmission system, and re-invest in existing generation assets. The revised plan now includes $246 million in capital spending, down from the original amount of $337 million.

As part of the process to adjust rates for 2013 and 2014, the Rate Stabilization Plan helped keep the rate request lower than it otherwise would have been, but there continue to be challenges related to the loss of ongoing fixed cost contributions from the pulp and paper industry.

“We know our customers are concerned about rising electricity prices, and this is one example of the steps we’re taking to minimize pressure on rates,” said Hanf. “We are focused on striking a careful balance that ensures we invest enough in our system to maintain reliability and safety for customers.”

Nova Scotia Power is addressing customer concerns about affordability in a number of ways, including a company-wide effort to find additional savings, such as the reduced capital plan proposal. The company is also working with low income advocacy groups and government agencies to improve options for low income customers.

Related News

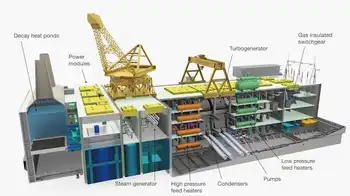

Big prizes awarded to European electricity prediction specialists

LONDON - Three European prediction specialists have won prizes worth €2 million for developing the most accurate predictions of electricity flow through a grid

The three winners of the Big Data Technologies Horizon Prize received their awards at a ceremony on 12th November in Austria.

The first prize of €1.2 million went to Professor José Vilar from Spain, while Belgians Sofie Verrewaere and Yann-Aël Le Borgne came in joint second place and won €400,000 each.

The challenge was open to individuals groups and organisations from countries taking part in the EU’s research and innovation programme, Horizon 2020.

Carlos Moedas, Commissioner for Research, Science and…