LARGE-SCALE ENERGY PROJECTS UNDERWAY IN NY

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

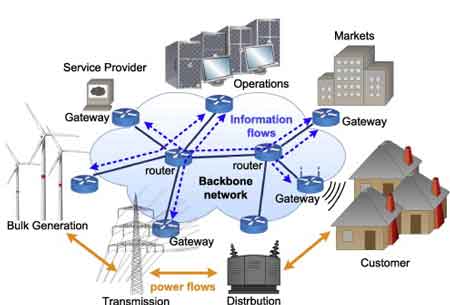

NYSERDA Renewable Energy Awards back 11 large-scale wind, solar, hydro, and fuel cell projects, advancing New York's Clean Energy Standard, adding 260 MW, leveraging private investment, and cutting carbon emissions under the state's REV strategy.

Key Points

State funding for wind, solar, hydro and fuel cells to expand renewables, add capacity, and cut carbon in New York.

✅ $360M supports 11 wind, solar, hydro, and fuel cell projects

✅ Adds over 260 MW toward Clean Energy Standard goals

✅ 20-year RECs at $24.24/MWh spur private investment

Reminder from the New York State Energy Research and Development Authority (NYSERDA): Governor Andrew M. Cuomo announced $360 million in awards for 11 large-scale renewable energy projects throughout the state in his State of the State yesterday. These projects provide strong support for the Clean Energy Standard that 50 percent of New York's electricity come from renewable energy sources by 2030, and complement the largest U.S. offshore wind farm initiative underway in the state.

The awards will leverage almost $1 billion in private sector investment for clean technology projects such as wind, solar, fuel cell and hydroelectric installations, and federal support like the DOE wind energy awards continues to spur progress across the sector. The projects are expected to generate enough clean, renewable energy to power more than 110,000 homes each year and reduce carbon emissions by more than 420,000 metric tons, equivalent to taking more than 88,000 cars off the road.

The 11 projects include two wind farms, one utility-scale solar farm, seven hydro projects, and one fuel cell project, as the state also begins offshore wind site investigations under the Governor's Reforming the Energy Vision (REV) strategy. Once operational, these projects will add over 260 megawatts of clean, renewable energy for use in New York State.

Due to the robust response to the solicitation and the approval of the Clean Energy Standard, which calls for the development of renewable and clean energy sources under REV, as well as New York's early achievement of state solar goals milestone, the amount of the solicitation was increased $210 million, from $150 million to $360 million.

The 11 large-scale renewable energy projects include:

Capital Region

- Hecate Energy Green County, Greene County: Hecate Energy LLC will build a 50 MW solar facility in Coxsackie.

Central New York

- Fulton Unit 1, Oswego County: Brookfield Renewable Energy Group, will install a new 890 kW high-flow turbine-generator at a hydroelectric facility in Oswego County.

- North Division Street Dam Hydroelectric Facility, Cayuga County: The City of Auburn will upgrade equipment, increase capacity and restore operation of the hydroelectric facility, resulting in a new capacity of 1.12 MW.

Mid-Hudson

- Swinging Bridge, Sullivan County: Eagle Creek Hydro Power LLC will add 0.85 MW to an existing hydroelectric facility in the town of Lumberland, resulting in a total installed capacity of more than 7 MW.

- Regen DG Project, Westchester County: Bloom Energy Corp. will install a 1.05 MW fuel cell at Regeneron Pharmaceuticals, Inc. in Tarrytown.

Mohawk Valley

- Belfort Unit 3, Herkimer County: Brookfield Energy Marketing LP upgraded its existing facility in Beaver River with two modern high-efficiency runners, resulting in a total installed capacity of 2.4 MW.

North Country

- Number Three Wind Farm, Lewis County: Invenergy Wind Development LLC will build a 105.8 MW wind farm in the towns of Lowville, Harrisburg and Denmark.

- Glen Park, Jefferson County: Northbrook New York LLC, a subsidiary of Cube Hydro Partners, LLC: Upgraded equipment at existing hydroelectric facility, resulting in a total installed capacity of more than 32 MW.

- Tannery Island Hydro, Jefferson County: Ampersand Tannery Island Hydro LLC installed and upgraded new equipment resulting in a total installed capacity of more than 1.8 MW.

Southern Tier

- Eight Point Wind Energy Center, Steuben County: NextEra Energy Resources LLC will build a 101.2 MW wind farm in the towns of Greenwood, Troupsburg and West Union.

Western New York

- Burt Dam Incremental Hydro, Niagara County: Ampersand Olcott Harbor Hydro LLC recently upgraded equipment resulting in a total installed capacity of 600 kW.

Support for these new projects is being provided by NYSERDA. The weighted average award price for this solicitation is $24.24 per megawatt hour of production over the 20-year terms of the awarded contracts.

John Rhodes, President and CEO, NYSERDA said, "Large-scale renewables are a critical component in achieving Governor Cuomo's nation-leading energy goals of 50 percent renewable power by 2030 and a 40 percent reduction in greenhouse gas emissions over the same time. These projects will provide renewables, aggressively reduce emissions and make energy more affordable for New Yorkers."

Audrey Zibelman, Public Service Commission Chair, said, "As a result of Governor Cuomo's nationally recognized Clean Energy Standard, New York will continue to attract billions of dollars in private investment for new renewable power supplies, developing new jobs and new choices for consumers. The projects announced today will bring significant benefits to consumers, including a cleaner environment and greater amounts of much-needed renewable energy resources."

These projects further New York's ambitious efforts, including contracts for 23 renewable projects statewide, to develop the clean energy infrastructure of tomorrow. NYSERDA's previous ten Main Tier solicitations for large-scale renewables have resulted in approximately 2,152 megawatts of new renewable capacity at 70 locations throughout the state, generating more than 5 million megawatt-hours of renewable energy every year. The power generated from these 70 projects is expected to provide enough clean power to supply over 825,000 homes per year, representing a total of $1.24 billion in investments in the Main Tier program.