Reversing the charge - Battery power from evs to the grid could open a fast lane

NFPA 70e Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Vehicle-to-Grid V2G unlocks EV charging flexibility and grid services, integrating renewable energy, demand response, and peak shaving to displace stationary storage and firm generation while lowering system costs and enhancing reliability.

Key Points

Vehicle-to-Grid V2G lets EV batteries discharge to grid, balancing renewables and cutting storage and firm generation.

✅ Displaces costly stationary storage and firm generation

✅ Enables demand response and peak shaving at scale

✅ Supports renewable integration and grid reliability

Owners of electric vehicles (EVs) are accustomed to plugging into charging stations at home and at work and filling up their batteries with electricity from the power grid. But someday soon, when these drivers plug in, their cars will also have the capacity to reverse the flow and send electrons back to the grid. As the number of EVs climbs, the fleet’s batteries could serve as a cost-effective, large-scale energy source, with potentially dramatic impacts on the energy transition, according to a new paper published by an MIT team in the journal Energy Advances.

“At scale, vehicle-to-grid (V2G) can boost renewable energy growth, displacing the need for stationary energy storage and decreasing reliance on firm [always-on] generators, such as natural gas, that are traditionally used to balance wind and solar intermittency,” says Jim Owens, lead author and a doctoral student in the MIT Department of Chemical Engineering. Additional authors include Emre Gençer, a principal research scientist at the MIT Energy Initiative (MITEI), and Ian Miller, a research specialist for MITEI at the time of the study.

The group’s work is the first comprehensive, systems-based analysis of future power systems, drawing on a novel mix of computational models integrating such factors as carbon emission goals, variable renewable energy (VRE) generation, and costs of building energy storage, production, and transmission infrastructure.

“We explored not just how EVs could provide service back to the grid — thinking of these vehicles almost like energy storage on wheels providing flexibility — but also the value of V2G applications to the entire energy system and if EVs could reduce the cost of decarbonizing the power system,” says Gençer. “The results were surprising; I personally didn’t believe we’d have so much potential here.”

Displacing new infrastructure

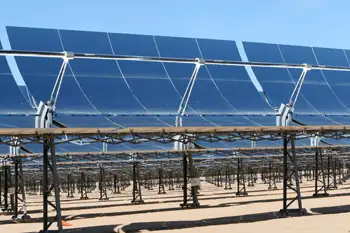

As the United States and other nations pursue stringent goals to limit carbon emissions, electrification of transportation has taken off, with the rate of EV adoption rapidly accelerating. (Some projections show EVs supplanting internal combustion vehicles over the next 30 years.) With the rise of emission-free driving, though, there will be increased demand for energy on already stressed state power grids nationwide. “The challenge is ensuring both that there’s enough electricity to charge the vehicles and that this electricity is coming from renewable sources,” says Gençer.

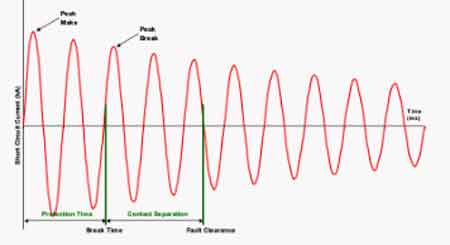

But solar and wind energy is intermittent. Without adequate backup for these sources, such as stationary energy storage facilities using lithium-ion batteries, for instance, or large-scale, natural gas- or hydrogen-fueled power plants, achieving clean energy goals will prove elusive. More vexing, costs for building the necessary new energy infrastructure runs to the hundreds of billions.

This is precisely where V2G can play a critical, and welcome, role, the researchers reported. In their case study of a theoretical New England power system meeting strict carbon constraints, for instance, the team found that participation from just 13.9 percent of the region’s 8 million light-duty (passenger) EVs displaced 14.7 gigawatts of stationary energy storage. This added up to $700 million in savings — the anticipated costs of building new storage capacity.

Their paper also described the role EV batteries could play at times of peak demand, such as hot summer days. “With proper grid coordination practices in place, V2G technology has the ability to inject electricity back into the system to cover these episodes, so we don’t need to install or invest in additional natural gas turbines,” says Owens. “The way that EVs and V2G can influence the future of our power systems is one of the most exciting and novel aspects of our study.”

Modeling power

To investigate the impacts of V2G on their hypothetical New England power system, the researchers integrated their EV travel and V2G service models with two of MITEI’s existing modeling tools: the Sustainable Energy System Analysis Modeling Environment (SESAME) to project vehicle fleet and electricity demand growth, and GenX, which models the investment and operation costs of electricity generation, storage, and transmission systems. They incorporated such inputs as different EV participation rates, costs of generation for conventional and renewable power suppliers, charging infrastructure upgrades, travel demand for vehicles, changes in electricity demand, and EV battery costs.

Their analysis found benefits from V2G applications in power systems (in terms of displacing energy storage and firm generation) at all levels of carbon emission restrictions, including one with no emissions caps at all. However, their models suggest that V2G delivers the greatest value to the power system when carbon constraints are most aggressive — at 10 grams of carbon dioxide per kilowatt hour load. Total system savings from V2G ranged from $183 million to $1,326 million, reflecting EV participation rates between 5 percent and 80 percent.

“Our study has begun to uncover the inherent value V2G has for a future power system, demonstrating that there is a lot of money we can save that would otherwise be spent on storage and firm generation,” says Owens.

Harnessing V2G

For scientists seeking ways to decarbonize the economy, the vision of millions of EVs parked in garages or in office spaces and plugged into the grid via vehicle-to-building charging for 90 percent of their operating lives proves an irresistible provocation. “There is all this storage sitting right there, a huge available capacity that will only grow, and it is wasted unless we take full advantage of it,” says Gençer.

This is not a distant prospect. Startup companies are currently testing software that would allow two-way communication between EVs and grid operators or other entities. With the right algorithms, EVs would charge from and dispatch energy to the grid according to profiles tailored to each car owner’s needs, never depleting the battery and endangering a commute.

“We don’t assume all vehicles will be available to send energy back to the grid at the same time, at 6 p.m. for instance, when most commuters return home in the early evening,” says Gençer. He believes that the vastly varied schedules of EV drivers will make enough battery power available to cover spikes in electricity use over an average 24-hour period. And there are other potential sources of battery power down the road, such as electric school buses that are employed only for short stints during the day and then sit idle, with the potential to power buildings during peak hours.

The MIT team acknowledges the challenges of V2G consumer buy-in. While EV owners relish a clean, green drive, they may not be as enthusiastic handing over access to their car’s battery to a utility or an aggregator working with power system operators. Policies and incentives would help.

“Since you’re providing a service to the grid, much as solar panel users do, you could get paid to sell electricity back for your participation, and paid at a premium when electricity prices are very high,” says Gençer.

“People may not be willing to participate ’round the clock, but as states like California explore EVs for grid stability programs and incentives, if we have blackout scenarios like in Texas last year, or hot-day congestion on transmission lines, maybe we can turn on these vehicles for 24 to 48 hours, sending energy back to the system,” adds Owens. “If there’s a power outage and people wave a bunch of money at you, you might be willing to talk.”

“Basically, I think this comes back to all of us being in this together, right?” says Gençer. “As you contribute to society by giving this service to the grid, you will get the full benefit of reducing system costs, and also help to decarbonize the system faster and to a greater extent.”

Actionable insights

Owens, who is building his dissertation on V2G research, is now investigating the potential impact of heavy-duty electric vehicles in decarbonizing the power system. “The last-mile delivery trucks of companies like Amazon and FedEx are likely to be the earliest adopters of EVs,” Owen says. “They are appealing because they have regularly scheduled routes during the day and go back to the depot at night, which makes them very useful for providing electricity and balancing services in the power system.”

Owens is committed to “providing insights that are actionable by system planners, operators, and to a certain extent, investors,” he says. His work might come into play in determining what kind of charging infrastructure should be built, and where.

“Our analysis is really timely because the EV market has not yet been developed,” says Gençer. “This means we can share our insights with vehicle manufacturers and system operators — potentially influencing them to invest in V2G technologies, avoiding the costs of building utility-scale storage, and enabling the transition to a cleaner future. It’s a huge win, within our grasp.”