Trump's Vision of U.S. Energy Dominance Faces Real-World Constraints

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

U.S. Energy Dominance envisions deregulation, oil and gas growth, LNG exports, pipelines, and geopolitical leverage, while facing OPEC pricing power, infrastructure bottlenecks, climate policy pressures, and accelerating renewables in global markets.

Key Points

U.S. policy to grow fossil fuel output and exports via deregulation, bolstering energy security, geopolitical influence.

✅ Deregulation to expand drilling, pipelines, and export capacity

✅ Exposed to OPEC pricing, global shocks, and cost competitiveness

✅ Faces infrastructure, ESG finance, and renewables transition risks

Former President Donald Trump has consistently advocated for “energy dominance” as a cornerstone of his energy policy. In his vision, the United States would leverage its abundant natural resources to achieve energy self-sufficiency, flood global markets with cheap energy, and undercut competitors like Russia and OPEC nations. However, while the rhetoric resonates with many Americans, particularly those in energy-producing states, the pursuit of energy dominance faces significant real-world challenges that could limit its feasibility and impact.

The Energy Dominance Vision

Trump’s energy dominance strategy revolves around deregulation, increased domestic production of oil and gas, and the rollback of climate-oriented restrictions. During his presidency, he emphasized opening federal lands to drilling, accelerating the approval of pipelines, and, through an executive order, boosting uranium and nuclear energy initiatives, as well as withdrawing from international agreements like the Paris Climate Accord. The goal was not only to meet domestic energy demands but also to establish the U.S. as a major exporter of fossil fuels, thereby reducing reliance on foreign energy sources.

This approach gained traction during Trump’s first term, with the U.S. achieving record levels of oil and natural gas production. Energy exports surged, making the U.S. a net energy exporter for the first time in decades. Yet, critics argue that this policy prioritizes short-term economic gains over long-term sustainability, while supporters believe it provides a roadmap for energy security and geopolitical leverage.

Market Realities

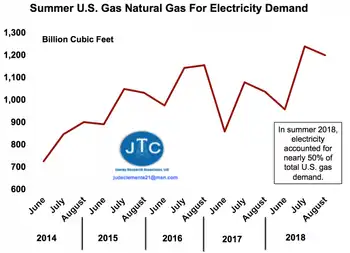

The energy market is complex, influenced by factors beyond the control of any single administration, with energy crisis impacts often cascading across sectors. While the U.S. has significant reserves of oil and gas, the global market sets prices. Even if the U.S. ramps up production, it cannot insulate itself entirely from price shocks caused by geopolitical instability, OPEC production cuts, or natural disasters.

For instance, despite record production in the late 2010s, American consumers faced volatile gasoline prices during an energy crisis driven by $5 gas and external factors like tensions in the Middle East and fluctuating global demand. Additionally, the cost of production in the U.S. is often higher than in countries with more easily accessible reserves, such as Saudi Arabia. This limits the competitive advantage of U.S. energy producers in global markets.

Infrastructure and Environmental Concerns

A major obstacle to achieving energy dominance is infrastructure. Expanding oil and gas production requires investments in pipelines, export terminals, and refineries. However, these projects often face delays due to regulatory hurdles, legal challenges, and public opposition. High-profile pipeline projects like Keystone XL and Dakota Access have become battlegrounds between industry proponents and environmental activists, and cross-border dynamics such as support for Canadian energy projects amid tariff threats further complicate permitting, highlighting the difficulty of reconciling energy expansion with environmental and community concerns.

Moreover, the transition to cleaner energy sources is accelerating globally, with many countries committing to net-zero emissions targets. This trend could reduce the demand for fossil fuels in the long run, potentially leaving U.S. producers with stranded assets if global markets shift more quickly than anticipated.

Geopolitical Implications

Trump’s energy dominance strategy also hinges on the belief that U.S. energy exports can weaken adversaries like Russia and Iran. While increased American exports of liquefied natural gas (LNG) to Europe have reduced the continent’s reliance on Russian gas, achieving total energy independence for allies is a monumental task. Europe’s energy infrastructure, designed for pipeline imports from Russia, cannot be overhauled overnight to accommodate LNG shipments.

Additionally, the influence of major producers like Saudi Arabia and the OPEC+ alliance remains significant, even as shifts in U.S. policy affect neighbors; in Canada, some viewed Biden as better for the energy sector than alternatives. These countries can adjust production levels to influence prices, sometimes undercutting U.S. efforts to expand its market share.

The Renewable Energy Challenge

The growing focus on renewable energy adds another layer of complexity. Solar, wind, and battery storage technologies are becoming increasingly cost-competitive with fossil fuels. Many U.S. states and private companies are investing heavily in clean energy to align with consumer preferences and global trends, amid arguments that stepping away from fossil fuels can bolster national security. This shift could dampen the domestic demand for oil and gas, challenging the long-term viability of Trump’s energy dominance agenda.

Moreover, international pressure to address climate change could limit the expansion of fossil fuel infrastructure. Financial institutions and investors are increasingly reluctant to fund projects perceived as environmentally harmful, further constraining growth in the sector.

While Trump’s call for U.S. energy dominance taps into a desire for economic growth and energy security, it faces numerous challenges. Global market dynamics, infrastructure bottlenecks, environmental concerns, and the transition to renewable energy all pose significant barriers to achieving the ambitious vision.

For the U.S. to navigate these challenges effectively, a balanced approach that incorporates both traditional energy sources and investments in clean energy is likely needed. Striking this balance will require careful policymaking that considers not just immediate economic gains but also long-term sustainability and global competitiveness.