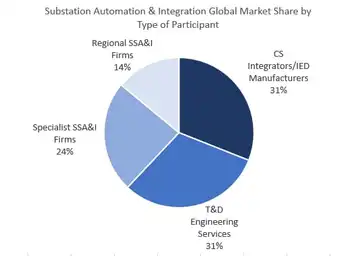

Four Major Types of Substation Integration Service Providers Account for More than $1 Billion in Annual Revenues

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Substation Automation Services help electric utilities modernize through integration, EPC engineering, protective relaying, communications and security, with CAPEX and OPEX insights and a growing global market for third-party providers worldwide rapidly.

Key Points

Engineering, integration, and EPC support modernizing utility substations with protection, control, and secure communications

✅ Third-party engineering, EPC, and OEM services for utilities

✅ Integration of multi-vendor devices and platforms

✅ Focus on relays, communications, security, CAPEX-OPEX

The Newton-Evans Research Company has released additional findings from its newly published four volume research series entitled: The World Market for Substation Automation and Integration Programs in Electric Utilities: 2017-2020.

This report series has observed four major types of professional third-party service providers that assist electric utilities with substation modernization. These firms range from (1) smaller local or regional engineering consultancies with substation engineering resources to (2) major global participants in EPC work, to (3) the engineering services units of manufacturers of substation devices and platforms, to (4) substation integration specialist firms that source and integrate devices from multiple manufacturers for utility and industrial clients, and often provide substation automation training to support implementation.

2016 Global Share Estimates for Professional Services Providers of Electric Power Substation Integration and Automation Activities

The North American market report (Volume One) includes survey participation from 65 large and midsize US and Canadian electric utilities while the international market report (Volume Two) includes survey participation from 32 unique utilities in 20 countries around the world. In addition to the baseline survey questions, the report includes 2017 substation survey findings on four additional specific topics: communications issues; protective relaying trends; security topics and the CAPEX/OPEX outlook for substation modernization.

Volume Three is the detailed market synopsis and global outlook for substation automation and integration:

Section One of the report provides top-level views of substation modernization, automation & integration and the emerging digital grid landscape, and a narrative market synopsis.

Section Two provides mid-year 2017 estimates of population, electric power generation capacity, transmission substations, including the 2 GW UK substation commissioning as a benchmark, and primary MV distribution substations for more than 120 countries in eight world regions. Information on substation related expenditures and spending for protection and control for each major world region and several major countries is also provided.

Section Three provides information on NGO funding resources for substation modernization among developing nations.

Section Four of this report volume includes North American market share estimates for 2016 shipments of many substation automation-related devices and equipment, such as trends in the digital relay market for utilities.

The Supplier Profiles report (Volume Four) provides descriptive information on the substation modernization offerings of more than 90 product and services companies, covering leading players in the transformer market as well.