Renewable Energy Projects - Technical Solutions

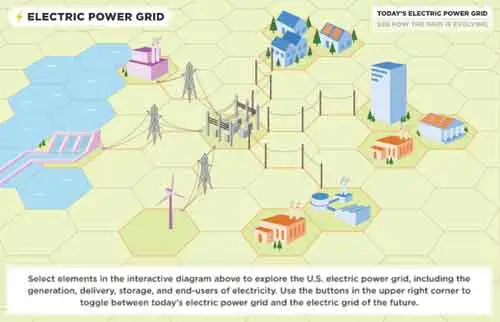

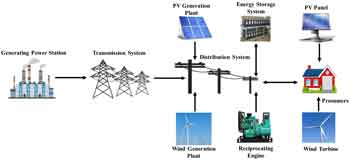

Renewable energy projects optimize power systems with grid integration, solar PV, wind turbines, battery storage, inverters, and power electronics, enhancing smart grid reliability, microgrids, transmission, and distribution through modeling, protection, and control engineering.

What Are Renewable Energy Projects?

Projects that design, integrate, and control solar, wind, and storage for reliable, efficient electric power systems.

? Grid integration studies: load flow, stability, and protection schemes.

? Power electronics and inverter control for MPPT and grid codes.

? SCADA, forecasting, and storage optimization in microgrids.

Renewable Energy Projects seem to have survived the first cycle of the world economic recession. In fact, late 2008 and all of 2009 seemed better than many economists had recently expected. After a slowdown in global investment activity at the end of 2008, sustainable energy projects rebounded during the final three quarters of 2010. For readers seeking a concise overview, the concept of what renewable energy is underpins these investment trends today.

The result was a total new investment in worldwide Renewable Energy Projects reached about $162 billion in 2009, down slightly from the revised target of $173 billion for 2008. This was still the second-highest annual figure ever recorded and nearly four times the total investment level of 2004. This performance demonstrated that Renewable Energy Projects were certainly not a typical bubble created by the so-called "credit boom", but were rather an investment story that will continue to be important for years to come. Understanding the mix of renewable energy sources helps explain the durability of capital flows in this sector.

The visual underscores how renewable power markets can rebound quickly when financing conditions stabilize.

While many policy-makers have increased their focus on encouraging the growth of Renewable Energy Projects (partly to stimulate job creation and offset the forces of recession), projects received new support. From the financial crisis of autumn 2008 until the spring of 2010, the world's chief economies set aside about $188 billion of “green stimulus” programs for Renewable Energy Projects. And since that time, the money has started to be spent. The United States recently announced a large grant scheme to assist the financing of renewable energy projects, and other countries followed the example of Germany, Spain and other European countries by commencing feed-in tariff programs to encourage and stimulate investment in Renewable Energy Projects.. Such measures are pivotal as governments scale clean renewable energy deployment across sectors and regions worldwide.

The major development banks, led by Germany’s KfW and the European Investment Bank, also became important actors in helping Renewable Energy Projects to weather the storm and expand into new markets. However, Renewable Energy Projects often face a bumpy path.

Blended finance vehicles increasingly target diverse renewable power sources to spread risk and accelerate grid integration across emerging markets.

The story of 2009, however, was one of resilience for Renewable Energy Projects. While there were areas of weakness, such as project development in the US and financing for biofuel plants, there was also a decisive shift in the balance of investment towards developing countries, particularly China. Renewable Energy Projects in China was the strongest feature of the year by far, although other areas of strength worldwide in 2009 included offshore wind investment in the North Sea and the financing of power storage and electric vehicle technology companies. There was also a marked improvement in the cost competitiveness of renewable power generation compared to fossil-fuel electricity generation. These shifts align with the fundamentals described in renewable energy facts, which clarify cost trends and technology learning curves.

New investment in Renewable Energy Projects in 2009 was $162 billion, down from a revised $173 billion in 2008. The 7% fall reflected the impact of the recession on investment in Europe and North America in particular, with renewable energy projects and companies finding it harder to access finance:

-

China saw a surge in investment in Renewable Energy Projects. Of the $119 billion invested worldwide by the financial sector in clean energy companies and utility-scale projects, $33.7 billion was invested in China, up 53% from 2008. Financial investment in Europe was down 10% at $43.7 billion, while that in Asia and Oceania, at $40.8 billion, exceeded that in the Americas, at $32.3 billion, for the first time.

-

Clean energy share prices rose almost 40% in 2009, reversing around a third of the losses they experienced in 2008. The WilderHill New Energy Global Innovation Index, or NEX, which tracks the performance of 88 sustainable energy stocks worldwide, nearly doubled to 248.68 from its low of 132.03 reached on 9 March 2009.

-

Major economies began to spend some of the estimated $188 billion in Renewable Energy Projects they announced in the months after the collapse of Lehman Brothers in September 2008. However, the wheels of administration turn slowly, and even at the end of 2009, only about 9% of the money had been spent. A larger share of the stimulus funds is likely to be spent in 2010 and 2011.

-

Total investment in Renewable Energy Projects by venture capital funds was $2.7 billion in 2009, down 36% from 2008. VC players found it harder to raise new money due to general investor caution and the difficulty of achieving exits amid weak stock markets.

Amid these fluctuations, the long-term outlook for renewable electricity remains strong, driven by policy support and improving economics.