Electricity News in December 2017

UPS pre-orders 125 Tesla electric semi-trucks

UPS Tesla Electric Semi Order marks the largest pre-order of all-electric Class-8 big rigs, advancing sustainable freight logistics with lower total cost of ownership, expanded charging infrastructure support, and competitive range versus diesel trucks.

Key Points

UPS's purchase of 125 Tesla all-electric Class-8 semis to cut costs, emissions, and modernize long-haul freight.

✅ Largest public pre-order: 125 electric Class-8 trucks

✅ Aims lower total cost of ownership vs diesel

✅ Includes charging infrastructure consulting by Tesla

United Parcel Service Inc. said on Tuesday it is buying 125 Tesla Inc. all-electric semi-trucks, the largest order for the big rig so far, as the package delivery company expands its fleet of alternative-fuel vehicles, including options like the all-electric Transit cargo van now entering the market.

Tesla is trying to convince the trucking community it can build an affordable electric big rig with the range and cargo capacity to compete with relatively low-cost, time-tested diesel trucks. This is the largest public order of the big rig so far, Tesla said.

The Tesla trucks will cost around $200,000 each for a total order of about $25 million. UPS expects the semi-trucks, the big rigs that haul freight along America's highways, will have a lower total cost of ownership than conventional vehicles, which run about $120,000.

Tesla has received pre-orders from such major companies as Wal-Mart, fleet operator J.B. Hunt Transport Services Inc. and food service distributor Sysco Corp.

Prior to UPS, the largest single pre-order came from PepsiCo Inc, for 100 trucks.

UPS said it has provided Tesla with real-world routing information as part of its evaluation of the vehicle's expected performance.

"As with any introductory technology for our fleet, we want to make sure it's in a position to succeed," Scott Phillippi, UPS senior director for automotive maintenance and engineering for international operations, told Reuters.

Phillippi said the 125 trucks will allow UPS to conduct a proper test of their abilities. He said the company was still determining their routes, but the semis will "primarily be in the United States." Tesla will provide consultation and support on charging infrastructure, as electric truck fleets will need a lot of power to operate at scale.

"We have high expectations and are very optimistic that this will be a good product and it will have firm support from Tesla to make it work," Phillippi said.

The UPS alternative fuel fleet already includes trucks propelled by electricity, natural gas, propane and other non-traditional fuels, and interest in electric mail trucks underscores how delivery fleets are evolving.

About 260,000 semis, or heavy-duty Class-8 trucks, are produced in North America annually, according to FTR, an industry economics research firm.

Including the UPS order, Tesla has at least 410 pre-orders in hand, according to a Reuters tally.

Navistar International Corp. and Volkswagen AG hope to launch a smaller, electric medium-duty truck by late 2019, while rival Daimler AG has delivered the first of a smaller range of electric trucks to customers in New York, and Volvo Trucks planned a complete range of electric trucks in Europe by 2021.

Tesla unveiled its semi last month, following earlier plans to reveal the truck in October, and expects the truck to be in production by 2019.

Related News

NEB: Demand for solar electricity lagging behind in Canada

Canada Solar Energy lags despite falling costs, with 0.5% of electricity from solar, largely in Ontario. NEB reports renewables replacing coal, while wind, hydro, and utility-scale capacity grow alongside distributed rooftop systems.

Key Points

Canada Solar Energy refers to the nation's solar market, supplying 0.5% of electricity, mostly concentrated in Ontario.

✅ 0.5% of Canada's electricity from solar, mainly in Ontario

✅ Costs per watt near $0.95; utility and rooftop PV expanding

✅ Wind and hydro grow as coal is phased out by 2030

Although the cost to build solar power has plummeted over the last decade, a new report suggests Canadians aren't rushing use the sun to make electricity.

The National Energy Board has released its annual look at the state of renewable energy in Canada and it says solar energy accounts for just 0.5 per cent of all Canada's generated electricity.

And almost all of that exists entirely in Ontario, the report notes, though renewable growth projections were scaled back after a provincial clean energy program was scrapped by policymakers.

NEB chief economist Shelley Milutinovic said the trend in Canada is that renewable energy sources like wind and solar are replacing coal as Canada moves to eliminate that as a source of electricity by 2030.

Between 2005 and 2016, non-hydroelectric renewables - wind, solar and biomass - grew from 1.5 per cent of total electricity generation in Canada to 7.2 per cent.

During that same period coal fell from 16 per cent to 9.3 per cent as a source of power. Canada intends to eliminate coal as a source of power by 2030 and only four provinces still get any power from the fossil fuel.

The Organization for Economic Co-operation and Development released a review of Canada's environmental policies this week which gave the country a rough ride for its energy-intensive, high-emitting, resource-based economy, but did point to Canada's electrical supply as a positive.

Only about 20 per cent of Canada's electricity comes from fossil fuels now - divided almost equally between coal and natural gas. Nuclear energy accounts for 15 per cent of Canada's electricity supply.

The rest comes from renewables. Hydro is the big beast in that, responsible for almost 60 per cent of Canada's power in 2016. While actual hydro power generation has grown about seven per cent in the last decade, Canada ranks in the top 10 for hydropower jobs even as other renewables are exploding.

The amount of electricity generated by the wind is 20 times what it was in 2005, and wind as a percentage of total power grew from just 0.2 per cent in 2005 to 4.7 per cent in 2016.

Solar didn't exist as a source of power for utility companies in Canada a decade ago. By 2016, solar capacity was 2,310 megawatts, almost all of it in Ontario, and national capacity is set to hit 5 GW according to recent reports.

Outside of Ontario, solar installations are mostly quite small, though the Prairie Provinces are projected to lead upcoming renewable growth across Canada. The largest solar farm in western Canada is a two-megawatt one on the Green Acres Hutterite Colony east of Calgary.

Milutinovic said the costs of solar and wind are now very comparable to other sources of power which are making them more and more attractive.

The cost to install a solar panel is about one-tenth of what it was in 2000, at about 95 cents per watt, according to the International Energy Agency.

Despite that, Canada is outmatched in solar on the international scene.

While Canada's biggest solar farm is about 100 megawatts, India this year unleashed one 10 times as large. The Kunrool Ultra Mega Solar Park is the largest in the world with 1000 megawatts of installed capacity.

India had just 17 megawatts of installed solar capacity in 2010. It now has 12,000 megawatts.

China is the world's solar leader, both in the manufacturing of solar panels and their installation. In 2005, China had 70 megawatts of installed solar power. In 2016,China had developed 78,000 MW.

Canada is 13th in the world in the amount of installed solar capacity. Where Canada gets just 0.5 per cent of its power from solar, Italy gets 7.5 per cent, Germany gets 6.7 per cent, Japan 4.9 per cent, the United States 1.4 per cent, China 1.07 per cent, and the Netherlands outpaces Canada in solar output as well.

Milutinovic said the one thing not measured in this report however is the capacity for solar installations on private homes and businesses. She said some of the Ontario solar generation numbers include those, but elsewhere that is simply not being tracked.

So there is no good data on how many individuals now have solar panels on their roofs or how many farms have them in their fields.

She said it is one area governments should be looking at to get a better picture of what is actually happening on this front.

Related News

Egypt Plans Power Link to Saudis in $1.6 Billion Project

Egypt-Saudi Electricity Interconnection enables cross-border power trading, 3,000 MW capacity, and peak-demand balancing across the Middle East, boosting grid stability, reliability, and energy security through an advanced electricity network, interconnector infrastructure, and GCC grid integration.

Key Points

A 3,000 MW grid link letting Egypt and Saudi Arabia trade power, balance peak demand, and boost regional reliability.

✅ $1.6B project; Egypt invests ~$600M; 2-year construction timeline

✅ 3,000 MW capacity; peak-load shifting; cross-border reliability

✅ Links GCC grid; complements Jordan and Libya interconnectors

Egypt will connect its electricity network to Saudi Arabia, joining a system in the Middle East that has allowed neighbors to share power, similar to the Scotland-England subsea project that will bring renewable power south.

The link will cost about $1.6 billion, with Egypt paying about $600 million, Egypt’s Electricity Minister Mohamed Shaker said Monday at a conference in Cairo, as the country pursues a smart grid transformation to modernize its network. Contracts to build the network will be signed in March or April, and construction is expected to take about two years, he said. In times of surplus, Egypt can export electricity and then import power during shortages.

"It will enable us to benefit from the difference in peak consumption,” Shaker said. “The reliability of the network will also increase.”

Transmissions of electricity across borders in the Gulf became possible in 2009, when a power grid connected Qatar, Kuwait, Saudi Arabia and Bahrain, a dynamic also seen when Ukraine joined Europe's grid under emergency conditions. The aim of the grid is to ensure that member countries of the Gulf Cooperation Council can import power in an emergency. Egypt, which is not in the GCC, may have been able to avert an electricity shortage it suffered in 2014 if the link with Saudi Arabia existed at the time, Shaker said.

The link with Saudi Arabia should have a capacity of 3,000 megawatts, he said. Egypt has a 450-megawatt link with Jordan and one with Libya at 200 megawatts, the minister said. Egypt will seek to use its strategic location to connect power grids in Asia, where the Philippines power grid efforts are raising standards, and elsewhere in Africa, he said.

In 2009, a power grid linked Qatar, Kuwait, Saudi Arabia and Bahrain, allowing the GCC states to transmit electricity across borders, much like proposals for a western Canadian grid that aim to improve regional reliability.

Related News

Investigation underway to determine cause of Atlanta Airport blackout

Atlanta Airport Power Outage disrupts Hartsfield-Jackson as an underground fire cripples switchgear redundancy, canceling flights during holiday travel; Georgia Power restores electricity overnight while utility crews probe causes and monitor system resilience.

Key Points

A major Hartsfield-Jackson blackout from an underground fire; power restored as switchgear redundancy is investigated.

✅ Underground fire near Plane Train tunnel damaged switchgear systems

✅ Over 1,100 flights canceled; holiday travel severely disrupted

✅ Georgia Power restored service; redundancy and root cause under review

Power has been restored at the world’s busiest airport after a massive outage Sunday afternoon left planes and passengers stranded for hours, forced airlines to cancel more than 1,100 flights and created a logistical nightmare during the already-busy holiday travel season.

An underground fire caused a complete power outage Sunday afternoon at Hartsfield-Jackson Atlanta International Airport, resulting in thousands of canceled flights at the world's busiest terminal and affecting travelers worldwide.

The massive outage didn’t just leave passengers stranded overnight Sunday, it also affected travelers with flights Monday morning schedules.

According to Paul Bowers, the president and CEO of Georgia Power, “From our standpoint, we apologize for the inconvenience,” he said. The utility restored power to the airport shortly before midnight.

Utility Crews are monitoring the fixes that restored power and investigating what caused the fire and why it was able to damage redundant systems. Bowers said the fire occurred in a tunnel that runs along the path of the underground Plane Train tunnel near Concourse E.

Sixteen highly trained utility personnel worked in the passageway to reconnect the network.“Our investigation is going through the process of what do we do to ensure we have the redundancy going back at the airport, because right now we are a single source feed,” Bowers said.

“We will have that complete by the end of the week, and then we will turn to what caused the failure of the switchgear.”

Though the cause isn’t yet known, he said foul play is not suspected.“There are two things that could happen,” he said.

“There are inner workings of the switchgear that could create the heat that caused the fire, or the splicing going into that switchgear -- that the cable had a failure on that going into the switch gear.”

When asked if age of the system could have been a failure, Bowers said his company conducts regular inspections.“We constantly inspect,” he said. “We inspect on an annual basis to ensure the reliability of the network, and that redundancy is protection for the airport.”Bowers said he is not familiar with any similar fire or outage at the airport.

“The issue for us is to ensure the reliability is here and that it doesn’t happen again and to ensure that our network is resilient enough to withstand any kind of fire,” he said. He added that Georgia Power will seek to determine what can be done in the future to avoid a similar event, such as those experienced during regional outages in other communities.

Related News

PG&E Supports Local Communities as It Pays More Than $230 Million in Property Taxes to 50 California Counties

PG&E property tax payments bolster counties, education, public safety, and infrastructure across Northern and Central California, reflecting semi-annual levies tied to utility assets, capital investments, and economic development that serve 16 million customers.

Key Points

PG&E property tax payments are semi-annual county taxes funding public services and linked to utility infrastructure.

✅ $230M paid for Jul-Dec 2017 across 50 California counties

✅ Estimated $461M for FY 2017-2018, up 12% year over year

✅ Investments: $5.9B in grid, Gas Safety Academy, control center

Pacific Gas and Electric Company (PG&E) paid property taxes of more than $230 million this fall to the 50 counties where the energy company owns property and operates gas and electric infrastructure that serves 16 million Californians. The tax payments help support essential public services like education and public health and safety actions across the region.

The semi-annual property tax payments made today cover the period from July 1 to December 31, 2017.

Total payments for the full tax year of July 1, 2017 to June 30, 2018 are estimated to total more than $461 million—an increase of $50 million, or 12 percent, compared with the prior fiscal year, even as customer rates are expected to stabilize in the years ahead.

“Property tax payments provide crucial resources to the many communities where we live and work, supporting everything from education to public safety. By continuing to make local investments in gas and electric infrastructure, we are not only creating one of the safest and most reliable energy systems in the country, including wildfire risk reduction programs and related efforts, we’re investing in the local economy and helping our communities thrive,” said Jason Wells, senior vice president and chief financial officer for PG&E.

PG&E invested more than $5.7 billion last year and expects to invest $5.9 billion this year to enhance and upgrade its gas and electrical infrastructure amid power line fire risks across Northern and Central California.

Some recent investments include the construction of PG&E’s $75 millionGas Safety Academy in Winters in Yolo County, which opened in September. Last year, PG&E opened a $36 million, state-of-the-art electric distribution control center in Rocklin.

PG&E supports the communities it serves in a variety of ways. In 2016, PG&E provided more than $28 million in charitable contributions to enrich local educational opportunities, preserve the environment, and support economic vitality and emergency preparedness and safety, including its Wildfire Assistance Program for impacted residents. PG&E employees provide thousands of hours of volunteer service in their local communities. The company also offers a broad spectrum of economic development services to help local businesses grow.

Related News

Ohio nuclear generators to face more competition with new 955-MW gas plant

Ohio gas-fired generation accelerates as combined-cycle plants join PJM Interconnection, challenging FirstEnergy's Davis-Besse baseload in Lucas County with 869-955 MW capacity and lower costs than nuclear, this summer and a new 2020 project.

Key Points

Ohio gas-fired generation is new combined-cycle capacity for PJM, adding 955 MW and competing with nuclear baseload.

✅ 955 MW Lucas County plant approved by Ohio Power Siting Board

✅ 869 MW Oregon Clean Energy Center entered service this summer

✅ PJM says reliability unaffected without FirstEnergy nuclear

Nuclear generators already struggling in Ohio will face even more competition from almost 900 MW of gas-fired generation that came online this summer, amid concerns over a growing supply gap in some regions, and another 950 MW plant now in the works.

Both plants will connect to the PJM Integration market, according to the Toledo Blade, and will generate more power than FirstEnergy's nearby Davis-Besse nuclear plant overall.

The Clean Energy Future–Oregon project will cost an estimated $900 million to construct, and is expected to begin operation in 2020. The project was initially approved more than four years ago.

Nuclear plants in Ohio have pressed for subsidies to remain in operation, as their emissions-free power is being pushed off the grid by cheaper natural gas, reflecting a broader debate over the future of struggling nuclear plants across the U.S. In May, FirstEnergy CEO Chuck Jones told the Ohio Senate Public Utilities Committee that its Davis-Besse and Perry nuclear plants are unlikely to successfully compete with low cost gas-fired generation in the wholesale power market.

Proponents of supporting baseload generation like coal and nuclear have pointed to their contributions to the reliability and resiliency of the power system, and some jurisdictions are considering new large-scale nuclear to meet those goals. But FirstEnergy's Ohio nuclear plants are not necessary for system reliability, according to Craig Glazer, vice president of federal government policy at PJM Interconnection and the former chairman of the Public Utilities Commission of Ohio.

The Ohio Power Siting Board last week authorized Clean Energy Future-Oregon LLC to construct a 955 MW gas-fired, combined-cycle power plant in Lucas County.

The plant will be located on a 30-acre parcel of land in Oregon, Ohio, and will interconnect to the regional electric transmission grid via nearby 138 and 345 kV transmission lines.

The project is being developed by CME Energy, which this summer also brought online the Oregon Clean Energy Center, an 869 MW gas-fired power plant at a nearby location, while governments elsewhere weigh new gas plants to boost electricity production.

Related News

FERC needs to review capacity market performance, GAO recommends

FERC Capacity Markets face scrutiny as GAO flags inconsistent data on resource adequacy and costs, urging performance goals, risk assessment, and better metrics across PJM, ISO-NE, NYISO, and MISO amid cost-recovery proposals.

Key Points

FERC capacity markets aim for resource adequacy, but GAO finds weak data and urges goals and performance reviews.

✅ GAO cites inconsistent data on resource adequacy and costs

✅ Calls for performance goals, metrics, and risk assessment

✅ Applies to PJM, ISO-NE, NYISO; MISO market is voluntary

Capacity markets may or may not be functioning properly, but FERC can't adequately make that determination, according to the GAO report.

"Available information on the level of resource adequacy ... and related costs in regions with and without capacity markets is not comprehensive or consistent," the report found. "Moreover, consistent data on historical trends in resource adequacy and related costs are not available for regions without capacity markets."

The review concluded that FERC collects some useful information in regions with and without capacity markets, but GAO said it "identified problems with data quality, such as inconsistent data."

GAO included three recommendations, including calling for FERC to take steps to improve the quality of data collected, and regularly assess the overall performance of capacity markets by developing goals for those assessments.

"FERC should develop and document an approach to regularly identify, assess, and respond to risks that capacity markets face," the report also recommended. The commission "has not established performance goals for capacity markets, measured progress against those goals, or used performance information to make changes to capacity markets as needed."

The recommendation comes as the agency is grappling with a controversial proposal to assure cost-recovery for struggling coal and nuclear plants in the power markets. So far, the proposal would only apply to power markets with capacity markets, including PJM Interconnection, the New England ISO, the New York ISO and possibly MISO. However MISO only has a voluntary capacity market, making it unclear how the proposed rule would be applied there.

Related News

Four Major Types of Substation Integration Service Providers Account for More than $1 Billion in Annual Revenues

Substation Automation Services help electric utilities modernize through integration, EPC engineering, protective relaying, communications and security, with CAPEX and OPEX insights and a growing global market for third-party providers worldwide rapidly.

Key Points

Engineering, integration, and EPC support modernizing utility substations with protection, control, and secure communications

✅ Third-party engineering, EPC, and OEM services for utilities

✅ Integration of multi-vendor devices and platforms

✅ Focus on relays, communications, security, CAPEX-OPEX

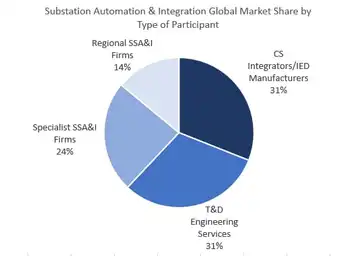

The Newton-Evans Research Company has released additional findings from its newly published four volume research series entitled: The World Market for Substation Automation and Integration Programs in Electric Utilities: 2017-2020.

This report series has observed four major types of professional third-party service providers that assist electric utilities with substation modernization. These firms range from (1) smaller local or regional engineering consultancies with substation engineering resources to (2) major global participants in EPC work, to (3) the engineering services units of manufacturers of substation devices and platforms, to (4) substation integration specialist firms that source and integrate devices from multiple manufacturers for utility and industrial clients, and often provide substation automation training to support implementation.

2016 Global Share Estimates for Professional Services Providers of Electric Power Substation Integration and Automation Activities

The North American market report (Volume One) includes survey participation from 65 large and midsize US and Canadian electric utilities while the international market report (Volume Two) includes survey participation from 32 unique utilities in 20 countries around the world. In addition to the baseline survey questions, the report includes 2017 substation survey findings on four additional specific topics: communications issues; protective relaying trends; security topics and the CAPEX/OPEX outlook for substation modernization.

Volume Three is the detailed market synopsis and global outlook for substation automation and integration:

Section One of the report provides top-level views of substation modernization, automation & integration and the emerging digital grid landscape, and a narrative market synopsis.

Section Two provides mid-year 2017 estimates of population, electric power generation capacity, transmission substations, including the 2 GW UK substation commissioning as a benchmark, and primary MV distribution substations for more than 120 countries in eight world regions. Information on substation related expenditures and spending for protection and control for each major world region and several major countries is also provided.

Section Three provides information on NGO funding resources for substation modernization among developing nations.

Section Four of this report volume includes North American market share estimates for 2016 shipments of many substation automation-related devices and equipment, such as trends in the digital relay market for utilities.

The Supplier Profiles report (Volume Four) provides descriptive information on the substation modernization offerings of more than 90 product and services companies, covering leading players in the transformer market as well.

Related News

Global Wind Energy To Shift Southward In Years To Come

Climate Change Effects on Global Wind Power include shifting wind resources, altered temperature gradients, and regional hotspots, with declines in Northern Hemisphere mid-latitudes and gains across the Southern Hemisphere and tropics, according to climate models.

Key Points

Shifting temperature gradients cut wind potential in the north and boost resources across southern and tropical regions.

✅ Northern mid-latitude winds weaken under high emissions

✅ Southern and tropical hotspots strengthen over oceans

✅ Planning must adapt as models show regional uncertainty

In the next century, wind resources may decrease in many regions of the Northern Hemisphere and could sharply increase in some hotspot regions down south, according to a study by University of Colorado Boulder researchers. The first-of-its-kind study predicting how global wind power may shift with climate change appears today in Nature Geoscience.

'There's been a lot of research looking at the potential climate impact of energy production transformations-like shifting away from fossil fuels toward renewables,' said lead author Kris Karnauskas, CIRES Fellow and Assistant Professor in Atmospheric and Oceanic Sciences (ATOC) at CU Boulder. 'But not as much focuses on the impact of climate change on energy production by weather-dependent renewables, like wind energy.'

Wind powers only about 3.7 percent of worldwide energy consumption today, but global wind power capacity is increasing rapidly-about 20 percent a year, and long-term analyses like the BNEF 2050 outlook point to major growth ahead. Karnauskas and colleagues Julie Lundquist and Lei Zhang, also in ATOC, wanted to better understand likely shifts in production, so they turned to an international set of climate model outputs to assess changes in wind energy resources across the globe. The team then used a 'power curve' from the wind energy industry to convert predictions of global winds, density and temperature into an estimate of wind energy production potential.

While not all of the climate models agreed on what the future will bring, substantial changes may be in store, especially a prominent asymmetry in wind power potential across the globe. If carbon dioxide emissions continue at high levels, wind power resources may decrease in the Northern Hemisphere's mid-latitudes, and increase in the Southern Hemisphere and tropics by 2100.

Strangely, the team also found that if emission levels are mitigated, dropping lower in coming decades, they see only a reduction of wind power in the north-it may not be countered with an increase of power in the south.

Renewable energy decision makers typically plan and install wind farms in areas with consistently strong winds today. For example, the prairies of the American Midwest-persistently windy today and in recent decades-are dotted with tens of thousands of turbines. While the new assessment finds wind power production in these regions over the next twenty years will be similar to that of today, it could drop by the end of the century.

By contrast, potential wind energy production in northeastern Australia could see dramatic increases.

Potential global wind power in coming years. Top images represent next 40 years, bottom images represent next 80 years. Left images represent lower emissions, right images represent higher emissions scenario. Red areas are wind power hotspots, blue areas are reductions. White areas are uncertain. Image: Kris Karnauskas/CIRES

There were different reasons for the Northern decline and the Southern increase in wind power potential in the high-emissions scenario, Karnauskas and his co-authors found in their analysis of modeling results. In the Northern Hemisphere, warmer temperatures at the North Pole weaken the temperature difference between this cold region and the warm equator. A smaller temperature gradient means slower winds in the northern mid-latitudes.

'These decreases in North America occur primarily during the winter season, when those temperature gradients should be strong and drive strong winds,' said Associate Professor Lundquist, who is also a RASEI Fellow. In addition to North America, the team identified possible wind power reductions in Japan, Mongolia and the Mediterranean by the end of the century. This may be bad news for the Japanese, who are rapidly accelerating their wind power development, with growth despite COVID-19 observed in recent years.

In the Southern Hemisphere, where there is more ocean than land, a different kind of gradient increases: land warms faster than the surrounding, much-larger oceans. That intensified gradient increases the winds. Hotspots for likely wind power increases include: Brazil, West Africa, where hydropower support could complement wind growth, South Africa and Australia.

'Europe is a big question mark,' added Karnauskas. 'We have no idea what we'll see there. That's almost scary, given that Europe is producing a lot of wind energy already, with offshore wind market poised to become a $1 trillion business in the coming decades.' The trend in this region (and in others, like the southeastern United States) is just too uncertain: some models forecast wind power increase, and others, a decrease.

In a warming world, harnessing more wind power in coming decades could be critical for countries trying to meet emission reduction standards set by the Paris Climate Agreement, even as Africa may not go green this decade, highlighting regional challenges. The team's results may help inform decision-makers across the globe determining where to deploy this technology.

'The climate models are too uncertain about what will happen in highly productive wind energy regions, like Europe, the Central United States, and Inner Mongolia,' said Lundquist. 'We need to use different tools to try to forecast the future-this global study gives us a roadmap for where we should focus next with higher-resolution tools.'

Related News

Why Is Georgia Importing So Much Electricity?

Georgia Electricity Imports October 2017 surged as hydropower output fell and thermal power plants underperformed; ESCO balanced demand via low-cost imports, mainly from Azerbaijan, amid rising tariffs, kWh consumption growth, and a widening generation-consumption gap.

Key Points

They mark a record import surge due to costly local generation, lower hydropower, ESCO balancing costs, and rising demand.

✅ Imports rose 832% YoY to 157 mln kWh, mainly from Azerbaijan

✅ TPP output fell despite capacity; only low-tariff plants ran

✅ Balancing price 13.8 tetri/kWh signaled costly domestic PPAs

In October 2017, Georgian power plants generated 828 mln. KWh of electricity, marginally up (+0.79%) compared to September. Following the traditional seasonal pattern and amid European concerns over dispatchable power shortages affecting markets, the share of electricity produced by renewable sources declined to 71% of total generation (87% in September), while thermal power generation’s share increased, accounting for 29% of total generation (compared to 13% in September). When we compare last October’s total generation with the total generation of October 2016, however, we observe an 8.7% decrease in total generation (in October 2016, total generation was 907 mln. kWh). The overall decline in generation with respect to the previous year is due to a simultaneous decline in both thermal power and hydro power generation.

Consumption of electricity on the local market in the same period was 949 mln. kWh (+7% compared to October 2016, and +3% with respect to September 2017), and reflected global trends such as India's electricity growth in recent years. The gap between consumption and generation increased to 121 mln. kWh (15% of the amount generated in October), up from 100 mln. kWh in September. Even more importantly, the situation was radically different with respect to the prior year, when generation exceeded consumption.

The import figure for October was by far the highest from the last 12 years (since ESCO was established), occurring as Ukraine electricity exports resumed regionally, highlighting wider cross-border dynamics. In October 2017, Georgia imported 157 mln. kWh of electricity (for 5.2 ¢/kWh – 13 tetri/kWh). This constituted an 832% increase compared to October 2016, and is about 50% larger than the second largest import figure (104.2 mln. kWh in October 2014). Most of the October 2017 imports (99.6%) came from Azerbaijan, with the remaining 0.04% coming from Russia.

The main question that comes to mind when observing these statistics is: why did Georgia import so much? One might argue that this is just the result of a bad year for hydropower generation and increased demand. This argument, however, is not fully convincing. While it is true that hydropower generation declined and demand increased, the country’s excess demand could have been easily satisfied by its existing thermal power plants, even as imported coal volumes rose in regional markets. Instead of increasing, however, the electricity coming from thermal power plants declined as well. Therefore, that cannot be the reason, and another must be found. The first that comes to mind is that importing electricity may have been cheaper than buying it from local TPPs, or from other generators selling electricity to ESCO under power purchase agreements (PPAs). We can test the first part of this hypothesis by comparing the average price of imported electricity to the price ceiling on the tariff that TPPs can charge for the electricity they sell. Looking at the trade statistics from Geostat, the average price for imported electricity in October 2017 remained stable with respect to the same month of the previous year, at 5.2 ¢ (13 tetri) per kWh. Only two thermal power plants (Gardabani and Mtkvari) had a price ceiling below 13 tetri per kWh. Observing the electricity balance of Georgia, we see that indeed more than 98% of the electricity generated by TPPs in October 2017 was generated by those two power plants.

What about other potential sources of electricity amid Central Asia's power shortages at the time? To answer this question, we can use the information derived from the weighted average price of balancing electricity. Why balancing electricity? Because it allows us to reconstruct the costs the market operator (ESCO) faced during the month of October to make sure demand and supply were balanced, and it allows us to gain an insight about the price of electricity sold through PPAs.

ESCO reports that the weighted average price of balancing electricity in October 2017 was 13.8 tetri/kWh, (25% higher than in October 2016, when it was below the average weighted cost of imports – 11 vs. 13 – and when the quantity of imported electricity was substantially smaller). Knowing that in October 2017, 61% of balancing electricity came from imports, while 39% came from hydropower and wind power plants selling electricity to ESCO under their PPAs, we can deduce that in this case, internal generation was (on average) also substantially more expensive than imports. Therefore, the high cost of internally generated electricity, rather than the technical impossibility of generating enough electricity to satisfy electricity demand, indeed appears to be one the main reasons why electricity imports spiked in October 2017.

Related News

Hong Kong to expect electricity bills to rise 1 or 2 per cent

Hong Kong Electricity Tariff Increase reflects a projected 1-2% rise as HK Electric and CLP Power shift to cleaner fuel and natural gas, expand gas-fired units and LNG terminals, and adjust the fuel clause charge.

Key Points

An expected 1-2% 2018 rise from cleaner fuel, natural gas projects, asset growth, and shrinking fuel cost surpluses.

✅ Expected 1-2% rise amid cleaner fuel and gas shift

✅ Fuel clause charge and asset expansion pressure prices

✅ HK Electric and CLP Power urged to use surpluses prudently

Hong Kong customers have been asked to expect higher electricity bills next year, as seen with BC Hydro rate increases in Canada, with a member of a government panel on energy policy anticipating an increase in tariffs of one or two per cent.

The environment minister, Wong Kam-sing, also hinted they should be prepared to dig deeper into their pockets for electricity, as debates over California electric bills illustrate, in the wake of power companies needing to use more expensive but cleaner fuel to generate power in the future.

HK Electric supplies power to Hong Kong Island, Lamma Island and Ap Lei Chau. Photo: David Wong

The city’s two power companies, HK Electric and CLP Power, are to brief lawmakers on their respective annual tariff adjustments for 2018, amid Ontario electricity price pressures drawing international attention, at a Legislative Council economic development panel meeting on Tuesday.

HK Electric supplies electricity to Hong Kong Island and neighbouring Lamma Island and Ap Lei Chau, while CLP Power serves Kowloon and the New Territories, including Lantau Island.

Wong said on Monday: “We have to appreciate that when we use cleaner fuel, there is a need for electricity tariffs to keep pace. I believe it is the hope of mainstream society to see a low-carbon and healthier environment.”

Secretary for the Environment Wong Kam-sing believes most people desire a low-carbon environment. Photo: Sam Tsang

But he declined to comment on how much the tariffs might rise.

World Green Organisation chief executive William Yu Yuen-ping, also a member of the Energy Advisory Committee, urged the companies to better use their “overflowing” surpluses in their fuel cost recovery accounts.

Tariffs are comprised of two components: a basic amount reflecting a company’s operating costs and investments, and the fuel clause charge, which is based on what the company projects it will pay for fuel for the year.

William Yu of World Green Organisation says the companies should use their surpluses more carefully. Photo: May Tse

Critics have claimed the local power suppliers routinely overestimate their fuel costs and amass huge surpluses.

In recent years, the two managed to freeze or cut their tariffs thanks to savings from lower fuel costs. Last year, HK Electric offered special rebates to its customers, which saw its tariff drop by 17.2 per cent. CLP Power froze its own charge for 2017.

Yu said the two companies should use the surpluses “more carefully” to stabilise tariffs.

Rise after fall in Hong Kong electricity use linked to subsidies

“We estimate a big share of the surplus has been used up and so the honeymoon period is over.”

Based on his group’s research, Yu believed the tariffs would increase by one or two per cent.

Economist and fellow committee member Billy Mak Sui-choi said the expansion of the power companies’ fixed asset bases, such as building new gas-fired units and offshore liquefied natural gas terminals, a pattern reflected in Nova Scotia's 14% rate hike recently approved by regulators, would also cause tariffs to rise.

To fight climate change and improve air quality, the government has pledged to cut carbon intensity by between 50 and 60 per cent by 2020. Officials set a target of boosting the use of natural gas for electricity generation to half the total fuel mix from 2020.

Both power companies are privately owned and monitored by the government through a mutually agreed scheme of control agreements, akin to oversight seen under the UK energy price cap in other jurisdictions. These require the firms to seek government approval for their development plans, including their projected basic tariff levels.

At present, the permitted rate of return on their net fixed assets is 9.99 per cent. The deals are due to expire late next year.

Earlier this year, officials reached a deal with the two companies on the post-2018 scheme, settling on a 15-year term. The new agreements slash their permitted rate of return to 8 per cent.

Related News

Electricity production from Irish windfarms hits all-time high

Ireland Wind Power Exports drive record renewable electricity, with onshore and offshore wind capacity surging, SEAI report finds, cutting fossil fuel imports and CO2 emissions and boosted by Corrib gas field and windier conditions.

Key Points

Electricity exports enabled by record onshore and offshore wind in Ireland, reducing fossil fuel imports.

✅ Wind capacity rose to 2,827 MW, boosting electricity generation

✅ Renewables met 27% of gross electricity consumption in 2016

✅ CO2 cuts of 3.1 Mt and lower fossil fuel import spend

Ireland became an exporter of electricity last year on the back of record production from onshore and offshore windfarms, in line with a record year for renewables globally in 2016, and this year’s production could be even higher, a new report shows.

And the country’s spending on imported fossil fuels fell by €1.2 billion last year following the opening of the often-controversial Corrib gas field off the Mayo coast.

A report from Sustainable Energy Authority of Ireland (SEAI), due to be published on Tuesday, highlights major changes in where Ireland’s energy comes from, as renewables surpassed fossil fuels in Europe for the first time, and how it is now being consumed.

Ireland produced its largest amount of renewable electricity ever last year, reflecting leadership in integrating renewables onto the grid, on the back of the introduction of an additional 400 megawatts of power from wind turbines.

This brought the total capacity of Ireland’s wind turbines, on land and at sea, to 2,827 megawatts, amid rising European wind investments across the region, according to the SEAI’s annual Energy in Ireland Report. It includes analysis going back to 1990.

Most of the turbines that entered service last year did so towards the end of last year, so this year’s figures should be higher again, the report says. In addition, the more windy conditions seen this year will also boost production.

Renewable electricity generation accounted for more than 27 per cent of gross electricity consumption in 2016, with over one-third green within four years expected nationally, while the use of renewables in electricity generation reduced CO2 emissions by 3.1 million tonnes and avoided €192 million of fossil fuel imports.

Related News

Progress being made on doubling renewable electricity by 2030: SaskPower

SaskPower Renewable Energy 2030 advances 50% renewables through wind power, solar projects, and geothermal research, backed by natural gas capacity, grid integration, competitive procurement, PPAs, and capacity expansion to meet rising demand in Saskatchewan.

Key Points

SaskPower's plan to reach 50% renewable power by 2030 via wind, solar, geothermal research, and supporting natural gas.

✅ Plans to reach 2,100 MW wind and 60 MW solar by 2030

✅ Geothermal pilot via PPA; grid integration projects

✅ New gas plants add 700 MW+ for reliability, demand growth

SaskPower says progress is being made on its goal of increasing renewable electricity generation from the current 25 per cent to as much as 50 per cent by 2030, as outlined in its 2019-20 annual report released.

The Crown corporation announced in 2015 it would reduce emissions by 40 per cent below 2005 levels by 2030, which would involve doubling the percentage of renewable electricity.

“Developing cleaner electricity generation options is essential to power Saskatchewan’s future and I’m excited to see that future continuing to take shape,” Tim Eckel, SaskPower’s vice-president of asset management, planning and sustainability, said in a press release.

“In the past two years, we have started a number of new renewable generation projects as well as projects that support renewable integration. Saskatchewan people will see more of that as we continue towards 2030.”

SaskPower has announced plans to add 60 megawatt (MW) of ground solar generation by 2021 through a combination of competitive procurement, a partnership with First Nations Power Authority and community projects such as the Flying Dust First Nation agreement now under consideration.

A competitive process for Saskatchewan’s first 10 MW utility-scale solar project has also been launched.

Wind power capacity is expected to increase from the current 221 MW to around 2,100 MW by 2030. SaskPower has launched the competitive process to buy up to 200 MW of wind generation with the successful proponent expected to be named this spring.

A power purchase agreement with DEEP Earth Energy Production Corp. was signed in May to allow further research into the potential for Saskatchewan’s first geothermal power project under study.

At the same time, SaskPower said it must increase its overall generation capacity in response to the province’s growing demand for electricity, including during record power demand periods.

“We are evaluating the full range of generation options, including imports from Manitoba Hydro as needed, which will allow us to determine the portfolio that best allows us to deliver reliable, cost-effective and sustainable power,” the Crown corporation said in a press release.

SaskPower has started construction on the Chinook Power Station, which will add 350 MW of natural gas generation as well as announced site considerations for the province’s next 350 MW to 700 MW natural gas plant.

Related News

Manitoba Hydro hikes face opposition as hearings begin

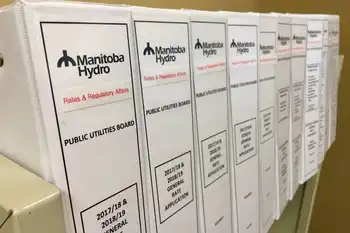

Manitoba Hydro rate hikes face public hearings over electricity rates, utility bills, and debt, with impacts on low-income households, Indigenous communities, and Winnipeg services amid credit rating pressure and rising energy costs.

Key Points

Manitoba Hydro seeks 7.9% annual increases to stabilize finances and debt, impacting electricity costs for households.

✅ Proposed hikes: 7.9% yearly through 2023/24

✅ Driven by debt, credit rating declines, rising interest

✅ Disproportionate impact on low-income and Indigenous communities

Hearings began Monday into Manitoba Hydro’s request for consecutive annual rate hikes of 7.9 per cent. The crown corporation is asking for the steep hikes to commence April 1, 2018.

The increases would continue through 2023/2024, under a multi-year rate plan before dropping to what Hydro calls “sustainable” levels.

Patti Ramage, legal counsel for Hydro, said while she understands no one welcomes the “exceptional” rate increases, the company is dealing with exceptional circumstances.

It’s the largest rate increase Hydro has ever asked for, though a scaled-back increase was discussed later, saying rising debt and declining credit ratings are affecting its financial stability.

President and CEO Kelvin Shepherd said Hydro is borrowing money to fund its interest payments, and acknowledged that isn’t an effective business model.

Hydro’s application states that it will be spending up to 63 per cent of its revenue on paying financial expenses if the current request for rate hikes is not approved.

If it does get the increase it wants, that number could shrink to 45 per cent – which Ramage says is still quite high, but preferable to the alternative.

She cited the need to take immediate action to fix Hydro’s finances instead of simply hoping for the best.

“The worst thing we can do is defer action… that’s why we need to get this right,” Ramage said.

A number of intervenors presented varying responses to Hydro’s push for increased rates, with many focusing on how the hikes would affect Manitobans with lower incomes.

Senwung Luk spoke on behalf of the Assembly of Manitoba Chiefs, and said the proposed rates would hit First Nations reserves particularly hard.

He noted that 44.2 per cent of housing on reserves in the province needs significant improvement, which means electricity use tends to be higher to compensate for the lower quality of infrastructure.

Luk says this problem is compounded by the higher rates of poverty in Indigenous populations, with 76 per cent of children on reserves in Manitoba living below the poverty line.

If the increase goes forward, he said the AMC hopes to see a reduced rate for those living on reserves, despite a recent appeal court ruling on such pricing.

Byron Williams, speaking on behalf of the Consumers Coalition, said the 7.9 per cent increase unreasonably favours the interests of Hydro, and is unjustly biased against virtually everyone else.

In Saskatchewan, the NDP criticized an SaskPower 8 per cent rate hike as unfair to customers, highlighting regional concerns.

Williams said customers using electric space heating would be more heavily targeted by the rate increase, facing an extra $13.14 a month as opposed to the $6.88 that would be tacked onto the bills of those not using electric space heating.

Williams also called Hydro’s financial forecasts unreliable, bringing the 7.9 per cent figure into question.

Lawyer George Orle, speaking for the Manitoba Keewatinowi Okimakanak, said the proposed rate hikes would “make a mockery” of the sacrifices made by First Nations across the province, given that so much of Hydro’s infrastructure is on Indigenous land.

The city of Winnipeg also spoke out against the jump, saying property taxes could rise or services could be cut if the hikes go ahead to compensate for increased, unsustainable electricity costs.

In British Columbia, a BC Hydro 3 per cent increase also moved forward, drawing attention to affordability.

A common theme at the hearing was that Hydro’s request was not backed by facts, and that it was heading towards fear-mongering.

Manitoba Hydro’s CEO begged to differ as he plead his case during the first hearing of a process that is expected to take 10 weeks.

Related News

SaskPower exploring geothermal power plant in efforts to reach 2030 targets

SaskPower Geothermal Power aims to deliver renewable baseload energy in Saskatchewan, complementing wind and solar. With DEEP's 5 MW pilot near Estevan tapping aquifers, it supports grid reliability alongside LED streetlights and flare gas.

Key Points

SaskPower Geothermal Power is a baseload plan using DEEP's aquifers to deliver zero-emission power in Saskatchewan.

✅ 5 MW DEEP pilot near Estevan targets hot sedimentary aquifers

✅ Provides 24/7 renewable baseload, complementing wind and solar

✅ Higher upfront costs and timelines challenge rapid deployment

It would be a first for Saskatchewan and Canada.

SaskPower‘s efforts to double renewable electricity by 2030 could potentially include geothermal power stations.

Regina and Saskatoon areas were selected to provide a range of settings to test the new LED streetlights SaskPower is piloting. SaskPower pilot project converting streetlights to LED

The second project in SaskPower’s flare gas power generation program is contributing 750 kilowatts of electricity to Saskatchewan’s power grid. SaskPower turning waste flare gas into electricity

SaskPower reporting power outages in some regions as high winds sweep across Saskatchewan. SaskPower launches homeowner energy efficiency assessment tool

“If projections hold true, we’re going to need to find over 2,000 megawatts of renewable power,” Kirsten Marcia, president and CEO of Deep Earth Energy Production (DEEP), said.

“Geothermal is not the only solution here, but we hope to have a very significant place at the table.”

With a power purchase agreement with SaskPower signed in May, and ongoing initiatives such as purchasing power from Flying Dust First Nation to diversify supply, DEEP hopes to build a five megawatt, zero emission power plant near Estevan, where subterranean water is the warmest in Saskatchewan.

Typically, geothermal operations use the water for heat, as in Manitoba's geothermal homes initiative where thousands of residences would be converted; however DEEP’s plant will pass water through an exchanger to create steam, which will drive a turbine and generate energy.

“You think of our potash resources, our oil and gas resources, and at the very bottom of those sedimentary units is thick, 150 metre deep aquifer,” Marcia said. “We could drill it here in Saskatoon, but it’s too shallow to be hot enough, and the same aquifer continues to deepen as we go towards the United States, it’s about 3.4 kilometers in depth, so that’s what gives it the heat.”

But is investment in geothermal power generation worth it for the province? Experts say they’re cautiously optimistic, but initial costs may drive away potential interest, which is why SaskPower is also planning to buy more electricity from Manitoba Hydro as a complementary measure.

“The payback period is going to be much longer,” said Grant Ferguson, an associate professor of geological engineering at the University of Saskatchewan. “So we’re going to run into problems with risk and financing and these sorts of things that might not be in play with something like a wind or solar project.”

Time is also a factor.

Each unit is expected to generate between five and 10 megawatts of power; multiple unites would be required to generate the amount of power needed in Saskatchewan. Nearly a decade of work has gone into DEEP’s first station.

“If we’re looking towards 2030 and we’re taking 10 years for one, then it’s going to take a while to pull all this off,” Ferguson said.

“Maybe if it's on the space of two or three years then we can build these things up.”

The benefit geothermal electricity has over solar and wind generated power? Electricity is consistently being generated, even during record power demand events in Saskatchewan.

“Ideally, this becomes a baseload power supply,” Marcia said, “so unlike wind and solar, which provide an intermittent power supply, geothermal is the only renewable that provides power 24 hours a day, seven days a week.”

DEEP’s first plant is expected to be built in two years. It’s expected the aquifer will be able to support a capacity of roughly 200 megawatts.

Related News

‘Tsunami of data’ could consume one fifth of global electricity by 2025

ICT Electricity Demand is surging as data centers, 5G, IoT, and server farms expand, straining grids, boosting carbon emissions, and challenging climate targets unless efficiency, renewable energy, and smarter cooling dramatically improve.

Key Points

ICT electricity demand is power used by networks, devices, and data centers across the global communications sector.

✅ Projected to reach up to 20 percent of global electricity by 2025

✅ Driven by data centers, 5G traffic, IoT, and high-res streaming

✅ Mitigation: efficiency, renewable PPAs, advanced cooling, workload shifts

The communications industry could use 20% of all the world’s electricity by 2025, hampering attempts to meet climate change targets, even as countries like New Zealand's electrification plans seek broader decarbonization, and straining grids as demand by power-hungry server farms storing digital data from billions of smartphones, tablets and internet-connected devices grows exponentially.

The industry has long argued that it can considerably reduce carbon emissions by increasing efficiency and reducing waste, but academics are challenging industry assumptions. A new paper, due to be published by US researchers later this month, will forecast that information and communications technology could create up to 3.5% of global emissions by 2020 – surpassing aviation and shipping – and up to 14% 2040, around the same proportion as the US today.

Global computing power demand from internet-connected devices, high resolution video streaming, emails, surveillance cameras and a new generation of smart TVs is increasing 20% a year, consuming roughly 3-5% of the world’s electricity in 2015, says Swedish researcher Anders Andrae.

In an update o a 2016 peer-reviewed study, Andrae found that without dramatic increases in efficiency, the ICT industry could use 20% of all electricity and emit up to 5.5% of the world’s carbon emissions by 2025. This would be more than any country, except China, India and the USA, where China's data center electricity use is drawing scrutiny.

He expects industry power demand to increase from 200-300 terawatt hours (TWh) of electricity a year now, to 1,200 or even 3,000TWh by 2025. Data centres on their own could produce 1.9 gigatonnes (Gt) (or 3.2% of the global total) of carbon emissions, he says.

“The situation is alarming,” said Andrae, who works for the Chinese communications technology firm Huawei. “We have a tsunami of data approaching. Everything which can be is being digitalised. It is a perfect storm. 5G [the fifth generation of mobile technology] is coming, IP [internet protocol] traffic is much higher than estimated, and all cars and machines, robots and artificial intelligence are being digitalised, producing huge amounts of data which is stored in data centres.”

US researchers expect power consumption to triple in the next five years as one billion more people come online in developing countries, and the “internet of things” (IoT), driverless cars, robots, video surveillance and artificial intelligence grows exponentially in rich countries.

The industry has encouraged the idea that the digital transformation of economies and large-scale energy efficiencies will slash global emissions by 20% or more, but the scale and speed of the revolution has been a surprise.

Global internet traffic will increase nearly threefold in the next five years says the latest Cisco Visual Networking Index, a leading industry tracker of internet use.

“More than one billion new internet users are expected, growing from three billion in 2015 to 4.1bn by 2020. Over the next five years global IP networks will support up to 10bn new devices and connections, increasing from 16.3bn in 2015 to 26bn by 2020,” says Cisco.

A 2016 Berkeley laboratory report for the US government estimated the country’s data centres, which held about 350m terabytes of data in 2015, could together need over 100TWh of electricity a year by 2020. This is the equivalent of about 10 large nuclear power stations.

Data centre capacity is also rocketing in Europe, where the EU's plan to double electricity use by 2050 could compound demand, and Asia with London, Frankfurt, Paris and Amsterdam expected to add nearly 200MW of consumption in 2017, or the power equivalent of a medium size power station.

“We are seeing massive growth of data centres in all regions. Trends that started in the US are now standard in Europe. Asia is taking off massively,” says Mitual Patel, head of EMEA data centre research at global investment firm CBRE.

“The volume of data being handled by such centres is growing at unprecedented rates. They are seen as a key element in the next stage of growth for the ICT industry”, says Peter Corcoran, a researcher at the university of Ireland, Galway.

Using renewable energy sounds good but no one else benefits from what will be generated, and it skews national attempts to reduce emissions

Ireland, which with Denmark is becoming a data base for the world’s biggest tech companies, has 350MW connected to data centres but this is expected to triple to over 1,000MW, or the equivalent of a nuclear power station size plant, in the next five years.

Permission has been given for a further 550MW to be connected and 750MW more is in the pipeline, says Eirgrid, the country’s main grid operator.

“If all enquiries connect, the data centre load could account for 20% of Ireland’s peak demand,” says Eirgrid in its All-Island Generation Capacity Statement 2017-2026 report.

The data will be stored in vast new one million square feet or larger “hyper-scale” server farms, which companies are now building. The scale of these farms is huge; a single $1bn Apple data centre planned for Athenry in Co Galway, expects to eventually use 300MW of electricity, or over 8% of the national capacity and more than the daily entire usage of Dublin. It will require 144 large diesel generators as back up for when the wind does not blow.

Facebook’s Lulea data centre in Sweden, located on the edge of the Arctic circle, uses outside air for cooling rather than air conditioning and runs on hydroelectic power generated on the nearby Lule River. Photograph: David Levene for the Guardian

Pressed by Greenpeace and other environment groups, large tech companies with a public face , including Google, Facebook, Apple, Intel and Amazon, have promised to use renewable energy to power data centres. In most cases they are buying it off grid but some are planning to build solar and wind farms close to their centres.

Greenpeace IT analyst Gary Cook says only about 20% of the electricity used in the world’s data centres is so far renewable, with 80% of the power still coming from fossil fuels.

“The good news is that some companies have certainly embraced their responsibility, and are moving quite aggressively to meet their rapid growth with renewable energy. Others are just growing aggressively,” he says.

Architect David Hughes, who has challenged Apple’s new centre in Ireland, says the government should not be taken in by the promises.

“Using renewable energy sounds good but no one else benefits from what will be generated, and it skews national attempts to reduce emissions. Data centres … have eaten into any progress we made to achieving Ireland’s 40% carbon emissions reduction target. They are just adding to demand and reducing our percentage. They are getting a free ride at the Irish citizens’ expense,” says Hughes.

Eirgrid estimates indicate that by 2025, one in every 3kWh generated in Ireland could be going to a data centre, he added. “We have sleepwalked our way into a 10% increase in electricity consumption.”

Fossil fuel plants may have to be kept open longer to power other parts of the country, and manage issues like SF6 use in electrical equipment, and the costs will fall on the consumer, he says. “We will have to upgrade our grid and build more power generation both wind and backup generation for when the wind isn’t there and this all goes onto people’s bills.”

Under a best case scenario, says Andrae, there will be massive continuous improvements of power saving, as the global energy transition gathers pace, renewable energy will become the norm and the explosive growth in demand for data will slow.

But equally, he says, demand could continue to rise dramatically if the industry keeps growing at 20% a year, driverless cars each with dozens of embedded sensors, and cypto-currencies like Bitcoin which need vast amounts of computer power become mainstream.

“There is a real risk that it all gets out of control. Policy makers need to keep a close eye on this,” says Andrae.

Related News

Investigation reveals power company 'gamed' $100M from Ontario's electricity system

Goreway Power Station Overbilling exposed by Ontario Energy Board shows IESO oversight failures, GCG gaming, and $100M in inappropriate payments at the Brampton natural gas plant, penalized with fines and repayments impacting Ontario ratepayers.

Key Points

Goreway exploited IESO GCG flaws, causing about $100M in improper payouts and fines.

✅ OEB probe flagged $89M in ineligible start-up O&M charges

✅ IESO fined Goreway $10M; majority of excess costs recovered

✅ Audit found $200M in overbilling across nine generators

Hydro customers shelled out about $100 million in "inappropriate" payments to a natural gas plant that exploited flaws in how Ontario manages its private electricity generators, according to the Ontario Energy Board.

The company operating the Goreway Power Station in Brampton "gamed" the system for at least three years, according to an investigation by the provincial energy regulator.

The investigation also delivers stinging criticism of the provincial government's Independent Electricity System Operator (IESO), slamming it for a lack of oversight. The probe by the Ontario Energy Board's market surveillance panel was completed nearly a year ago, but was only made public in November because it was buried on its website without a news release. CBC News is the first media outlet to report on the investigation.

The excess payments to Goreway Power Station included:

- $89 million in ineligible expenses billed as the costs of firing up power production.

- $5.6 million paid in three months from a flaw in how IESO calculated top-ups for the company committing to generate power a day in advance.

- Of $11.2 million paid to compensate the company for IESO ordering it to start or stop generating power, the investigation concluded "a substantial portion ... was the result of gaming."

Most privately-owned natural gas-fired plants in the province do not generate electricity constantly, but start and stop production in response to fluctuating market demand, even as the energy minister has requested an halt to natural gas generation across the grid. IESO pays them a premium for the costs of firing up production, through what it calls "generation cost guarantee" programs.

But the investigation found IESO did little checking into the details of Goreway Power Station's billings.

Goreway Power Station, located near Highway 407 in Brampton, Ont., is an 875 megawatt natural gas power plant. (Goreway)

"Conservatively, at least $89 million of Goreway's submissions were clearly ineligible by any reasonable measure," concludes the report.

"Goreway routinely submitted what were obviously inappropriate expenses to be reimbursed by the IESO, and ultimately borne by Ontario ratepayers,"

The investigation panel found an "extraordinary pattern" to these billings by Goreway Power Station, suggesting the IESO should have caught on sooner. The company submitted more than $100 million in start-up operating and maintenance costs during the three-year period investigated — more than all other gas-fired generators in the province combined. The company's costs per start-up were more than double the next most expensive power generator.

"Goreway repeatedly exploited defects in the GCG (generation cost guarantee) program, and in doing so received at least $89 million in gamed GCG payments."

Company fined $10M

The investigation covered a three-year period from when Goreway Power Station began generating power in June 2009. Investigators said that delays in releasing documents slowed down their probe, and they only obtained all the records they needed in April 2016.

The investigating panel does not have the power to impose penalties on companies it found broke the rules.

The IESO fined Goreway Power Station $10 million. The company has also repaid IESO "a substantial portion" of the excess payments it received during its first six years of operating, but the exact figure is blacked out in the investigation report that was made public.

The control room from which the provincial government's Independent Electricity System Operator manages Ontario's power supply. The agency is also responsible for managing contracts with private power producers.(IESO)

"Goreway does not agree with many of the draft report's findings and conclusions, including any suggestion that Goreway engaged in gaming or that it deliberately misled the IESO," writes lawyer George Vegh on behalf of the company in a response to the investigation report, dated Aug. 1.

"Goreway has implemented initiatives designed to ensure that compliance is a chief operating principle."

The power station, located near Highway 407 in Brampton, is a joint venture between Toyota Tsusho Corp. and JERA Co. Inc. During the period under scrutiny, the project was run by Toyota Tsusho and Chubu Electric Power Inc., both headquartered in Japan.

Investigators fear 'same situation' exists today

The report blames the provincially-controlled IESO for creating a system with defects that allowed the over-billing.

"Goreway was able to — and repeatedly did — exploit these defects," says the investigation report. It goes on to explain the flaws "have created opportunities for exploitation, to the serious financial disadvantage of Ontario's ratepayers," even as greening Ontario's grid could entail massive costs.

The investigation suggests IESO hasn't made adequate changes to ensure it won't happen again, at a time when an analysis of a dirtier grid is raising concerns.

"Goreway stands as a clear example of how generators are able to exploit the generation costs guarantee regime," says the report.

"The Panel is concerned that the same situation remains in place today."

PC energy critic Todd Smith raised CBC News' report on the Goreway Power Station in Tuesday's question period. (Ontario Legislature)

After CBC News broke the story Tuesday, the provincial government was forced to respond in question period, amid a broader push for new gas plants to boost electricity production.

"Here we have yet another gas plant scandal in Peel region that's costing electricity customers over $100 million," said PC energy critic Todd Smith. He slammed "the incompetence of a government that once again failed to look out for electricity customers."

Economic Development Minister Brad Duguid said: "There is no excuse for any company in this province to ever game the system."

Nine companies overbilled $200M: audit

The IESO found out about the overbilling "some time ago," said Duguid.

"They fully investigated, they've recovered most of the cost, they delivered a $10 million fine — the biggest fine on record."

The program that Goreway exploited became the subject of an audit that the IESO launched in 2011. The agency uncovered $200 million in ineligible billings by nine power producers, wrote the IESO vice president for policy Terry Young in an email to CBC News.

The IESO has recovered up to 85 per cent of those ineligible costs, Young noted.

Reforms to the design of the the program have removed the potential for overpayments and made it more efficient, he said, even as Ontario weighs embracing clean power more broadly. Last year, its total annual costs dropped to $23 million, down from $61 million in 2014.

Related News

Maritime Link sends first electricity between Newfoundland, Nova Scotia

Maritime Link HVDC Transmission connects Newfoundland and Nova Scotia to the North American grid, enabling renewable energy imports, subsea cable interconnection, Muskrat Falls hydro power delivery, and lower carbon emissions across Atlantic Canada.

Key Points

A 500 MW HVDC intertie linking Newfoundland and Nova Scotia to deliver Muskrat Falls hydro power.

✅ 500 MW capacity using twin 170 km subsea HVDC cables

✅ Interconnects Newfoundland and Nova Scotia to the North American grid

✅ Enables Muskrat Falls hydro imports, cutting CO2 and costs

For the first time, electricity has been sent between Newfoundland and Nova Scotia through the new Maritime Link.

The 500-megawatt transmission line — which connects Newfoundland to the North American energy grid for the first time and echoes projects like the New England Clean Power Link underway — was tested Friday.

"This changes not only the energy options for Newfoundland and Labrador but also for Nova Scotia and Atlantic Canada," said Rick Janega, the CEO of Emera Newfoundland and Labrador, which owns the link.

"It's an historic event in our eyes, one that transforms the electricity system in our region forever."

'On time and on budget'

It will eventually carry power from the Muskrat Falls hydro project in Labrador, where construction is running two years behind schedule and $4 billion over budget, a context in which the Manitoba Hydro line to Minnesota has also faced delay, to Nova Scotia consumers. It was supposed to start producing power later this year, but the new deadline is 2020 at the earliest.

The project includes two 170-kilometre subsea cables across the Cabot Strait between Cape Ray in southwestern Newfoundland and Point Aconi in Cape Breton.

The two cables, each the width of a two-litre pop bottle, can carry 250 megawatts of high voltage direct current, and rest on the ocean floor at depths up to 470 metres.

This reel of cable arrived in St. John's back in April aboard the Norwegian vessel Nexans Skagerrak, after the first power cable reached Nova Scotia earlier in the project. (Submitted by Emera NL)

The Maritime Link also includes almost 50 kilometres of overland transmission in Nova Scotia and more than 300 kilometres of overland transmission in Newfoundland, paralleling milestones on Site C transmission work in British Columbia.

The link won't go into commercial operation until January 1.

Janega said the $1.6-billion project is on time and on budget.

"We're very pleased to be in a position to be able to say that after seven years of working on this. It's quite an accomplishment," he said.

This Norwegian vessel was used to transport the 5,500 tonne subsea cable. (Submitted by Emera NL)

Once in service, the link will improve electrical interconnections between the Atlantic provinces, aligning with climate adaptation guidance for Canadian utilities.

"For Nova Scotia it will allow it to achieve its 40 per cent renewable energy target in 2020. For Newfoundland it will allow them to shut off the Holyrood generating station, in fact using the Maritime Link in advance of the balance of the project coming into service," Janega said.

Karen Hutt, president and CEO of Nova Scotia Power, which is owned by Emera Inc., calls it a great day for Nova Scotia.

"When it goes into operation in January, the Maritime Link will benefit Nova Scotia Power customers by creating a more stable and secure system, helping reduce carbon emissions, and enabling NSP to purchase power from new sources," Hutt said in a statement.