Electricity News in October 2021

Electricity prices rise more than double EU average in first half of 2021

Estonia energy prices 2021 show sharp electricity hikes versus the EU average, mixed natural gas trends, kWh tariffs on Nord Pool spiking, and VAT, taxes, and support measures shaping household bills.

Key Points

EU-high electricity growth, early gas dip, then Nord Pool spikes; taxes, VAT, and subsidies shaped energy bills.

✅ Electricity up 7% on year; EU average 2.8% in H1 2021.

✅ Gas fell 1% in H1; later spiked with global market.

✅ VAT, taxes, excise and aid impacted household costs.

Estonia saw one of the highest rates in growth of electricity prices in the first half of 2021, compared with the same period in key trends in 2020 across Europe. These figures were posted before the more recent, record level of electricity and natural gas prices; the latter actually dropped slightly in Estonia in the first half of the year.

While electricity prices rose 7 percent on year in the first half of 2021 in Estonia, the average for the EU as a whole, where energy prices drove inflation across the bloc, stood at 2.8 percent over the same period, BNS reports.

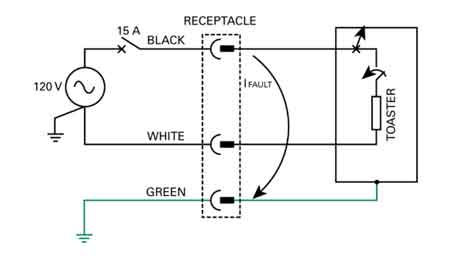

Hungary (€10 per 100 Kwh) and Bulgaria (€10.20 per 100 Kwh) saw the lowest electricity prices EU-wide, while at €31.9 per KWH, Germany's power prices posted the most expensive rate, while Denmark, Belgium and Ireland also had high prices, in excess of €25 per Kwh.

Slovenia saw the highest electricity price rise, at 15 percent, and even the United States' electricity prices saw their steepest rise in decades during the same era, while Estonia was in third place, joint with Romania at 7 percent as noted, and behind Poland (8 percent).

Lithuania, on the other hand, experienced the third highest electricity price fall over the first half of 2021, compared with the same period in 2020, at 6 percent, behind only Cyprus (7 percent) and the Netherlands (10 percent, largely due to a tax cut).

Urmas Reinsalu: VAT on electricity, gas and heating needs to be lowered

The EU average price of electricity was €21.9 percent per Kwh, with taxes and excise accounting for 39 percent of this, even as prices in Spain surged across the day-ahead market.

Estonia has also seen severe electricity price rises in the second half of the year so far, with records set and then promptly broken several times earlier in October, while an Irish electricity provider raised prices amid similar pressures, and a support package for low income households rolled out for the winter season (October to March next year). The price on the Nord Pool market as of €95.01 per Kwh; a day earlier it had stood at €66.21 per Kwh, while on October 19 the price was €140.68 per Kwh.

Gas prices

Natural gas prices to household, meanwhile, dropped in Estonia over the same period, at a sharper rate (1 percent) than the EU average (0.5 percent), according to Eurostat.

Gas prices across the EU were lowest in Lithuania (€2.8 per 100 Kwh) and highest in the Netherlands (€9.6 per KWH), while the highest growth was seen in Denmark (19 percent), in the first half of 2021.

Natural gas prices dropped in 20 member states, however, with the largest drop again coming in Lithuania (23 percent).

The average price of natural gas EU-side in the first half of 2021 was €6.4, and taxes and excise duties accounted on average for 36 percent of the total.

The second half of the year has seen steep gas price rises in Estonia, largely the result of increases on the world market, though European gas benchmarks later fell to pre-Ukraine war levels.

Related News

Energy crisis is a 'wake up call' for Europe to ditch fossil fuels

EU Clean Energy Transition underscores the shift from fossil fuels to renewable energy, decarbonization, and hydrogen, as soaring gas prices and electricity volatility spur resilience, storage, and joint procurement across the single market.

Key Points

EU Clean Energy Transition shifts from fossil fuels to renewables, enhancing resilience and reducing price volatility.

✅ Cuts reliance on Russian gas and fossil imports

✅ Scales renewables, hydrogen, and energy storage

✅ Stabilizes electricity prices via market resilience

Soaring energy prices, described as Europe's energy nightmare, are a stark reminder of how dependent Europe is on fossil fuels and should serve to accelerate the shift towards renewable forms of energy.

"This experience today of the rising energy prices is a clear wake up call... that we should accelerate the transition to clean energy, wean ourselves off the fossil fuel dependency," a senior EU official told reporters as the European Commission unveiled a series of emergency electricity measures aimed at tackling the crisis.

The European Union is facing a sharp spike in energy prices, driven by increased global demand as the world recovers from the pandemic and lower-than-expected natural gas deliveries from Russia. Wholesale electricity prices have increased by 200% compared to the 2019 average, underscoring why rolling back electricity prices is tougher than it appears, according to the European Commission.

"Winter is coming and for many electricity costs are larger than they have been for a decade," Energy Commissioner Kadri Simson told reporters on Wednesday.

80 million European households struggle to stay warm

Wholesale gas prices — which have surged to record highs in France, Spain, Germany and Italy, amid reports of Germany's local utilities crying for help — are expected to remain high through the winter.

Prices are expected to fall in the spring, but remain higher than the average of past years, according to the Commission. Most EU countries rely on gas-fired power stations to meet electricity demand, and about 40% of that gas comes from Russia, with the EU outlining a plan to dump Russian energy to reduce this reliance, according to Eurostat.

Simson said that the Commission's initial assessment indicates that Russia's Gazprom has been fulfilling its long-term contracts "while providing little or no additional supply."

Kremlin spokesman Dmitry Peskov told journalists on Wednesday that Russia has increased gas supplies to Europe to the maximum possible level under existing contracts, but could not exceed those thresholds. "We can say that Russia is flawlessly fulfilling all contractual obligations," he said.

Measures EU states can take to help consumers and businesses cope with soaring electricity costs include emergency income support to households to help them pay their energy bills, alongside potential gas price cap strategies, state aid for companies, and targeted tax reductions. Member states can also temporarily delay bill payments and put in place processes to ensure that no one is disconnected from the grid.

Green energy the solution

The Commission also published a series of longer term measures the bloc should consider to reduce its dependence on fossil fuels and tackle energy price volatility, despite opposition from nine countries to electricity market reforms.

"Our immediate priority is to protect Europe's consumers, especially the most vulnerable," Simson said. "Second, we want to make our energy system better prepared and more resilient, so we don't have to face a similar situation in the future," she added.

Energy crisis could force more UK factories to close

This would require speeding up the green energy transition rather than slowing it down, Simson said. "We are not facing an energy price surge because of our climate policy or because renewable energy is expensive. We are facing it because the fossil fuel prices are spiking," she continued.

"The only long term remedy against demand shocks and price volatility is a transition to a green energy system."

Simson said she will propose to EU leaders a package of measures to decarbonize Europe's gas and hydrogen markets by 2050. Other measures to improve energy market stability could include increasing gas storage capacity and buying gas jointly at an EU level.

Related News

Nine EU countries oppose electricity market reforms as fix for energy price spike

EU Electricity Market Reform Opposition highlights nine states resisting an overhaul of the wholesale power market amid gas price spikes, urging energy efficiency, interconnection targets, and EU caution rather than redesigns affecting renewables.

Key Points

Nine EU states reject overhauling wholesale power pricing, favoring efficiency and prudent policy over redesigns.

✅ Nine states oppose redesign of wholesale power market.

✅ Call for efficiency and 15% interconnection by 2030.

✅ Ministers to debate responses amid gas-driven price spikes.

Germany, Denmark, Ireland and six other European countries said on Monday they would not support a reform of the EU electricity market, ahead of an emergency meeting of energy ministers to discuss emergency measures and the recent price spike.

European gas and power prices soared to record high levels in autumn and have remained high, prompting countries including Spain and France to urge Brussels to redesign its electricity market rules.

Nine countries on Monday poured cold water on those proposals, in a joint statement that said they "cannot support any measure that conflicts with the internal gas and electricity market" such as an overhaul of the wholesale power market altogether.

"As the price spikes have global drivers, we should be very careful before interfering in the design of internal energy markets," the statement said.

"This will not be a remedy to mitigate the current rising energy prices linked to fossil fuels markets across Europe."

Austria, Germany, Denmark, Estonia, Finland, Ireland, Luxembourg, Latvia and the Netherlands signed the statement, which called instead for more measures to save energy and a target for a 15% interconnection of the EU electricity market by 2030.

European energy ministers meet tomorrow to discuss their response to the price spike, including gas price cap strategies under consideration. Most countries are using tax cuts, subsidies and other national measures to shield consumers against the impact higher gas prices are having on energy bills, but EU governments are struggling to agree on a longer term response.

Spain has led calls for a revamp of the wholesale power market in response to the price spike, amid tensions between France and Germany over reform, arguing that the system is not supporting the EU's green transition.

Under the current system, the wholesale electricity price is set by the last power plant needed to meet overall demand for power. Gas plants often set the price in this system, which Spain said was unfair as it results in cheap renewable energy being sold for the same price as costlier fossil fuel-based power.

The European Commission has said it will investigate whether the EU power market is functioning well, but that there is no evidence to suggest a different system would have better protected countries against the surge in energy costs, and that rolling back electricity prices is tougher than it appears during such spikes.

Related News

US Moving Towards 30% Electricity From Wind & Solar

US Wind and Solar Outlook 2026 projects cheap renewables displacing coal and gas, with utility-scale additions, rooftop solar growth, improved grid reliability, and EV V2G integration accelerating decarbonization across the electricity market.

Key Points

An analysis forecasting wind and solar growth, displacing coal and gas as utility-scale and rooftop solar expand.

✅ Utility-scale solar installs avg 21 GW/yr through 2026.

✅ 37.7 GW wind in pipeline; 127.8 GW already online.

✅ Small-scale solar could near 100 TWh in 2026.

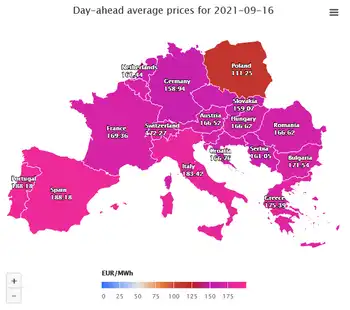

A recent report from the Institute for Energy Economics and Financial Analysis (IEEFA) predicts that cheap renewables in the form of wind and solar will push coal and gas out of the energy market space. Already at 9% of US generation, the report predicts that wind and solar will supply almost 30% of US electricity demand by 2026, consistent with renewables nearing one-fourth of U.S. generation projections for the near term.

“The Solar Energy Industries Association now expects utility-scale installations to average more than 21,000MW a year through 2026, following a year when U.S. solar generation rose 25% and with a peak of 25,000MW in 2023,” IEEFA writes. “Continued growth is also expected in U.S. wind generation, mirroring global trends where China's solar PV expansion outpaced all other fuels in 2016, with 37.7GW of new capacity already under construction or in advanced development, which would be added to 127.8GW in existing installed capacity.”

Meanwhile, with wind and solar growth booming, fossil fuels are declining, as renewables surpassed coal in 2022 nationwide. “Coal and natural gas are now locked into an essentially zero-sum game where increases in one fuel’s generation comes at the expense of the other. Together, they are not gaining market share, rather they are trading it back and forth, and the rapid growth in renewable generation will cut even deeper into the market share of both.”

And what of rooftop solar? Some states in Australia now have periods where the entire state grid is powered just by solar on the roofs of private citizens. As this revolution progresses in the USA, especially if a tenfold national solar push moves forward, what impact will it make on fossil fuel generators — which are expensive to build, expensive to maintain, expensive to fuel, and rely on an expensive distribution network.

“EIA estimates that this ‘small-scale solar’ produced 41.7 million MWh of power in 2020, when solar accounted for about 3% of U.S. electricity, a 19 percent increase from 2019. This growth will likely continue in the years ahead as costs continue to fall and concerns about grid reliability rise. Assuming a conservative 15 percent annual increase in small-scale solar going forward would push the sector’s generation to almost 100 million MWh in 2026.”

The Joker in the story might be the impact from electric vehicle adoption. Sales are set to surge and there’s more and more interest in V2G technology, even as wind and solar could provide 50% by 2050 in broader forecasts.

Related News

China's electric power woes cast clouds on U.S. solar's near-term future

China Power Rationing disrupts the solar supply chain as coal shortages, price controls, and dual-control emissions policy curb electricity, squeezing polysilicon, aluminum, and module production and raising equipment costs amid surging post-Covid industrial demand.

Key Points

China's electricity curbs from coal shortages, price caps, and emissions targets disrupt solar output and materials.

✅ Polysilicon and aluminum output cut by power rationing

✅ Coal price spikes and power price caps squeeze generators

✅ Dual-control emissions policy triggers provincial curbs

The solar manufacturing supply chain is among the industries being affected by a combination of soaring power demand, coal shortages, and carbon emission reduction measures which have seen widespread power cuts in China.

In Yunnan province, in southwest China, producers of the silicon metal which feeds polysilicon have been operating at 10% of the output they achieved in August. They are expected to continue to do so for the rest of the year as provincial authorities try to control electricity demand with a measure that is also affecting the phosphorus industry.

Fellow solar supply chain members from the aluminum industry in Guangxi province, in the south, have been forced to operate just two days per week, alongside peers in the concrete, steel, lime, and ceramics segments. Manufacturers in neighboring Guangdong have access to normal power supplies only on Fridays and Saturdays with electricity rationed to a 15% grid security load for the rest of the time.

pv magazine USA reported that a Tier 1 solar module manufacturer warned customers in an email that energy shortages in China have forced it to reduce or stop production at its Chinese manufacturing sites. The company warned the event will also affect output from its downstream cell and module production facilities in Southeast Asia.

The memo said that in order to recover from the effects of the “potential Force Majeure event,” it may delay or stop equipment delivery or seek to renegotiate contracts to pass through higher prices.

Raw material sourcing

With reports of drastic power shortages emerging from China in recent days, the country has actually been experiencing problems since late June, and similar pressures have seen India ration coal supplies this year, but rationing is not unusual during the peak summer hours.

What has changed this time is that the outages have continued and prompted rationing measures across 19 of the nation’s provinces for the rest of the year. The problems have been caused by a combination of rising post-Covid electricity demand at a time when the politically-motivated ban on imports of Australian coal has tightened supply; and the manner in which Beijing controls power prices, with the situation further exacerbated by carbon emissions reduction policy.

Demand

Electricity demand from industry, underscoring China’s electricity appetite, was 13.5 percentage points higher in the first eight months of the year than in the same period of 2020, at 3,585 TWh. That reflected a 13.8% year-on-year rise in total consumption, following earlier power demand drops when coronavirus shuttered plants, to 5.47 PWh, according to data from state energy industry trade body the China Electricity Council.

Figures produced by the China General Administration of Customs tell the same story: a rebound driven by the global recovery from the pandemic, as global power demand surges above pre-pandemic levels, with China recording import and export trade worth RMB2.48 trillion ($385 billion) in January-to-August. That was up 23.7% on the same period of last year and 22.8% higher than in the first eight months of 2019.

With Beijing having enforced an unofficial ban on imports of Australian coal for the last year or so – as the result of an ongoing diplomatic spat with Australia – rising demand for coal (which provided around 73% of Chinese electricity in the first half of the year) has further raised prices for the fossil fuel.

The problem for Chinese coal-fired power generators is that Beijing maintains strict controls on the price of electricity. As a result, input costs cannot be passed on to consumers. The mismatch between a liberalized coal market and centrally controlled end-user prices is illustrated by the current situation in Guangdong. There, a coal price of RMB1,560 per ton ($242) has pushed the cost of coal-fired electricity up to RMB0.472 per kilowatt-hour ($0.073). With coal power companies facing an electricity price ceiling of around RMB0.463/kWh ($0.071), generators are losing around RMB0.12 for every kilowatt-hour they generate. In that situation, rationing electricity supplies is an obvious remedy.

The crisis has been worsened by the introduction of China’s “dual control” energy policy, which aims to help meet President Xi Jinping’s climate change pledge of hitting peak carbon emissions this decade and a net zero economy by 2060, and to reduce coal power production over time. Dual control refers to attempts to wind down greenhouse gas emissions at both a national level and in more local areas, such as provinces and cities.

Red status

With the finer details of the carbon reduction policy yet to be ironed out, government departments and provincial and city authorities have started to set their own emission-reduction targets. In mid-August, state planning body the China National Development and Reform Commission (NDRC) published a table of the energy control situation across the nation. With nine provinces marked red for their energy consumption, and a further 10 highlighted as yellow, officials received another motivation to introduce power rationing.

China’s solar industry is being impacted by coal shortages for electric power generation. In this 2014 photo, a thermal generating plant’s cooling towers loom over a street in Henan Province.

Image: flickr/V.T. Polywoda

The current approach of rolling blackouts seems unlikely to be a sustainable solution, as surging electricity demand strains power systems worldwide, given the damage it could inflict on industry and the resentment it would cause in parts of the nation already preparing for winter.

The choice facing China’s policymakers is whether to ramp up coal supplies to force prices down by using decommissioned domestic supplies and halting the ban on Australian imports, or to raise electricity prices to prompt generators to get the lights back on. While the drawbacks of raising household electricity bills seem obvious, the first approach of using more coal could endanger the nation’s climate change commitments on the even of the COP26 meeting in Glasgow, Scotland, in November. Sources close to the NDRC have suggested the electricity price may be set to rise soon.

GDP

What is clear is the effect the energy crisis is having on the Chinese economy and on the solar supply chain. Leading up to a national day holiday in China, the coal price in northern China rose to around RMB2,000 per ton ($310), three times higher than at the beginning of the year.

Investment bank China International Capital Corp. blamed the dual control emission reduction policy for the electricity shortages. It predicted a 0.1-0.15 percentage point impact on economic growth in the last quarter of 2021. Morgan Stanley has put that figure at 1% in the current quarter, if industrial output restrictions continue. And Japan’s Nomura Securities revised down its annual forecast on Chinese growth from 8.2% to 7.7%. It now expects GDP gains in the third and fourth quarters to cool from 5.1% to 4.7%, and from 4.4% to 3%, respectively.

Related News

4 ways the energy crisis hits U.S. electricity, gas, EVs

U.S. Energy Crunch disrupts fuel and power markets, driving natural gas price spikes, coal resurgence, utility mix shifts, supply chain strains for EV batteries, and inflation pressures, complicating climate policy, OPEC outreach and LNG trade

Key Points

Supply-demand gaps raise fuel costs, revive coal, strain EV materials, and complicate U.S. climate policy and plans.

✅ Natural gas spikes shift generation from gas to coal

✅ Supply chain shortages hit nickel, silicon, and chips

✅ Policy tensions between price relief and decarbonization

A global energy crunch is creating pain for people struggling to fill their tanks and heat their homes, as well as roiling the utility industry’s plans to change its mix of generation and complicating the Biden administration’s plans to tackle climate change.

The ripple effects of a surge in natural gas prices include a spike in coal use and emissions that counter clean energy targets. High fossil fuel prices also are translating into high prices and a supply crunch for key minerals like silicon used in clean energy projects. On a call with investors yesterday, a Tesla Inc. executive said the company is having a hard time finding enough nickel for batteries.

The crisis could pose political problems for the Biden administration, which spent the last few months fending off criticism about rising fuel prices and inflation (Energywire, Oct. 14).

“Energy issues at this moment are as salient to the American public as they have been in quite some time,” said Christopher Borick, who directs the Muhlenberg College Institute of Public Opinion in Pennsylvania, where Biden stopped yesterday to pitch his infrastructure plan.

While gasoline prices have gotten headlines all summer, natural gas prices have risen faster than motor fuels, more than doubling from an average $1.92 per thousand cubic feet in September 2020 to $5.16 last month. By comparison, gasoline prices have risen about 55 percent in the last year, to $3.36 per gallon nationwide this week, according to AAA.

The roots of the problem go back to the beginning of the pandemic and the recession in 2020. Oil and gas prices fell so fast then that many producers, particularly in the U.S., simply stopped drilling.

Oil companies began predicting a few months later that the abrupt shutdown would eventually lead to shortages and price spikes when the economy recovered. Those predictions turned out to be accurate.

With the economy beginning to recover, demand for gas has gone up, but there’s not enough supply to go around.

While the U.S. energy crunch isn’t as severe as Europe’s energy crisis today, and analysts predict that gas prices will gradually fall next year, consumers could be in for a rough couple of months.

Here’s four ways the global energy crisis is impacting the United States, from the electricity sector to the political landscape:

What are the political repercussions?

For the Biden administration, the energy price hikes come amid fears of rising inflation and persistent supply bottlenecks at the nation’s ports as its climate ambitions face headwinds in Congress.

“The confluence of energy prices, logistical challenges and the need to move on climate have raised this to the top tier,” said Borick, who in the past has polled on energy and environmental issues in Pennsylvania.

Borick noted the administration is facing counterpressures: Even as it pushes to decarbonize the nation’s electric system, it wants to keep gas prices in check. High gasoline prices have been linked to declining political approval ratings, including for presidents, even if much of the price hikes are beyond their control.

White House press secretary Jen Psaki said earlier this month that the administration can take steps to address what it called “short-term supply issues,” but also needs to focus on the long term — and climate.

In hopes of capping prices, the White House has spoken with members of OPEC about increasing oil production — though OPEC has little control over natural gas prices. And earlier this month, the administration talked to U.S. oil and gas producers about helping to bring down prices.

That comes even as environmentalists have pushed Biden to ban federal fossil fuel leasing and drilling and stop new projects.

The moves to curb prices have prompted ridicule from Republicans, who have accused Biden of declaring war on U.S. energy by canceling the Keystone XL pipeline.

“The Biden administration won’t say it out loud, yet let’s admit it: There is a crisis,” Sen. John Barrasso (R-Wyo.) said this week on the Senate floor. “It is one that Joe Biden and his administration has created. It is a crisis of Joe Biden’s own making.”

The situation has also resurfaced comparisons to former President Carter, who struggled politically in the 1970s with gasoline shortages and other energy pressures. Some political scientists say, though, the comparison between the two isn’t apples to apples.

"In 1979, the crisis began with the Iranian Revolution, producing a supply shortage. In the USA, some states rationed the supply. That’s not occurring now. Oil prices were also regulated, another difference, “ said Terry Madonna, a senior fellow in residence for political affairs at Millersville University.

A Morning Consult poll released yesterday carried warning signs for Democrats with worries about the economy on the rise across the political spectrum.

Voters, however, were evenly split on how Biden is handling energy. Forty-two percent of respondents approve of Biden’s energy policy, compared with 45 percent who disapproved. The margin of error is 2 percentage points.

Will the electricity mix change?

Higher gas prices are giving coal a boost in some markets.

Atlanta-based Southern Co. told CNBC earlier this week, for instance, that coal was about 17 percent of the company’s power mix last year. That has changed in 2021.

“The unintended consequence of high gas prices is that coal becomes more economic, and so my sense is … our coal production has bumped up above 20 percent,” Southern CEO Tom Fanning said. “Now, how long that’ll persist, I don’t know.”

Fanning said “what we’re seeing right now, and the real challenge in America, is this notion of energy in transition.”

But the U.S. power sector has been evolving for years, with more renewables and less coal on the grid, and experts say the current energy crunch won’t change long-term utility trends in the industry.

“In general, I wouldn’t place too much emphasis on short-term fluctuations,” Jay Apt, a professor at Carnegie Mellon University, said in an email. “There is still a robust supply chain for most components needed for low-pollution power, including renewables.”

In fact, elevated fossil fuel prices, and high natural gas prices in particular, could accelerate the move toward wind, solar and batteries in some areas. That’s because power plants that run on coal and natural gas can be affected by rising and volatile fuel prices, as illustrated by the recent move in commodities globally. That means higher costs to run the facilities, even if power prices often climb along with gas prices.

“If I were a utility planner, this would cause me to double down on new generation from [wind] and solar and storage as opposed to building additional natural gas plants where, you know, I could be having these super high and volatile operating costs,” said Bri-Mathias Hodge, an associate professor in the Department of Electrical, Computer and Energy Engineering at the University of Colorado, Boulder.

Ed Hirs, an energy fellow at the University of Houston, said the current global situation doesn’t change the U.S. power sector’s overall move toward generation with lower operating costs.

For example, he said nuclear and coal plants can require hundreds of employees, and both have fuel costs. Hirs said a gas facility also needs fuel and may need dozens of employees. Wind and solar facilities often need a smaller number of workers and don’t require fuel in their operations, he noted.

“Eventually the cheap wins out,” Hirs said.

That isn’t even factoring in climate change — the reason world leaders are seeking to slash greenhouse gas emissions. Indeed, lowering emissions remains a priority among many states and big companies in the U.S.

Over the next 10 to 15 years, Hirs said, a key question will be whether battery technology can compete economically in terms of backing up renewables. He said a national carbon price, if enacted, would aid renewables and enhance returns on batteries.

“The real battle is going to be between natural gas and battery storage,” Hirs said.

Apt and M. Granger Morgan, who’s also a Carnegie Mellon professor, noted in a Hill piece last month that the U.S. gets about 40 percent of its power from carbon-free sources, including nuclear.

“Modelers and many power system operators agree that it is possible that renewables can cost-effectively make up roughly 80% of electricity generation,” the professors wrote, adding that other sources could include “storage and gas turbines powered with hydrogen, synfuels, or natural gas with carbon capture.”

What about EVs and renewables?

As for electric vehicles, executives with Tesla said on a call yesterday that supply-chain problems are the major brake on production for both vehicles and batteries.

Chief Financial Officer Zachary Kirkhorn said that the company’s factories aren’t running at full capacity because of an ongoing shortage of semiconductor chips. Customers are waiting longer for vehicles, he said, and wait lists are growing.

The challenges extend to raw materials. In batteries, Kirkhorn said, the company is having trouble finding enough nickel, and in vehicles, it is scrounging for aluminum. He said the problem is "not small," and that prices may rise as supply contracts come up for renewal.

The supply problems are creating "cost headwinds," he said, and so are rising labor costs. Tesla is not immune from the worker shortages that are plaguing the entire U.S. economy.

The production woes aren’t limited to Tesla: Automakers around the world have have had their output crimped by the chip shortage that accompanied the economic rebound after pandemic lockdowns. Unlike many other automakers, Tesla hasn’t been forced to pause its factory lines.

Tesla said it is poised to greatly expand its production of batteries for the electric grid — with a caveat.

Last month, Tesla broke ground on a new California factory to make Megapack, its 3 megawatt-per-hour lithium-ion batteries for use by power companies. That future factory’s capacity, 40 gigawatt per hour a year, is vastly more than the 3 GWh it made in the last calendar year.

However, today’s supply-chain problems are braking the making of both Megapack and Powerwall, Tesla’s battery for homes, Kirkhorn said. He added that production will increase "as soon as parts allow us."

Other advocates for EVs and renewable power expressed little concern about the supply crunch’s meaning for their industries, noting that higher prices alone don’t automatically trigger a broader green revolution on their own.

Those problems likely wouldn’t change the immediate course of the energy transition, researchers said.

"Short-term trends, week to week or even month to month, don’t matter much for investors or policy makers," wrote John Graham, a former budget official with the Bush administration and professor at Indiana University’s O’Neill School of Public and Environmental Affairs, in an email to E&E News.

The crunch may give policymakers a glimpse of the future, however, according to one minerals analyst.

"This isn’t going to be an outlier. I think increasingly you’re going to see pockets of the world start to feel these strains," said Andrew Miller, product director at Benchmark Mineral Intelligence, which focuses its research on battery minerals and battery supply chains.

The U.S. and its allies are only now beginning to develop their own supply chains for batteries and other key clean energy technologies, he noted. "The issue you’re facing, and this is one coming over time, is to have the platform in place. You have to have the supply chain of raw materials," he said.

"I think you’re going to see the most turbulence over the coming decade. … It’s not going to be a smooth transition,” added Miller.

How long will gas prices stay high?

The gap between natural gas demand and supply has led to severe price spikes in Europe, where utilities and other gas buyers have to compete against China for cargoes of liquefied natural gas, according to a research note from IHS Markit Ltd.

Here in the U.S., the causes are the same, but the results aren’t as extreme. Less than 10 percent of domestic gas production is exported as LNG, so American customers don’t have to compete as much against overseas buyers.

Instead, gas-hungry sectors of the economy have run into another problem, IHS analyst Matthew Palmer said in an interview. Gas producers have been cautious about increasing their output, largely because of pressure from investors to limit their spending.

“That theme has really put a governor on production,” he said.

The disconnect will likely mean higher home gas bills and higher electric prices this winter, although deep freeze events or warm weather could disrupt the trend, he said. The U.S. Energy Information Administration is predicting that average heating bills for homes that use gas furnaces will rise 30 percent this winter.

This comes as U.S. gas supply remains high, according to a biennial assessment from the Potential Gas Committee, a group of volunteer geoscientists, engineers and other experts.

Including reserves, future gas supply in the U.S. stands at a record 3,863 trillion cubic feet, up 25 tcf from levels reported in 2019, the group said Tuesday at an event co-hosted with the American Gas Association.

Of that total, so-called technically recoverable resources — or those in the ground but not yet recovered — are 3,368 tcf, the PGC said, down less than 0.2 percent from the last assessment.

The amount of technically recoverable gas went relatively unchanged from year-end 2018 for several reasons, including a lack of company activity in exploration efforts last year due to COVID, said Alexei Milkov, the group’s executive director.

Another factor is that basins mature and shale plays “cannot increase in resources forever,” said Milkov, also a professor of geology and geological engineering at the Colorado School of Mines.

Still, Milkov added, “We cannot tell you right now if we are on a new plateau, or if we are going to start seeing more growth in gas resources again, right, because it’s a complex issue.”

The EIA predicts that gas production will increase and prices will begin to drop in 2022.

David Flaherty, CEO of the Republican polling firm Magellan Strategies in Colorado, said prices could particularly hit seniors. But he said he expected the energy crunch to ease in the U.S. well before the election.

“By early summer, this is likely to be behind us,” he said.

Related News

Competition in Electricity Has Been Good for Consumers and Good for the Environment

Electricity Market Competition drives lower wholesale prices, stable retail rates, better grid reliability, and faster emissions cuts as deregulation and renewables adoption pressure utilities, improve efficiency, and enhance consumer choice in power markets.

Key Points

Electricity market competition opens supply to rivals, lowering prices, improving reliability, and reducing emissions.

✅ Wholesale prices fell faster in competitive markets

✅ Retail rates rose less than in monopoly states

✅ Fewer outages, shorter durations, improved reliability

By Bernard L. Weinstein

Electricity used to be boring. Public utilities that provided power to homes and businesses were regulated monopolies and, by law, guaranteed a fixed rate-of-return on their generation, transmission, and distribution assets. Prices per kilowatt-hour were set by utility commissions after lengthy testimony from power companies, wanting higher rates, and consumer groups, wanting lower rates.

About 25 years ago, the electricity landscape started to change as economists and others argued that competition could lead to lower prices and stronger grid reliability. Opponents of competition argued that consumers weren’t knowledgeable enough about power markets to make intelligent choices in a competitive pricing environment. Nonetheless, today 20 states have total or partial competition for electricity, allowing independent power generators to compete in wholesale markets and retail electric providers (REPs) to compete for end-use customers, a dynamic echoed by the Alberta electricity market across North America. (Transmission, in all states, remains a regulated natural monopoly).

A recent study by the non-partisan Pacific Research Institute (PRI) provides compelling evidence that competition in power markets has been a boon for consumers. Using data from the U.S. Energy Information Administration (EIA), PRI’s researchers found that wholesale electricity prices in competitive markets have been generally declining or flat, prompting discussions of free electricity business models, over the last five years. For example, compared to 2015, wholesale power prices in New England have dropped more than 44 percent, those in most Mid-Atlantic States have fallen nearly 42 percent, and in New York City they’ve declined by nearly 45 percent. Wholesale power costs have also declined in monopoly states, but at a considerably slower rate.

As for end-users, states that have competitive retail electricity markets have seen smaller price increases, as consumers can shop for electricity in Texas more cheaply than in monopoly states. Again, using EIA data, PRI found that in 14 competitive jurisdictions, retail prices essentially remained flat between 2008 and 2020. By contrast, retail prices jumped an average of 21 percent in monopoly states. The ten states with the largest retail price increases were all monopoly-based frameworks. A 2017 report from the Retail Energy Supply Association found customers in states that still have monopoly utilities saw their average energy prices increase nearly 19 percent from 2008 to 2017 while prices fell 7 percent in competitive markets over the same period.

The PRI study also observed that competition has improved grid reliability, the recent power disruptions in California and Texas, alongside disruptions in coal and nuclear sectors across the U.S., notwithstanding. Looking at two common measures of grid resiliency, PRI’s analysis found that power interruptions were 10.4 percent lower in competitive states while the duration of outages was 6.5 percent lower.

Citing data from the EIA between 2008 and 2018, PRI reports that greenhouse gas emissions in competitive states declined on average 12.1 percent compared to 7.3 percent in monopoly states. This result is not surprising, and debates over whether Israeli power supply competition can bring cheaper electricity mirror these dynamics. In a competitive wholesale market, independent power producers have an incentive to seek out lower-cost options, including subsidized renewables like wind and solar. By contrast, generators in monopoly markets have no such incentive as they can pass on higher costs to end-users. Perhaps the most telling case is in the monopoly state of Georgia where the cost to build nuclear Plant Vogtle has doubled from its original estimate of $14 billion 12 years ago. Overruns are estimated to cost Georgia ratepayers an average of $854, and there is no definite date for this facility to come on line. This type of mismanagement doesn’t occur in competitive markets.

Unfortunately, some critics are attempting to halt the momentum for electricity competition and have pointed to last winter’s “deep freeze” in Texas that left several million customers without power for up to a week. But this example is misplaced. Power outages in February were the result of unprecedented and severe weather conditions affecting electricity generation and fuel supply, and numerous proposals to improve Texas grid reliability have focused on weatherization and fuel resilience; the state simply did not have enough access to natural gas and wind generation to meet demand. Competitive power markets were not a factor.

The benefits of wholesale and retail competition in power markets are incontrovertible. Evidence shows that households and businesses in competitive states are paying less for electricity while grid reliability has improved. The facts also suggest that wholesale and retail competition can lead to faster reductions in greenhouse gas emissions. In short, competition in power markets is good for consumers and good for the environment.

Bernard L. Weinstein is emeritus professor of applied economics at the University of North Texas, former associate director of the Maguire Energy Institute at Southern Methodist University, and a fellow of Goodenough College, London. He wrote this for InsideSources.com.

Related News

Sub-Saharan Africa has a huge electricity problem - but with challenge comes opportunity

Sub-Saharan Africa Energy Access faces critical deficits; SDG7, clean energy finance, off-grid solar, and microgrids drive electrification for health, education, and economy amid World Bank and IEA efforts to expand reliable, affordable power.

Key Points

Reliable, affordable power in sub-Saharan Africa via renewables, off-grid solar, and SDG7-led electrification.

✅ SDG7 targets universal, modern energy access by 2030

✅ Off-grid solar and microgrids boost rural electrification

✅ Health, education, and business depend on reliable power

Sub-Saharan Africa has an electricity problem. While the world as a whole has made great strides when it comes to providing access to electricity and moving toward universal electricity access worldwide (the world average is now 90 per cent with access, up from 83 per cent in 2010), southern and western African states still lag far behind.

According to Tracking SDG7: The Energy Progress Report, produced by a consortium of organisations including the World Bank, the International Energy Agency and the World Health Organization, 759 million people were without electricity in 2019 and threequarters of them were based in sub-Saharan Africa. At just seven per cent, South Sudan had the lowest access figures; Chad, Burundi and Malawi were only marginally higher. What’s more, due to a combination of factors, the situation is getting worse. In total, the region’s access deficit increased from 556 million people in 2010 to 570 million people in 2019.

These days, being without electricity has an impact on every sphere of life. The Covid-19 pandemic only served to put this into sharper relief. Intermittent electricity meant vaccination doses that rely on cold storage were impossible to deliver and, as more than 70 per cent of the health facilities in sub-Saharan Africa have no access to reliable electricity, the problem was vast. But even without a global pandemic, having no power stymies opportunity in every field, from education to economics.

French photojournalist Pascal Maitre, who has spent much of his career writing about sub-Saharan Africa, wanted to document the problems faced by people in areas with no electricity. He thought particularly carefully about the location for his project. ‘First, I was thinking I could take images in the Democratic Republic of the Congo,’ he says. ‘But then I thought that if you chose a place that has war, it’s logical that electricity won’t really work. So, instead, I wanted to find a place that is quite stable. I decided to go to Benin, where they have a democracy. It is a good example of a country that’s not in really bad shape but where they still have this problem. Also, I didn’t want to go to a place that is very remote, where it is normal not to have good service. So I decided to go to a place around 50 kilometres from the capital that you can get to by road.’

Maitre visited several villages in the region, as well as making trips to Chad and Senegal, and encountered the full range of limitations engendered by the power shortage. From teachers struggling to conduct lessons in the dark to midwives forced to work with only the weak light from a phone, the situation was clearly unacceptable. ‘People were very, very, very upset,’ he says. ‘I conducted a lot of interviews in different villages and lack of electricity touches education, economy, business, security and also emigration, because people have to move to big cities or maybe to Europe to get jobs.’

Where once the situation might have been accepted as the norm, people today are fully aware of the ways in which they are held back by the lack of power. As Maitre remembers: ‘A guy said to me one day, “Do you think it is normal that last time my wife delivered a baby, the midwife had to hold her phone between her teeth in order to see what she was doing?” You feel very frustrated.’ He adds that the fact that most people now have mobile phones only highlights the hardship. ‘Before, maybe it was not so frustrating. But now, most of these people have cellphones. The cellphone company puts antennae everywhere so the phones work, but people cannot recharge their phones. They have to go to the market, where someone will come with a generator to recharge.’

Governments and global organisations are very aware of the problem across the world as a whole. Sustainable Development Goal 7 (SDG7) – one of the 17 goals set out in 2015 by the United Nations General Assembly – was designed to ensure universal access to affordable, reliable, sustainable and modern energy by 2030, underscoring the push for clean, affordable and sustainable electricity for all by 2030. As part of this goal, international financial flows to developing countries in support of clean energy reached US$17 billion in 2018. As a result, some areas have seen huge improvement. According to the Energy Progress Report, in Latin America and the Caribbean, and in Eastern and South-Eastern Asia, the advance of electrification has been enough to approach universal access. By 2019, in Western Asia and North Africa, and Central and South Asia, 94 and 95 per cent of the population respectively had access to electricity.

But these statistics only serve to emphasise just how bad the situation is in sub-Saharan Africa, where electricity systems are unlikely to go green this decade according to several analyses. As the report states: ‘While renewable energy has demonstrated remarkable resilience during the pandemic, the unfortunate fact is that gains in energy access throughout Africa are being reversed: the number of people lacking access to electricity is set to increase in 2020, making basic electricity services unaffordable for up to 30 million people who had previously enjoyed access.’

The small silver lining is that if the situation is dealt with properly, the region could build a renewable-energy system from the ground up, rather than having to undergo the costly and complex transitions underway in developed countries. In rural areas, small-scale or off-grid renewable systems (mostly solar) are expected to play an important role, as highlighted by a recent IRENA report on decarbonisation, in increasing access. In fact, solar panels are already used in many areas. In 2019, 105 million people had access to off-grid solar solutions, up from 85 million in 2016, and almost half lived in sub-Saharan Africa, with 17 million in Kenya and eight million in Ethiopia.

Rachel Kyte is currently serving as the 14th dean of the Fletcher School at Tufts University in the USA, but her CV is long. She was previously CEO of the UN-affiliated Sustainable Energy for All (SeforALL), as well as the World Bank Group vice president and special envoy for climate change, leading the run-up to the Paris Agreement. According to her, a focus on renewables is absolutely essential, both for wider efforts to tackle climate change, with some advocating a fossil fuel lockdown to drive a climate revolution, but also for the people of sub-Saharan Africa. ‘The fossil fuel industry has said it will just extend the centralised fossil-fuel power systems that we have today to reach these people,’ she says.

Related News

Annual U.S. coal-fired electricity generation will increase for the first time since 2014

U.S. coal-fired generation 2021 rose as higher natural gas prices, stable coal costs, and a recovering power sector shifted the generation mix; capacity factors rebounded despite low coal stocks and ongoing plant retirements.

Key Points

Coal output rose 22% on high gas prices and higher capacity factors; a 5% decline is expected in 2022.

✅ Natural gas delivered cost averaged $4.93/MMBtu, more than double 2020

✅ Coal capacity factor rose to ~51% from 40% in 2020

✅ 2022 coal generation forecast to fall about 5%

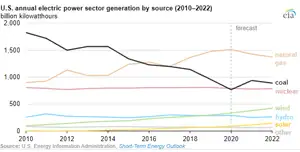

We expect 22% more U.S. coal-fired generation in 2021 than in 2020, according to our latest Short-Term Energy Outlook (STEO). The U.S. electric power sector has been generating more electricity from coal-fired power plants this year as a result of significantly higher natural gas prices and relatively stable coal prices, even as non-fossil sources reached 40% of total generation. This year, 2021, will yield the first year-over-year increase in coal generation in the United States since 2014, highlighted by a January power generation jump earlier in the year.

Coal and natural gas have been the two largest sources of electricity generation in the United States. In many areas of the country, these two fuels compete to supply electricity based on their relative costs and sensitivity to policies and gas prices as well. U.S. natural gas prices have been more volatile than coal prices, so the cost of natural gas often determines the relative share of generation provided by natural gas and coal.

Because natural gas-fired power plants convert fuel to electricity more efficiently than coal-fired plants, record natural gas generation has at times underscored that advantage, and natural gas-fired generation can have an economic advantage even if natural gas prices are slightly higher than coal prices. Between 2015 and 2020, the cost of natural gas delivered to electric generators remained relatively low and stable. This year, however, natural gas prices have been much higher than in recent years. The year-to-date delivered cost of natural gas to U.S. power plants has averaged $4.93 per million British thermal units (Btu), more than double last year’s price.

The overall decline in electricity demand in 2020 and record-low natural gas prices led coal plants to significantly reduce the percentage of time that they generated power. In 2020, the utilization rate (known as the capacity factor) of U.S. coal-fired generators averaged 40%. Before 2010, coal capacity factors routinely averaged 70% or more. This year’s higher natural gas prices have increased the average coal capacity factor to about 51%, which is almost the 2018 average, a year when wind and solar reached 10% nationally.

Although rising natural gas prices have resulted in more U.S. coal-fired generation than last year, this increase in coal generation will most likely not continue as solar and wind expand in the generation mix. The electric power sector has retired about 30% of its generating capacity at coal plants since 2010, and no new coal-fired capacity has come online in the United States since 2013. In addition, coal stocks at U.S. power plants are relatively low, and production at operating coal mines has not been increasing as rapidly as the recent increase in coal demand. For 2022, we forecast that U.S. coal-fired generation will decline about 5% in response to continuing retirements of generating capacity at coal power plants and slightly lower natural gas prices.

Related News

Longer, more frequent outages afflict the U.S. power grid as states fail to prepare for climate change

Power Grid Climate Resilience demands storm hardening, underground power lines, microgrids, batteries, and renewable energy as regulators and utilities confront climate change, sea level rise, and extreme weather to reduce outages and protect vulnerable communities.

Key Points

It is the grid capacity to resist and recover from climate hazards using buried lines, microgrids, and batteries.

✅ Underground lines reduce wind outages and wildfire ignition risk.

✅ Microgrids with solar and batteries sustain critical services.

✅ Regulators balance cost, resilience, equity, and reliability.

Every time a storm lashes the Carolina coast, the power lines on Tonye Gray’s street go down, cutting her lights and air conditioning. After Hurricane Florence in 2018, Gray went three days with no way to refrigerate medicine for her multiple sclerosis or pump the floodwater out of her basement.

What you need to know about the U.N. climate summit — and why it matters

“Florence was hell,” said Gray, 61, a marketing account manager and Wilmington native who finds herself increasingly frustrated by the city’s vulnerability.

“We’ve had storms long enough in Wilmington and this particular area that all power lines should have been underground by now. We know we’re going to get hit.”

Across the nation, severe weather fueled by climate change is pushing aging electrical systems past their limits, often with deadly results. Last year, amid increasing nationwide blackouts, the average American home endured more than eight hours without power, according to the U.S. Energy Information Administration — more than double the outage time five years ago.

This year alone, a wave of abnormally severe winter storms caused a disastrous power failure in Texas, leaving millions of homes in the dark, sometimes for days, and at least 200 dead. Power outages caused by Hurricane Ida contributed to at least 14 deaths in Louisiana, as some of the poorest parts of the state suffered through weeks of 90-degree heat without air conditioning.

As storms grow fiercer and more frequent, environmental groups are pushing states to completely reimagine the electrical grid, incorporating more grid-scale batteries, renewable energy sources and localized systems known as “microgrids,” which they say could reduce the incidence of wide-scale outages. Utility companies have proposed their own storm-proofing measures, including burying power lines underground.

But state regulators largely have rejected these ideas, citing pressure to keep energy rates affordable. Of $15.7 billion in grid improvements under consideration last year, regulators approved only $3.4 billion, according to a national survey by the NC Clean Energy Technology Center — about one-fifth, highlighting persistent vulnerabilities in the grid nationwide.

After a weather disaster, “everybody’s standing around saying, ‘Why didn’t you spend more to keep the lights on?’ ” Ted Thomas, chairman of the Arkansas Public Service Commission, said in an interview with The Washington Post. “But when you try to spend more when the system is working, it’s a tough sell.”

A major impediment is the failure by state regulators and the utility industry to consider the consequences of a more volatile climate — and to come up with better tools to prepare for it. For example, a Berkeley Lab study last year of outages caused by major weather events in six states found that neither state officials nor utility executives attempted to calculate the social and economic costs of longer and more frequent outages, such as food spoilage, business closures, supply chain disruptions and medical problems.

“There is no question that climatic changes are happening that directly affect the operation of the power grid,” said Justin Gundlach, a senior attorney at the Institute for Policy Integrity, a think tank at New York University Law School. “What you still haven’t seen … is a [state] commission saying: 'Isn’t climate the through line in all of this? Let’s examine it in an open-ended way. Let’s figure out where the information takes us and make some decisions.’ ”

In interviews, several state commissioners acknowledged that failure.

“Our electric grid was not built to handle the storms that are coming this next century,” said Tremaine L. Phillips, a commissioner on the Michigan Public Service Commission, which in August held an emergency meeting to discuss the problem of power outages. “We need to come up with a broader set of metrics in order to better understand the success of future improvements.”

Five disasters in four years

The need is especially urgent in North Carolina, where experts warn Atlantic grids and coastlines need a rethink as the state has declared a federal disaster from a hurricane or tropical storm five times in the past four years. Among them was Hurricane Florence, which brought torrential rain, catastrophic flooding and the state’s worst outage in over a decade in September 2018.

More than 1 million residents were left disconnected from refrigerators, air conditioners, ventilators and other essential machines, some for up to two weeks. Elderly residents dependent on oxygen were evacuated from nursing homes. Relief teams flew medical supplies to hospitals cut off by flooded roads. Desperate people facing closed stores and rotting food looted a Wilmington Family Dollar.

“I have PTSD from Hurricane Florence, not because of the actual storm but the aftermath,” said Evelyn Bryant, a community organizer who took part in the Wilmington response.

The storm reignited debate over a $13 billion proposal by Duke Energy, one of the largest power companies in the nation, to reinforce the state’s power grid. A few months earlier, the state had rejected Duke’s request for full repayment of those costs, determining that protecting the grid against weather is a normal part of doing business and not eligible for the type of reimbursement the company had sought.

After Florence, Duke offered a smaller, $2.5 billion plan, along with the argument that severe weather events are one of seven “megatrends” (including cyberthreats and population growth) that require greater investment, according to a PowerPoint presentation included in testimony to the state. The company owns the two largest utilities in North Carolina, Duke Energy Carolinas and Duke Energy Progress.

Vote Solar, a nonprofit climate advocacy group, objected to Duke’s plan, saying the utility had failed to study the risks of climate impacts. Duke’s flood maps, for example, had not been updated to reflect the latest projections for sea level rise, they said. In testimony, Vote Solar claimed Duke was using environmental trends to justify investments “it had already decided to pursue.”

The United States is one of the few countries where regulated utilities are usually guaranteed a rate of return on capital investments, even as studies show the U.S. experiences more blackouts than much of the developed world. That business model incentivizes spending regardless of how well it solves problems for customers and inspires skepticism. Ric O’Connell, executive director of GridLab, a nonprofit group that assists state and regional policymakers on electrical grid issues, said utilities in many states “are waving their hands and saying hurricanes” to justify spending that would do little to improve climate resilience.

In North Carolina, hurricanes convinced Republicans that climate change is real

Duke Energy spokesman Jeff Brooks acknowledged that the company had not conducted a climate risk study but pointed out that this type of analysis is still relatively new for the industry. He said Duke’s grid improvement plan “inherently was designed to think about future needs,” including reinforced substations with walls that rise several feet above the previous high watermark for flooding, and partly relied on federal flood maps to determine which stations are at most risk.

Brooks said Duke is not using weather events to justify routine projects, noting that the company had spent more than a year meeting with community stakeholders and using their feedback to make significant changes to its grid improvement plan.

This year, the North Carolina Utilities Commission finally approved a set of grid improvements that will cost customers $1.2 billion. But the commission reserved the right to deny Duke reimbursement of those costs if it cannot prove they are prudent and reasonable. The commission’s general counsel, Sam Watson, declined to discuss the decision, saying the commission can comment on specific cases only in public orders.

The utility is now burying power lines in “several neighborhoods across the state” that are most vulnerable to wide-scale outages, Brooks said. It is also fitting aboveground power lines with “self-healing” technology, a network of sensors that diverts electricity away from equipment failures to minimize the number of customers affected by an outage.

As part of a settlement with Vote Solar, Duke Energy last year agreed to work with state officials and local leaders to further evaluate the potential impacts of climate change, a process that Brooks said is expected to take two to three years.

High costs create hurdles

The debate in North Carolina is being echoed in states across the nation, where burying power lines has emerged as one of the most common proposals for insulating the grid from high winds, fires and flooding. But opponents have balked at the cost, which can run in the millions of dollars per mile.

In California, for example, Pacific Gas & Electric wants to bury 10,000 miles of power lines, both to make the grid more resilient and to reduce the risk of sparking wildfires. Its power equipment has contributed to multiple deadly wildfires in the past decade, including the 2018 Camp Fire that killed at least 85 people.

PG&E’s proposal has drawn scorn from critics, including San Jose Mayor Sam Liccardo, who say it would be too slow and expensive. But Patricia Poppe, the company’s CEO, told reporters that doing nothing would cost California even more in lost lives and property while struggling to keep the lights on during wildfires. The plan has yet to be submitted to the state, but Terrie Prosper, a spokeswoman for the California Public Utilities Commission, said the commission has supported underground lines as a wildfire mitigation strategy.

Another oft-floated solution is microgrids, small electrical systems that provide power to a single neighborhood, university or medical center. Most of the time, they are connected to a larger utility system. But in the event of an outage, microgrids can operate on their own, with the aid of solar energy stored in batteries.

In Florida, regulators recently approved a four-year microgrid pilot project, but the technology remains expensive and unproven. In Maryland, regulators in 2016 rejected a plan to spend about $16 million for two microgrids in Baltimore, in part because the local utility made no attempt to quantify “the tangible benefits to its customer base.”

Amid shut-off woes, a beacon of energy

In Texas, where officials have largely abandoned state regulation in favor of the free market, the results have been no more encouraging. Without requirements, as exist elsewhere, for building extra capacity for times of high demand or stress, the state was ill-equipped to handle an abnormal deep freeze in February that knocked out power to 4 million customers for days.

Since then, Berkshire Hathaway Energy and Starwood Energy Group each proposed spending $8 billion to build new power plants to provide backup capacity, with guaranteed returns on the investment of 9 percent, but the Texas legislature has not acted on either plan.

New York is one of the few states where regulators have assessed the risks of climate change and pushed utilities to invest in solutions. After 800,000 New Yorkers lost power for 10 days in 2012 in the wake of Hurricane Sandy, state regulators ordered utility giant Con Edison to evaluate the state’s vulnerability to weather events.

The resulting report, which estimated climate risks could cost the company as much as $5.2 billion by 2050, gave ConEd data to inform its investments in storm hardening measures, including new storm walls and submersible equipment in areas at risk of flooding.

Meanwhile, the New York Public Service Commission has aggressively enforced requirements that utility companies keep the lights on during big storms, fining utility providers nearly $190 million for violations including inadequate staffing during Tropical Storm Isaias in 2020.

“At the end of the day, we do not want New Yorkers to be at the mercy of outdated infrastructure,” said Rory M. Christian, who last month was appointed chair of the New York commission.

The price of inaction

In North Carolina, as Duke Energy slowly works to harden the grid, some are pursuing other means of fostering climate-resilient communities.

Beth Schrader, the recovery and resilience director for New Hanover County, which includes Wilmington, said some of the people who went the longest without power after Florence had no vehicles, no access to nearby grocery stores and no means of getting to relief centers set up around the city.

For example, Quanesha Mullins, a 37-year-old mother of three, went eight days without power in her housing project on Wilmington’s east side. Her family got by on food from the Red Cross and walked a mile to charge their phones at McDonald’s. With no air conditioning, they slept with the windows open in a neighborhood with a history of violent crime.

Schrader is working with researchers at the University of North Carolina in Charlotte to estimate the cost of helping people like Mullins. The researchers estimate that it would have cost about $572,000 to provide shelter, meals and emergency food stamp benefits to 100 families for two weeks, said Robert Cox, an engineering professor who researches power systems at UNC-Charlotte.

Such calculations could help spur local governments to do more to help vulnerable communities, for example by providing “resilience outposts” with backup power generators, heating or cooling rooms, Internet access and other resources, Schrader said. But they also are intended to show the costs of failing to shore up the grid.

“The regulators need to be moved along,” Cox said.

In the meantime, Tonye Gray finds herself worrying about what happens when the next storm hits. While Duke Energy says it is burying power lines in the most outage-prone areas, she has yet to see its yellow-vested crews turn up in her neighborhood.

“We feel,” she said, “that we’re at the end of the line.”

Related News

Canadian climate policy and its implications for electricity grids

Canada Electricity Decarbonization Costs indicate challenging greenhouse gas reductions across a fragmented grid, with wind, solar, nuclear, and natural gas tradeoffs, significant GDP impacts, and Net Zero targets constrained by intermittency and limited interties.

Key Points

Costs to cut power CO2 via wind, solar, gas, and nuclear, considering grid limits, intermittency, and GDP impacts.

✅ Alberta model: eliminate coal; add wind, solar, gas; 26-40% CO2 cuts

✅ Nuclear option enables >75% cuts at higher but feasible system costs

✅ National costs 1-2% GDP; reserves, transmission, land, and waste not included

Along with many western developed countries, Canada has pledged to reduce its greenhouse gas emissions by 40–45 percent by 2030 from 2005 emissions levels, and to achieve net-zero emissions by 2050.

This is a huge challenge that, when considered on a global scale, will do little to stop climate change because emissions by developing countries are rising faster than emissions are being reduced in developed countries. Even so, the potential for achieving emissions reduction targets is extremely challenging as there are questions as to how and whether targets can be met and at what cost. Because electricity can be produced from any source of energy, including wind, solar, geothermal, tidal, and any combustible material, climate change policies have focused especially on nations’ electricity grids, and in Canada cleaning up electricity is viewed as critical to meeting climate pledges.

Canada’s electricity grid consists of ten separate provincial grids that are weakly connected by transmission interties to adjacent grids and, in some cases, to electricity systems in the United States. At times, these interties are helpful in addressing small imbalances between electricity supply and demand so as to prevent brownouts or even blackouts, and are a source of export revenue for provinces that have abundant hydroelectricity, such as British Columbia, Manitoba, and Quebec.

Due to generally low intertie capacities between provinces, electricity trade is generally a very small proportion of total generation, though electricity has been a national climate success in recent years. Essentially, provincial grids are stand alone, generating electricity to meet domestic demand (known as load) from the lowest cost local resources.

Because climate change policies have focused on electricity (viz., wind and solar energy, electric vehicles), and Canada will need more electricity to hit net-zero according to the IEA, this study employs information from the Alberta electricity system to provide an estimate of the possible costs of reducing national CO2 emissions related to power generation. The Alberta system serves as an excellent case study for examining the potential for eliminating fossil-fuel generation because of its large coal fleet, favourable solar irradiance, exceptional wind regimes, and potential for utilizing BC’s reservoirs for storage.

Using a model of the Alberta electricity system, we find that it is infeasible to rely solely on renewable sources of energy for 100 percent of power generation—the costs are prohibitive. Under perfect conditions, however, CO2 emissions from the Alberta grid can be reduced by 26 to 40 percent by eliminating coal and replacing it with renewable energy such as wind and solar, and gas, but by more than 75 percent if nuclear power is permitted. The associated costs are estimated to be some $1.4 billion per year to reduce emissions by at most 40 percent, or $1.9 billion annually to reduce emissions by 75 percent or more using nuclear power (an option not considered feasible at this time).

Based on cost estimates from Alberta, and Ontario’s experience with subsidies to renewable energy, and warnings that the switch from fossil fuels to electricity could cost about $1.4 trillion, the costs of relying on changes to electricity generation (essentially eliminating coal and replacing it with renewable energy sources and gas) to reduce national CO2 emissions by about 7.4 percent range from some $16.8 to $33.7 billion annually. This constitutes some 1–2 percent of Canada’s GDP.

The national estimates provided here are conservative, however. They are based on removing coal-fired power from power grids throughout Canada. We could not account for scenarios where the scale of intermittency turned out worse than indicated in our dataset—available wind and solar energy might be lower than indicated by the available data. To take this into account, a reserve market is required, but the costs of operating such a capacity market were not included in the estimates provided in this study. Also ignored are the costs associated with the value of land in other alternative uses, the need for added transmission lines, environmental and human health costs, and the life-cycle costs of using intermittent renewable sources of energy, including costs related to the disposal of hazardous wastes from solar panels and wind turbines.

Related News

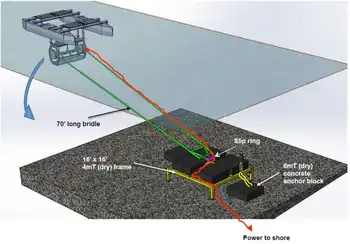

Is tidal energy the surge remote coastal communities need?

BC Tidal Energy Micro-Grids harness predictable tidal currents to replace diesel in remote Indigenous coastal communities, integrating marine renewables, storage, and demand management for resilient off-grid power along Vancouver Island and Haida Gwaii.

Key Points

Community-run tidal turbines and storage deliver reliable, diesel-free electricity to remote B.C. coastal communities.

✅ Predictable power from tidal currents reduces diesel dependence

✅ Integrates storage, demand management, and microgrid controls

✅ Local jobs via marine supply chains and community ownership

Many remote West Coast communities are reliant on diesel for electricity generation, which poses a number of negative economic and environmental effects.

But some sites along B.C.’s extensive coastline are ideal for tidal energy micro-grids that may well be the answer for off-grid communities to generate clean power, suggested experts at a COAST (Centre for Ocean Applied Sustainable Technologies) virtual event Wednesday.

There are 40 isolated coastal communities, many Indigenous communities, and 32 of them are primarily reliant on diesel for electricity generation, said Ben Whitby, program manager at PRIMED, a marine renewable energy research lab at the University of Victoria (UVic).

Besides being a costly and unreliable source of energy, there are environmental and community health considerations associated with shipping diesel to remote communities and running generators, Whitby said.

“It's not purely an economic question,” he said.

“You've got the emissions associated with diesel generation. There's also the risks of transporting diesel … and sometimes in a lot of remote communities on Vancouver Island, when deliveries of diesel don't come through, they end up with no power for three or four days at a time.”

The Heiltsuk First Nation, which suffered a 110,000-litre diesel spill in its territorial waters in 2016, is an unfortunate case study for the potential environmental, social, and cultural risks remote coastal communities face from the transport of fossil fuels along the rough shoreline.

A U.S. barge hauling fuel for coastal communities in Alaska ran aground in Gale Pass, fouling a sacred and primary Heiltsuk food-harvesting area.

There are a number of potential tidal energy sites near off-grid communities along the mainland, on both sides of Vancouver Island, and in the Haida Gwaii region, Whitby said.

Tidal energy exploits the natural ebb and flow of the coast’s tidal water using technologies like underwater kite turbines to capture currents, and is a highly predictable source of renewable energy, he said.

Micro-grids are self-reliant energy systems drawing on renewables from ocean, wave power resources, wind, solar, small hydro, and geothermal sources.

The community, rather than a public utility like BC Hydro, is responsible for demand management, storage, and generation with the power systems running independently or alongside backup fuel generators — offering the operators a measure of energy sovereignty.

Depending on proximity, cost, and renewable solutions, tidal energy isn’t necessarily the solution for every community, Whitby noted, adding that in comparison to hydro, tidal energy is still more expensive.

However, the best candidates for tidal energy are small, off-grid communities largely dependent on costly fossil fuels, Whitby said.

“That's really why the focus in B.C. is at a smaller scale,” he said.

“The time it would take (these communities) to recoup any capital investment is a lot shorter.

“And the cost is actually on a par because they're already paying a significant amount of money for that diesel-generated power.”

Lisa Kalynchuk, vice-president of research and innovation at UVic, said she was excited by the possibilities associated with tidal power, not only in B.C., but for all of Canada’s coasts.

“Canada has approximately 40,000 megawatts available on our three coastlines,” Kalynchuk said.

“Of course, not all this power can be realized, but it does exist, so that leads us to the hard part — tapping into this available energy and delivering it to those remote communities that need it.”