Canada's race to net-zero and the role of renewable energy

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Canada Net-Zero demands renewable energy deployment, leveraging hydropower to integrate wind, solar, and storage, scaling electrification, cutting oil and gas emissions, aligning policy, carbon pricing, and investment to deliver a clean grid by 2050.

Key Points

A national goal to cut emissions 40-45% by 2030 and reach economy-wide net-zero by 2050 through clean electrification.

✅ Hydropower balances intermittent wind and solar.

✅ Policy, carbon pricing, and investment accelerate deployment.

✅ Clean energy jobs surge as oil and gas decline.

As the UN climate talks draw near, Canada has enormous work left to do to reach its goals of reducing greenhouse gas emissions. Collectively, Canadians have to cut overall greenhouse-gas emissions by 40 to 45 per cent below 2005 levels by 2030 and achieve net-zero by 2050 across the economy.

And whereas countries like the U.K. have dramatically slashed their emissions levels, Canada's one of the few nations where emissions keep skyrocketing, and where fossil fuel extraction keeps increasing every year despite our climate targets.

Changes in national emissions and fossil fuel extraction since 1950, for G7 nations plus Norway and Australia

Graphic by Barry Saxifrage in Sep.15 article,Canada's climate solution? Keep increasing fossil fuels extraction.

Given its track record, and the IEA's finding that Canada will need more electricity to hit net-zero, how will Canada achieve its goal of getting to net-zero by 2050?

As Trudeau seeks to cement his political legacy, these are the MPs he’s considering for cabinet

By Andrew Perez | Opinion | October 25th 2021

In the upcoming online Conversations event on Thursday, 11 a.m. PT/2 p.m. ET, host and Canada's National Observer deputy managing editor David McKie will discuss how cleaning up Canada's electricity and renewable energy can put the country on track to hitting its targets with Clean Energy Canada executive director Merran Smith, Canadian Institute for Climate Choices senior economist Dale Beugin, and WaterPower Canada CEO Anne-Raphaëlle Audouin.

Getting to net-zero grid through renewable electricity

“If we wanted to be powered by 100 per cent renewable electricity, including proposals for a fully renewable electricity grid by 2030, Canada is one of the countries where this is actually possible,” said Audouin.

She says for that to happen, it would take a slate of clean energy providers working together to fill the gaps, rather than competing for market dominance.

“You couldn't power Canada just with wind and solar, even with batteries. That being said, renewables happen to work very well together ” she said. “Hydropower already makes up more than 90 per cent of Canada’s renewable generation and 60 per cent of the country’s total electricity needs are currently met thanks to this flexible, dispatchable, abundant source of baseload renewable electricity. It isn’t a stretch of the imagination to envision hydropower and wind and solar working increasingly together to clean up our grid. In fact, hydropower already backs up and allows intermittent renewable energies like wind and solar onto the grid.”

She noted that while hydropower alone won't be the solution, its long history and indisputable suite of attributes — hydroelectricity has been in Canada since the 1890s — will make it a key part of the clean energy transition required to replace coal, natural gas and oil, which still make up around 20 per cent of Canada's power sources.

Canada's vast access to water, wind, biomass, solar, geothermal, and ocean energy, and a federal government that has committed to climate goals, makes us well-positioned to lead the way to a net-zero future and eventually the electrification of our economy. So, what's holding the country back?

The new reality for renewables

According to Clean Energy Canada, it's possible to grow the clean energy sector, but only if businesses invest massively in renewables and governments give guidance and oversight informed by the implications of decarbonizing Canada's electricity grid research.

A recent modelling study from Clean Energy Canada and Navius Research exploring the energy picture here in Canada over the next decade shows our clean energy sector is expected to grow by about 50 per cent by 2030 to around 640,000 people. Already, the clean energy industry provides 430,500 jobs — more than the entire real estate sector — and that growth is expected to accelerate as our dependence on oil and gas decreases. In fact, clean energy jobs in Alberta are predicted to jump 164 per cent over the next decade.

Currently, provinces with the most hydropower generation are also the ones with the lowest electricity rates, reflecting that electricity has been a nationwide climate success in Canada. Wind and solar are now on par, or even more competitive, than natural gas, and that could have big implications for other major sectors of the economy. Grocery giant Loblaws (which owns brands including President's Choice, Joe Fresh, and Asian grocery chain T&T) deployed its fleet of fully electric delivery trucks in recent years, and Hydro-Québec just signed a $20-billion agreement to help power and decarbonize the state of New York over the next 25 years.

In The New Reality, Smith writes that many carbon-intensive industries, such as the mining sector, could also potentially benefit from the increased demand for certain natural resources — like lithium and nickel — as the world switches to electric vehicles and clean power.

“Oil and gas may have dominated Canada’s energy past, but it’s Canada’s clean energy sector that will define its new reality,” Smith emphasized.

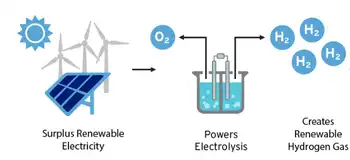

Despite its vast potential to be one of the world's clean energy leaders, Canada has a long way to getting on the path to net zero. Even though the country is home to some of the world's leading cleantech companies, such as B.C.-based clean hydrogen fuel cell providers Ballard Power and Loop Energy and Nova Scotia-based carbon utilization company CarbonCure, the country continues to expand fossil fuel extraction to the point that emissions are projected to jump to around 1,500 MtCO2 worth by 2030.