Power plants see a shift to natural gas

By Centre Daily Times

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Within the next 20 years, natural gas is expected to replace coal as the nationÂ’s dominant source of energy, some analysts believe.

ItÂ’s a change thatÂ’s being speeded by tougher Environmental Protection Agency regulations on coal use, as well as public backlash to the Fukushima Daiichi nuclear plant disaster in Japan.

“It’s really a game-changing fuel at least for the next 10 to 20 years,” said Doug Biden, president of the Electric Power Generation Association, a trade group representing wholesale power suppliers in Pennsylvania, Maryland, New Jersey and Ohio.

On March 17, the EPA announced it would seek to limit emissions of mercury, arsenic and other pollutants from coal-fired power plants, citing its authority under the Clean Air Act to address public health concerns. The rules, which are expected to be finalized by November, will require dirtier coal-fired power plants to be equipped with scrubbers and other pollution control equipment to make their emissions cleaner.

About one-quarter of all coal-fired power plants in the country will have to either add pollution controls, switch to a cleaner fuel, or retire, according to M.J. Bradley & Associates, an energy consulting firm. In Pennsylvania, between 10 and 12 power plants — around 30 percent — will require some kind of retrofit, Biden said.

“Owners of those plants have some very hard decisions to make now,” Biden said. “They have to look at the forward prices of electricity, the relative cost of coal versus natural gas, and whether it makes sense to retire those mostly older, smaller coal-fired power plants.”

Converting older coal-fired plants to natural gas is often not cost-efficient. Building a new natural gas-burning power plant costs about half as much as building a new coal plant, and one-sixth as much as a new nuclear facility, Biden said. And thereÂ’s less regulation involved.

“It takes a much shorter period of time to build a new gas plant relative to coal or nuclear, as you don’t have to go through a long, involved licensing process that could take four or five years before breaking ground,” Biden said.

Just as important to would-be power plant builders, natural gas has collected a degree of support from environmental groups. Natural gas, when burned, spews 80 percent less sulfur dioxide and nitrogen dioxide, coughs up roughly half the carbon dioxide as coal and emits no mercury — the main pollutant targeted in the new EPA rules.

“Burning of coal is dirty in so many different ways,” said Jeff Schmidt, director of the Sierra Club’s Pennsylvania Chapter. “So we do believe coal-fired power plants should be phased out and, in some cases, we believe that replacement should involve natural gas.”

Schmidt made clear his group’s opposition to the construction of any new nuclear projects in Pennsylvania, calling nuclear power “dangerous, dirty and hugely expensive.”

Perhaps the biggest factor driving the push toward new natural gas plants, according to several industry officials, is the newfound abundance of easily captured domestic supplies from so-called unconventional plays, such as the Marcellus Shale.

“We are certainly aware of the potential that Marcellus Shale has to really change the way that companies look at where they’re going to get their energy in the future,” said PPL spokesman George Lewis. PPL operates five coal, three natural gas and one nuclear power plant in Pennsylvania.

Natural gas is now far less expensive than other energy sources and is likely to stay that way for decades, said Exelon CEO John Rowe in a speech at the American Enterprise Institute on March 8. That, more than any other factor, is what drove his company to announce that it will retire, rather than upgrade, two coal-fired plants outside Philadelphia by May, he said.

“The thing causing conversion isn’t EPA mandates, it’s basic economics,” Rowe said.

Executives such as Rowe, preaching the promise of the future of natural gas for domestic consumption, have reached an eager audience in pipeline companies working to build infrastructure out of the Marcellus play. Pipeline companies have announced potential projects to bring gas to areas as far away as Canada and the Carolinas to serve the power industryÂ’s increasing demand for the fuel.

“We’ve been approached by a number of parties inquiring about moving Marcellus Shale gas to the Southeast,” said Colin Harper, an executive with NiSource, a pipeline company. “We see tremendous growth opportunities in the Southeast with EPA regulations expected to lead to coal plants being converted to gas.”

Bob Riga, general manager of marketing at Spectra Energy, said his company sees an opportunity in the Midwest, where it is predicted a large number of coal-fired power plants will become gas-powered facilities.

“Changes — namely the conversion of power plants to natural gas-fire generation, driven by the phasing out of coal — we think that could be a big opportunity for us and for producers tying into our system in the coming years,” he said.

A steady, low-cost supply of natural gas from Marcellus Shale, coupled with high coal prices due to increased demand from China, has changed the power generation industryÂ’s outlook on natural gas as a fuel source, Biden said.

“Three years ago, people from the electric industry would have depicted the growing reliance on natural gas as a potential reliability problem because we had hurricanes Katrina and Rita fresh in our mind and there was this fear that supply could be cut off at any time, especially in summer, when maximum demand occurs,” Biden said.

“With the discovery of this resource right under our feet, Marcellus Shale, that concern goes away... there’s an expectation of relative price stability that nobody had before.”

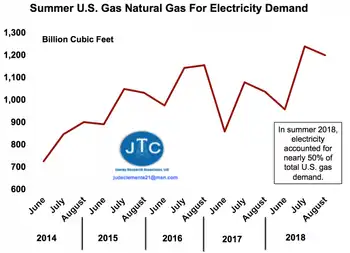

The shift may already be under way. Gas usage in the utility sector was up 6 percent in the first half of 2010 compared with the first half of 2009. Energy consulting firm Black and Veatch estimates coalÂ’s market share will fall from 48 percent to 22 percent by 2035, while natural gas will grow from a 21 percent market share to 40 percent in 2035.

While broad-based support has formed around natural gas as a path forward in the energy sector, from the president of Exelon to the president of the United States, some analysts have warned the coalition could be short-lived.

Schmidt, of the Sierra Club, referred to natural gas as a temporary solution and called for a move to renewable resources such as solar and wind power. Lewis, of PPL, said coal “still has a really important role to play in generating electricity.”

Morten Sissener, president of Power Industry Consulting, an energy consulting firm, said if issues regarding wastewater management canÂ’t be resolved in a way that makes the drilling process more environmentally friendly, natural gas stands to lose its position of primacy in energy markets. If more regulations are placed on drilling to protect the environment, the price of gas could rise to the point where it would no longer be cheaper than coal.

“The potential dark cloud hanging over Marcellus has to do with environmental impacts associated with drilling, water contamination and wastewater,” Sissener said. “Whether that controversy remains marginal or steps into the forefront of the debate about the viability of that method of drilling, that’s the unknown.”