TotalEnergies VSB Acquisition accelerates renewable energy growth, expanding wind and solar portfolios across Germany and Europe, advancing decarbonization, net-zero targets, and the energy transition through a US$1.65 billion strategic clean power investment.

Key Points

A US$1.65B deal: TotalEnergies acquires VSB to scale wind and solar in Europe and advance net-zero goals.

✅ US$1.65B purchase expands wind and solar pipeline

✅ Strengthens presence in Germany and wider Europe

✅ Advances net-zero, energy transition objectives

In a major move to expand its renewable energy portfolio, French energy giant TotalEnergies has announced its decision to acquire German renewable energy developer VSB for US$1.65 billion. This acquisition represents a significant step in TotalEnergies' strategy to accelerate its transition from fossil fuels to greener energy sources, aligning with the global push towards sustainability and carbon reduction, as reflected in Europe's green surge across key markets.

Strengthening TotalEnergies’ Renewable Energy Portfolio

TotalEnergies has long been one of the largest players in the global energy market, historically known for its oil and gas operations. However, in recent years, the company has made a concerted effort to diversify its portfolio and shift its focus toward renewable energy. The purchase of VSB, a leading developer of wind and solar energy projects, occurs amid rising European wind investment trends and is a clear reflection of TotalEnergies' commitment to this green energy transition.

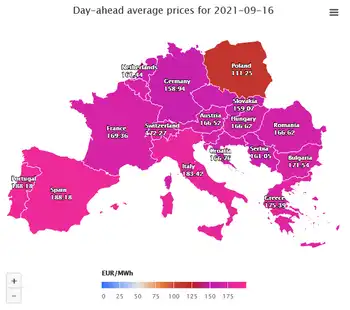

VSB, based in Dresden, Germany, specializes in the development, construction, and operation of renewable energy projects, particularly wind and solar power. The company has a significant presence in Europe, with a growing portfolio of projects in countries like Germany, where clean energy accounts for 50% of electricity today, Poland, and the Czech Republic. The acquisition will allow TotalEnergies to bolster its renewable energy capacity, particularly in the wind and solar sectors, which are key components of its long-term sustainability goals.

By acquiring VSB, TotalEnergies is not only increasing its renewable energy output but also gaining access to a highly experienced team with a proven track record in energy project development. This move is expected to expedite TotalEnergies’ renewable energy ambitions, enabling the company to build on VSB’s strong market presence and established partnerships across Europe.

VSB’s Strategic Role in the Energy Transition

VSB’s expertise in the renewable energy sector makes it a valuable addition to TotalEnergies' green energy strategy. The company has been at the forefront of the energy transition in Europe, particularly in wind energy development, as offshore wind is set to become a $1 trillion business over the coming decades. Over the years, VSB has completed numerous large-scale wind projects, including both onshore and offshore installations.

The acquisition also positions TotalEnergies to better compete in the rapidly growing European renewable energy market, including the UK, where offshore wind is powering up alongside strong demand due to increased governmental focus on achieving net-zero emissions by 2050. Germany, in particular, has set ambitious renewable energy targets as part of its Energiewende initiative, which aims to reduce the country’s carbon emissions and increase the share of renewables in its energy mix. By acquiring VSB, TotalEnergies is not only enhancing its capabilities in Germany but also gaining a foothold in other European markets where VSB has operations.

With Europe increasingly shifting toward wind and solar power as part of its decarbonization efforts, including emerging solutions like offshore green hydrogen that complement wind buildouts, VSB’s track record of developing large-scale, sustainable energy projects provides TotalEnergies with a strong competitive edge. The acquisition will further TotalEnergies' position as a leader in the renewable energy space, especially in wind and solar power generation.

Financial and Market Implications

The US$1.65 billion deal marks TotalEnergies' largest renewable energy acquisition in recent years and underscores the growing importance of green energy investments within the company’s broader business strategy. TotalEnergies plans to use this acquisition to scale up its renewable energy assets and move closer to its target of achieving net-zero emissions by 2050. The deal also positions TotalEnergies to capitalize on the expected growth of renewable energy across Europe, particularly in countries with aggressive renewable energy targets and incentives.

The transaction is also expected to boost TotalEnergies’ presence in the global renewable energy market. As the world increasingly turns to wind, solar, and other sustainable energy sources, TotalEnergies is positioning itself to be a major player in the global energy transition. The acquisition of VSB complements TotalEnergies' previous investments in renewable energy and further aligns its portfolio with international sustainability trends.

From a financial standpoint, TotalEnergies’ purchase of VSB reflects the growing trend of large energy companies investing heavily in renewable energy. With wind and solar power becoming more economically competitive with fossil fuels, this investment is seen as a prudent long-term strategy, one that is likely to yield strong returns as demand for clean energy continues to rise.

Looking Ahead: TotalEnergies' Green Transition

TotalEnergies' acquisition of VSB is part of the company’s broader strategy to diversify its energy offerings and shift away from its traditional reliance on oil and gas. The company has already made significant strides in renewable energy, with investments in solar, wind, and battery storage projects across the globe, as developments like France's largest battery storage platform underline this momentum. The VSB acquisition will only accelerate these efforts, positioning TotalEnergies as one of the foremost leaders in the clean energy revolution.

By 2030, TotalEnergies plans to allocate more than 25% of its total capital expenditure to renewable energies and electricity. The company has already set ambitious goals to reduce its carbon footprint and shift its business model to align with the global drive toward sustainability. The integration of VSB into TotalEnergies’ portfolio signals a firm commitment to these goals, ensuring the company remains at the forefront of the energy transition.

In conclusion, TotalEnergies’ purchase of VSB for US$1.65 billion marks a significant milestone in the company’s renewable energy journey. By acquiring a company with deep expertise in wind and solar power development, TotalEnergies is taking decisive steps to strengthen its position in the renewable energy market and further its ambitions of achieving net-zero emissions by 2050. This acquisition will not only enhance the company’s growth prospects but also contribute to the ongoing global shift toward clean, sustainable energy sources.

Related News