How Electricity Gets Priced in Europe and How That May Change

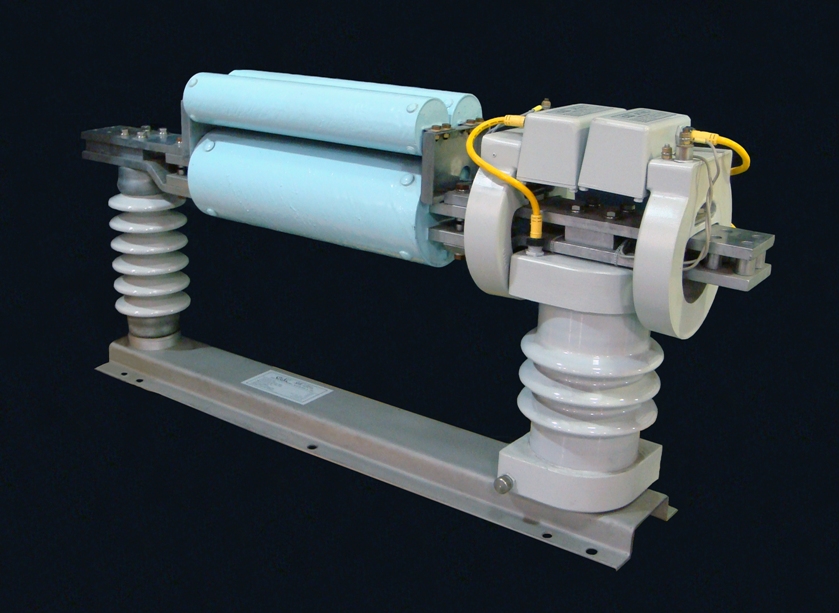

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

EU Power Market Overhaul targets soaring electricity prices by decoupling gas from power, boosting renewables, refining price caps, and stabilizing grids amid inflation, supply shocks, droughts, nuclear outages, and intermittent wind and solar.

Key Points

EU plan to redesign electricity pricing, curb gas-driven costs, boost renewables, and protect consumers from volatility.

✅ Decouples power prices from marginal gas generation

✅ Caps non-gas revenues to fund consumer relief

✅ Supports grid stability with storage, demand response, LNG

While energy prices are soaring around the world, Europe is in a particularly tight spot. Its heavy dependence on Russian gas -- on top of droughts, heat waves, an unreliable fleet of French nuclear reactors and a continent-wide shift to greener but more intermittent sources like solar and wind -- has been driving electricity bills up and feeding the highest inflation in decades. As Europe stands on the brink of a recession, and with the winter heating season approaching, officials are considering a major overhaul of the region’s power market to reflect the ongoing shift from fossil fuels to renewables.

1. How is electricity priced?

Unlike oil or natural gas, there’s no efficient way to save lots of electricity to use in the future, though projects to store electricity in gas pipes are emerging. Commercial use of large-scale batteries is still years away. So power prices have been set by the availability at any given moment. When it’s really windy or sunny, for example, then more is produced relatively cheaply and prices are lower. If that supply shrinks, then prices rise because more generators are brought online to help meet demand -- fueled by more expensive sources. The way the market has long worked is that it is that final technology, or type of plant, needed to meet the last unit of consumption that sets the price for everyone. In Europe this year, that has usually meant natural gas.

2. What is the relationship between power and gas?

Very close. Across western Europe, gas plants have been a vital part of the energy infrastructure for decades, with Irish price spikes highlighting dispatchable power risks, fed in large part by supplies piped in from Siberia. Gas-fired plants were relatively quick to build and the technology straightforward, at least compared with nuclear plants and burns cleaner than coal. About 18% of Europe’s electricity was generated at gas plants last year; in 2020 about 43% of the imported gas came from Russia. Even during the depths of the Cold War, there’d never been a serious supply problem -- until the relationship with Russia deteriorated this year after it invaded Ukraine. Diversifying away from Russia, such as by increasing imports of liquefied natural gas, requires new infrastructure that takes a lot of time and money.

3. Why does it work this way?

In theory, the relationship isn’t different from that with coal, for example. But production hiccups and heatwave curbs on plants from nuclear in France to hydro in Spain and Norway significantly changed the generation picture this year, and power hit records as plants buckled in the heat. Since coal-fired and nuclear plants are generally running all the time anyway, gas plants were being called upon more often -- at times just to keep the lights on as summer temperatures hit records. And with the war in Ukraine resulting in record gas prices, that pushed up overall production costs. It’s that relationship that has made the surging gas price the driver for electricity prices. And since the continent is all connected, it has pushed up prices across the region. The value of the European power market jumped threefold last year, to a record 836 billion euros ($827 billion today).

4. What’s being considered?

With large parts of European industry on its knees and households facing jumps in energy bills of several hundred percent, as record electricity prices ripple through markets, the pressure on governments and the European Union to intervene has never been higher. One major proposal is to impose a price cap on electricity from non-gas producers, with the difference between that and the market price channeled to relief for consumers. While it sounds simple, any such changes would rip up a market design that’s worked for decades and could threaten future investments because of unintended consequences.

5. How did this market evolve?

The Nordic region and the British market were front-runners in the 1990s, then Germany followed and is now the largest by far. A trader can buy and sell electricity delivered later on same day in blocks of an hour or even down to 15-minute periods, to meet sudden demand or take advantage of price differentials. The price for these contracts is decided entirely by the supply and demand, how much the wind is blowing or which coal plants are operating, for example. Demand tends to surge early in the morning and late afternoon. This system was designed when fossil fuels provided the bulk of power. Now there are more renewables, which are less predictable, with wind and solar surpassing gas in EU generation last year, and the proposed changes reflect that shift.

6. What else have governments done?

There are also traders who focus on longer-dated contracts covering periods several years ahead, where broader factors such as expected economic output and the extent to which renewables are crowding out gas help drive prices. This year’s wild price swings have prompted countries including Germany, Sweden and Finland to earmark billions of euros in emergency liquidity loans to backstop utilities hit with sudden margin calls on their trading.