Reregulating power

By Baltimore Sun

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

While it's clear that Maryland's 1999 deregulation law was deeply flawed, and while the recent transition to market prices was more painful than it needed to be, Baltimore's relatively high electricity rates are only part of the problem. Reliability is just as important an issue. If not addressed, Baltimore-area residents could face the prospect of blackouts or brownouts on hot summer days as early as 2011.

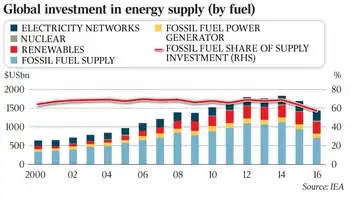

The issues of price and reliability are closely related and stem from a dysfunctional market for power. As a net importer of electricity, the Baltimore-Washington area has limited options - put in more power lines, build more (or expand existing) power plants, invest in conservation measures, or pursue some combination of the three.

Two major new transmission lines have been approved by PJM Interconnection, the organization that coordinates wholesale electricity supplies for the region. They could help, but neither is likely to be completed in three years, nor would they fully solve the problem.

Conservation and alternative energy sources could also prove helpful, but they, too, have their limits. It's all very well to buy energy-saving appliances, but Maryland's power capacity shortfall - potentially 1,500 megawatts (roughly the equivalent of Constellation's Brandon Shores plant) in five years - is bigger then that.

Adding sufficient capacity would certainly solve the problem, but whether Constellation Energy and other generators in the region are willing to make the investment remains to be seen. The catch is that the lack of capacity and congestion on the grid allow generators to charge more, a strong disincentive to invest in risky infrastructure.

More will be known when PJM conducts auctions next month and in May to determine where the grid's power will likely come from in 2011 and 2012, but Maryland needs to develop a sound regulatory strategy. It could, for instance, be advantageous to require Baltimore Gas and Electric to lock into long-term contracts as an incentive for companies to invest more in new generation.

Members of the Public Service Commission are scheduled to begin briefing lawmakers on some of those options tomorrow. The grim reality is that the high prices BGE customers pay today aren't going away; that's the nature of the marketplace. But things could get a lot worse in the not-too-distant future and it's up to the PSC, as well as Governor O'Malley and the General Assembly, to do a better job of regulating the electric system than those who came before them.