Energy goal a moving target for states

By New York Times

CSA Z462 Arc Flash Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Yet the experience of states that have adopted similar goals suggests that passing that requirement could be a lot easier than achieving it. The record so far is decidedly mixed: some states appear to be on track to meet energy targets, but others have fallen behind on the aggressive goals they set several years ago.

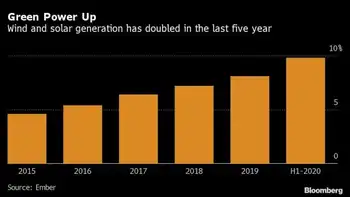

The state goals have contributed to rapid growth of wind turbines and solar power stations in some areas, notably the West, but that growth has come on a minuscule base. Nationwide, the hard numbers provide a sobering counterpoint to the green-energy enthusiasm sweeping Washington.

Al Gore is running advertisements claiming the nation could switch entirely to renewable power within a decade. But most experts do not see how. Even with the fast growth of recent years, less than 3 percent of the nationÂ’s electricity is coming from renewable sources, excepting dams.

“I think we are really overselling how quick, how easy and how complete the transition can be,” said George Sterzinger, executive director of the Renewable Energy Policy Project, a Washington advocacy group.

More than half the states have adopted formal green-energy goals. In many states the policies, known as renewable portfolio standards, are too new to be evaluated. But so far the number of successes and failures is “sort of a 50-50 kind of affair,” said Ryan Wiser, a scientist at Lawrence Berkeley National Laboratory and co-author of a recent report on the targets.

Connecticut and Massachusetts have made their utilities pay for missing targets, and utilities in Arizona and Nevada are lagging. California and New York appear almost certain to miss deadlines that are looming in the next few years.

A few states have met their goals, or even exceeded them. One big success has been Texas, which has capitalized on a wind power boom and already exceeded its 2015 goal. The state gets 4.5 percent of its electricity from the turbines. New MexicoÂ’s big utilities are at 6 percent renewable power, within striking distance of the stateÂ’s 10 percent goal by 2011.

The structure and aggressiveness of the targets varies widely among states — some have been able to meet their goals because they set relatively modest ones in the first place.

For instance, Maine set a goal of 30 percent renewable power by 2000 — an impressive-sounding target that was essentially meaningless because the state was already getting close to half its electricity from sources that counted against the goal, including dams. (A more recent law requires development of new renewables in Maine.)

In those states that set aggressive goals and have had trouble meeting them, a big hurdle has been building power lines that could transmit the electricity, Mr. Wiser said. Another has been the utilitiesÂ’ inability to secure enough long-term contracts to buy renewable power.

While the country has no shortage of entrepreneurs hoping to build wind turbines and solar arrays, they have been slowed by problems like finding suitable sites, overcoming local political opposition and securing financing. In a few cases, including some in upstate New York, allegations have been made that the developers bribed officials to win approval of their projects.

Many energy experts embrace renewable power standards as a policy mechanism to promote green energy, but with a nationwide standard starting to seem likely once Barack Obama and the new Congress take power, these experts are ratcheting down expectations of what can be achieved in the near term.

In fact, as utilities seek to meet growing electricity demand, they still turn most often to fossil fuels, rather than the sun or wind.

In New England, the trend is to build more plants that run on natural gas and oil, not wind, said Gordon van Welie, chief executive of the entity that operates New EnglandÂ’s power grid.

Similarly in California, John White, executive director of the Center for Energy Efficiency and Renewable Technology in Sacramento, noted that since 2002, when state legislators passed a renewables requirement, the state has installed 16 times as much capacity from natural gas plants than from renewable energy.

Indeed, California is the prime example of a state reaching high and falling short on renewable-power goals. Big utilities there are supposed to get 20 percent of their electricity from renewable sources by 2010, and most are expected to miss that deadline.

San Diego Gas & Electric gets a mere 6 percent of electricity from renewable sources, and the state’s other big utilities — Pacific Gas & Electric and Southern California Edison — are at 14 and 15.7 percent, which includes some dams. (The Edison number is a 2007 figure; the other two are more recent.)

Fines for missing the targets can run to $25 million a year, but because of fine print in the regulations, the San Diego utility and Pacific Gas & Electric said they did not expect to incur fines; a representative for Southern California Edison said he was not sure.

The utilities cited a catalog of reasons for falling short. These include stop-and-start federal tax incentives for renewable power, problems finding reliable suppliers among the many young and fragile start-ups in the industry, and difficulty getting transmission lines built and obtaining permits to build solar stations and wind farms.

“Not every part of the country is equally blessed in terms of having locations for renewables,” said Debra L. Reed, president and chief executive of San Diego Gas & Electric, which is having trouble getting new transmission lines built to an area with a lot of sunshine.

Moreover, for utilities, the effective goals keep changing. As customers’ electricity use rises, so does the amount of renewable-derived electricity the utilities must produce to meet their targets. “When you’re judged based on customer demand, you’re always chasing a moving target,” said Stuart R. Hemphill, vice president of Southern California Edison, which serves a fast-growing population.

New York is another case study. The state gets 19 percent of its electricity from decades-old hydroelectric plants, well above the national average. It wants to add another 5 percentage points with other renewables by 2013, but transmission is a barrier, and the state has not secured nearly enough renewable electricity to meet its goal.

Even in states that are making good progress toward their targets — like Texas, New Mexico and Wisconsin, according to Mr. Wiser — efforts could be undermined by the still-unfolding credit crisis. The squeeze is falling especially hard on renewable energy projects, because nearly all the expenses for such plants are upfront capital costs financed by debt, with little in “pay as you go” costs like fuel.

Small solar start-ups are being hit hard, but bigger companies face challenges, too. The billionaire Texas oilman T. Boone Pickens wants to build a huge wind project in the panhandle of Texas, but even he has been hampered by difficulty borrowing money.

The only mechanism the states have to force utilities into line is to fine them for not meeting the targets, but such costs would ultimately be passed on to electricity customers or company shareholders, neither of whom would look favorably on politicians who imposed such a burden in tough times.

That may explain why most of the penalties issued to date have been modest. In 2006, the payments totaled around $18 million for Massachusetts and $5.6 million for Connecticut, and virtually nothing in any other state, according to Mr. WiserÂ’s report.

Despite the difficulties, the power quotas have proved politically popular — so some states are trying to raise their targets. California’s governor, Arnold Schwarzenegger, is undeterred by the state’s difficulty meeting its present target; he signed an executive order recently raising California’s target to 33 percent of power from renewables by 2030. Minnesota and Massachusetts have recently raised their quotas.

Experts said that without far more attention to the practical barriers, including the lack of lines to carry power, those new goals will be as difficult to meet as the old ones.

A national standard, if the government decided to impose one, would put an even greater premium on new power lines, because more electricity would need to be moved from parts of the country with abundant wind and sunshine to the great cities where power is consumed.

Mr. Wiser said, “It comes down in a lot of ways to transmission, ultimately.”