Juneau forced to cope with sudden energy shortage

By Associated Press

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

"We sold all our clothespins the first day," said Doug White, general manager at Don Abel Building Supplies. "I don't think kids even knew what they were for, but they're learning now."

Avalanches in mid-April knocked down transmission lines and cut off Juneau's source of low-cost hydroelectric power. Threatened with a fivefold increase in utility bills, Juneau quickly powered down.

Stores, though open, went partially dark. Neon signs were switched off and vending machines unplugged. At home, residents of this former Gold Rush town began living a little bit like pioneers, dusting the snow off the grill, stringing clotheslines in the backyard and flicking off their TV sets. Within a week, electrical usage across town was down as much as 30 percent.

Energy conservation is a hard sell in much of the U.S., but Juneau has proved that people will change their ways if the financial incentives are big enough.

"Turn off, turn down, unplug," said Sarah Lewis, chairwoman of the Juneau Commission on Sustainability. "That's what everyone is doing and being vigilant about and commenting when others are not."

The April 16 snow slides that roared out of the mountains some 25 miles southeast of town uprooted transmission towers and plowed through 1.5 miles of high-voltage lines that link this largely isolated community of 30,000 to the Snettisham hydroelectric dam. As back-up diesel generators shouldered the load, the electric company began warning customers that life in Juneau - already expensive - was about to get a lot more so.

With oil prices reaching a record $120 a barrel, Alaska Electric Light and Power said customers might have to pay for an extra $25 million in diesel over the three months it will take to repair the lines. The utility warned that rates would probably leap from an average of 11 cents per kilowatt-hour to more than 50 cents, or about five times the 10.3 cents that is the national average.

Conversations all over town turned to kilowatt hours, tariff rates and saving energy.

Heidi Graves said her 16-year-old son, Levi - the one who never would turn off his Nintendo - was the first to get on board. He was worried that the family of six would have to cancel its vacation next August.

Levi multiplied the electric bill by five and came up with $950. "It's more than our house payment," said his mother.

Now members of the Graves family eat dinner by candlelight, do dishes by hand, plan to dry their clothes on a rack by the wood stove, and limit their time on the computer.

"My husband has bruised himself and tripped over the dog just to keep the lights off," Graves said.

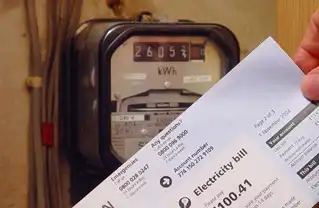

Graves also ordered a history of past electrical use so that the family could ferret out which appliances were the real power hogs, and they learned how to read their own electric meter, which they are now doing several times a day.

Though the Graves heat solely with wood, perhaps one in five houses in Juneau is wired for electric heat because hydroelectric power is relatively cheap and natural gas is unavailable.

In part because Juneau is so far removed from the Lower 48 and is inaccessible by road, its cost of living is 34.5 percent higher than that of the average U.S. city, and its housing costs are 50 percent higher, according to a survey of 300 American cities. Even an oil change is $60, twice what it costs in many places down south.

Residents will see the sobering new rates on paper - and the early results of their conservation efforts - as the first electric bills are set to begin arriving in mailboxes.

Energy expert Allen Meier of California's Lawrence Berkeley National Laboratory is visiting Juneau to offer advice on the crisis. He said the closest comparison may be Brazil in 2001, when severe drought gripped the hydropower-dependent country. Brazilians were told to reduce their electricity usage by 20 percent or be disconnected.

"In two months, the whole country cut their demand by 20 percent and they never really returned to the same level of consumption after that," Meier said.

Eighth-grader Matthew Staley is hoping the people of Juneau will likewise develop new habits over the course of three months, and "realize that - wow - we have to keep this up. Like switching to fluorescent lights, they'll just keep on with them."