Lake Erie Connector Investment advances a 1,000 MW HVDC transmission link connecting Ontario to the PJM Interconnection, enhancing grid reliability, clean power trade, and GHG reductions through a public-private partnership led by CIB and ITC.

Key Points

A $1.7B public-private HVDC project linking Ontario and PJM to boost reliability, cut GHGs, and enable clean power trade.

✅ 1,000 MW, 117 km HVDC link between Ontario and PJM

✅ $655M CIB and $1.05B private financing, ITC to own-operate

✅ Cuts system costs, boosts reliability, reduces GHG emissions

The Canada Infrastructure Bank (CIB) and ITC Investment Holdings (ITC) have signed an agreement in principle to invest $1.7 billion in the Lake Erie Connector project.

Under the terms of the agreement, the CIB will invest up to $655 million or up to 40% of the project cost. ITC, a subsidiary of Fortis Inc., and private sector lenders will invest up to $1.05 billion, the balance of the project's capital cost.

The CIB and ITC Investment Holdings signed an agreement in principle to invest $1.7B in the Lake Erie Connector project.

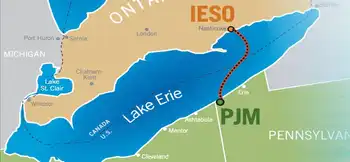

The Lake Erie Connector is a proposed 117 kilometre underwater transmission line connecting Ontario with the PJM Interconnection, the largest electricity market in North America, and aligns with broader regional efforts such as the Maine transmission line to import Quebec hydro to strengthen cross-border interconnections.

The 1,000 megawatt, high-voltage direct current connection will help lower electricity costs for customers in Ontario and improve the reliability and security of Ontario's energy grid, complementing emerging solutions like battery storage across the province. The Lake Erie Connector will reduce greenhouse gas emissions and be a source of low-carbon electricity in the Ontario and U.S. electricity markets.

During construction, the Lake Erie Connector is expected to create 383 jobs per year and drive more than $300 million in economic activity, and complements major clean manufacturing investments like a $1.6 billion battery plant in the Niagara Region that supports the EV supply chain. Over its life, the project will provide 845 permanent jobs and economic benefits by boosting Ontario's GDP by $8.8 billion.

The project will also help Ontario to optimize its current infrastructure, avoid costs associated with existing production curtailments or shutdowns. It can leverage existing generation capacity and transmission lines to support electricity demand, alongside new resources such as the largest battery storage project planned for southwestern Ontario.

ITC continues its discussions with First Nations communities and is working towards meaningful participation in the near term and as the project moves forward to financial close.

The CIB anticipates financial close late in 2021, pending final project transmission agreements, with construction commencing soon after. ITC will own the transmission line and be responsible for all aspects of design, engineering, construction, operations and maintenance.

ITC acquired the Lake Erie Connector project in August 2014 and it has received all necessary regulatory and permitting approvals, including a U.S. Presidential Permit and approval from the Canada Energy Regulator.

This is the CIB's first investment commitment in a transmission project and another example of the CIB's momentum to quickly implement its $10B Growth Plan, amid broader investments in green energy solutions in British Columbia that support clean growth.

Endorsements

This project will allow Ontario to export its clean, non-emitting power to one of the largest power markets in the world and, as a result, benefit Canadians economically while also significantly contributing to greenhouse gas emissions reductions in the PJM market. The project allows Ontario to better manage peak capacity and meet future reliability needs in a more sustainable way. This is a true win-win for both Canada and the U.S., both economically and environmentally.

Ehren Cory, CEO, Canada Infrastructure Bank

The Lake Erie Connector has tremendous potential to generate customer savings, help achieve shared carbon reduction goals, and increase electricity system reliability and flexibility. We look forward to working with the CIB, provincial and federal governments to support a more affordable, customer-focused system for Ontarians.

Jon Jipping, EVP & COO, ITC Investment Holdings Inc., a subsidiary of Canadian-based Fortis Inc.

We are encouraged by this recent announcement by the Canada Infrastructure Bank. Mississaugas of the Credit First Nation has an interest in projects within our historic treaty lands that have environmental benefits and that offer economic participation for our community.

Chief Stacey Laforme, Mississaugas of the Credit First Nation

While our evaluation of the project continues, we recognize this project can contribute to the economic resilience of our Shareholder, the Mississaugas of the Credit First Nation. Subject to the successful conclusion of our collaborative efforts with ITC, we look forward to our involvement in building the necessary infrastructure that enable Ontario's economic engine.

Leonard Rickard, CEO, Mississaugas of the Credit Business Corporation

The Lake Erie Connector demonstrates the advantages of public-private partnerships to develop critical infrastructure that delivers greater value to Ontarians. Connecting Ontario's electricity grid to the PJM electricity market will bring significant, tangible benefits to our province. This new connection will create high-quality jobs, improve system flexibility, and allow Ontario to export more excess electricity to promote cost-savings for Ontario's electricity consumers.

Greg Rickford, Minister of Energy, Northern Development and Mines, Minister of Indigenous Affairs

With the US pledging to achieve a carbon-free electrical grid by 2035, Canada has an opportunity to export clean power, helping to reduce emissions, maximizing clean power use and making electricity more affordable for Canadians. The Lake Erie Connector is a perfect example of that. The Canada Infrastructure Bank's investment will give Ontario direct access to North America's largest electricity market - 13 states and D.C. This is part of our infrastructure plan to create jobs across the country, tackle climate change, and increase Canada's competitiveness in the clean economy, alongside innovation programs like the Hydrogen Innovation Fund that foster clean technology.

Quick Facts

- The Lake Erie Connector is a 1,000 megawatt, 117 kilometre long underwater transmission line connecting Ontario and Pennsylvania.

- The PJM Interconnection is a regional transmission organization coordinating the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

- The project will help to reduce electricity system costs for customers in Ontario, and aligns with ongoing consultations on industrial electricity pricing and programs, while helping to support future capacity needs.

- The CIB is mandated to invest CAD $35 billion and attract private sector investment into new revenue-generating infrastructure projects that are in the public interest and support Canadian economic growth.

- The investment commitment is subject to final due diligence and approval by the CIB's Board.

Related News