BC Hydro Electricity Imports shape CleanBC claims as Powerex trades cross-border electricity, blending hydro with coal and gas supplies, affecting emissions, grid carbon intensity, and how electric vehicles and households assess "clean" power.

Key Points

Powerex buys power for BC Hydro, mixing hydro with coal and gas, shifting emissions and affecting CleanBC targets.

✅ Powerex trades optimize price, not carbon intensity

✅ Imports can include coal- and gas-fired generation

✅ Emissions affect EV and CleanBC decarbonization claims

British Columbians naturally assume they’re using clean power when they fire up holiday lights, juice up a cell phone or plug in a shiny new electric car.

That’s the message conveyed in advertisements for the CleanBC initiative launched by the NDP government, amid indications that residents are split on going nuclear according to a survey, which has spent $3.17 million on a CleanBC “information campaign,” including almost $570,000 for focus group testing and telephone town halls, according to the B.C. finance ministry.

“We’ll reduce air pollution by shifting to clean B.C. energy,” say the CleanBC ads, which feature scenic photos of hydro reservoirs. “CleanBC: Our Nature. Our Power. Our Future.”

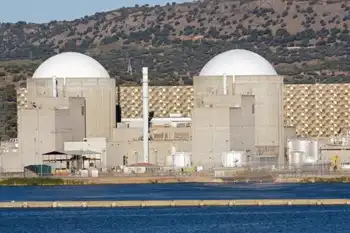

Yet despite all the bumph, British Columbians have no way of knowing if the electricity they use comes from a coal-fired plant in Alberta or Wyoming, a nuclear plant in Washington, a gas-fired plant in California or a hydro dam in B.C.

Here’s why.

BC Hydro’s wholly-owned corporate subsidiary, Powerex Corp., exports B.C. power when prices are high and imports power from other jurisdictions when prices are low.

In 2018, for instance, B.C. imported more electricity than it exported — not because B.C. has a power shortage (it has a growing surplus due to the recent spate of mill closures and the commissioning of two new generating stations in B.C.) but because Powerex reaps bigger profits when BC Hydro slows down generators to import cheaper power, especially at night.

“B.C. buys its power from outside B.C., which we would argue is not clean,” says Martin Mullany, interim executive director for Clean Energy BC.

“A good chunk of the electricity we use is imported,” Mullany says. “In reality we are trading for brown power” — meaning power generated from conventional ‘dirty’ sources such as coal and gas.

Wyoming, which generates almost 90 per cent of its power from coal, was among the 12 U.S. states that exported power to B.C. last year. (Notably, B.C. did not export any electricity to Wyoming in 2018.)

Utah, where coal-fired power plants produce 70 per cent of the state’s energy amid debate over the costs of scrapping coal-fired electricity, and Montana, which derives about 55 per cent of its power from coal, also exported power to B.C. last year.

So did Nebraska, which gets 63 per cent of its power from coal, 15 per cent from nuclear plants, 14 per cent from wind and three per cent from natural gas.

Coal is responsible for about 23 per cent of the power generated in Arizona, another exporter to B.C., while gas produces about 44 per cent of the electricity in that state.

In 2017, the latest year for which statistics are available, electricity imports to B.C. totalled just over 1.2 million tonnes of carbon dioxide emissions, according to the B.C. environment ministry — roughly the equivalent of putting 255,000 new cars on the road, using the U.S. Environmental Protection Agency’s calculation of 4.71 tonnes of annual carbon emissions for a standard passenger vehicle.

These figures far outstrip the estimated local and upstream emissions from the contested Woodfibre LNG plant in Squamish that is expected to release annual emissions equivalent to 170,000 new cars on the road.

Import emissions cast a new light on B.C.’s latest “milestone” announcement that 30,000 electric cars are now among 3.7 million registered vehicles in the province.

BC Electric Vehicles Announcement Horgan Heyman Mungall Weaver

In November of 2018 the province announced a new target to have all new light-duty cars and trucks sold to be zero-emission vehicles by the year 2040. Photo: Province of B.C. / Flickr

“Making sure more of the vehicles driven in the province are powered by BC Hydro’s clean electricity is one of the most important steps to reduce [carbon] pollution,” said the November 28 release from the energy ministry, noting that electrification has prompted a first call for power in 15 years from BC Hydro.

Mullany points out that Powerex’s priority is to make money for the province and not to reduce emissions.

“It’s not there for the cleanest outcome,” he said. “At some time we have to step up to say it’s either the money or the clean power, which is more important to us?”

Electricity bought and sold by little-known, unregulated Powerex

These transactions are money-makers for Powerex, an opaque entity that is exempt from B.C.’s freedom of information laws.

Little detailed information is available to the public about the dealings of Powerex, which is overseen by a board of directors comprised of BC Hydro board members and BC Hydro CEO and president Chris O’Reilly.

According to BC Hydro’s annual service plan, Powerex’s net income ranged from $59 million to $436 million from 2014 to 2018.

“We will never know the true picture. It’s a black box.”

Powerex’s CEO Tom Bechard — the highest paid public servant in the province — took home $939,000 in pay and benefits last year, earning $430,000 of his executive compensation through a bonus and holdback based on his individual and company performance.

“The problem is that all of the trade goes on at Powerex and Powerex is an unregulated entity,” Mullany says.

“We will never know the true picture. It’s a black box.”

In 2018, Powerex exported 8.7 million megawatt hours of electricity to the U.S. for a total value of almost $570 million, according to data from the Canada Energy Regulator. That same year, Powerex imported 9.6 million megawatt hours of electricity from the U.S. for almost $360 million.

Powerex sold B.C.’s publicly subsidized power for an average of $87 per megawatt hour in 2018, according to the Canada Energy Regulator. It imported electricity for an average of $58 per megawatt hour that year.

In an emailed statement in response to questions from The Narwhal, BC Hydro said “there can be a need to import some power to meet our electricity needs” due to dam reservoir fluctuations during the year and from year to year.

‘Impossible’ to determine if electricity is from coal or wind power

Emissions associated with electricity imports are on average “significantly lower than the emissions of a natural gas generating plant because we mostly import electricity from hydro generation and, increasingly, power produced from wind and solar,” BC Hydro claimed in its statement.

But U.S. energy economist Robert McCullough says there’s no way to distinguish gas and coal-fired U.S. power exports to B.C. from wind or hydro power, noting that “electrons lack labels.”

Similarly, when B.C. imports power from Alberta, where generators are shifting to gas and 48.5 per cent of electricity production is coal-fired and 38 per cent comes from natural gas, there’s no way to tell if the electricity is from coal, wind or gas, McCullough says.

“It really is impossible to make that determination.”

Wyoming Gilette coal pits NASA

The Gillette coal pits in Wyoming, one of the largest coal-producers in the U.S. Photo: NASA Earth Observatory

Neither the Canada Energy Regulator nor Statistics Canada could provide annual data on electricity imports and exports between B.C. and Alberta.

But you can watch imports and exports in real time on this handy Alberta website, which also lists Alberta’s power sources.

In 2018, California, Washington and Oregon supplied considerably more power to B.C. than other states, according to data from Canada Energy Regulator.

Washington, where about one-quarter of generated power comes from fossil fuels, led the pack, with more than $339 million in electricity exports to B.C.

California, which still gets more than half of its power from gas-fired plants even though it leads the U.S. in renewable energy with substantial investments in wind, solar and geothermal, was in second place, selling about $18.4 million worth of power to B.C.

And Oregon, which produces about 43 per cent of its power from natural gas and six per cent from coal, exported about $6.2 million worth of electricity to B.C. last year.

By comparison, Nebraska’s power exports to B.C. totalled about $1.6 million, Montana’s added up to $1.3 million, Nevada’s were about $706,000 and Wyoming’s were about $346,000.

Clean electrons or dirty electrons?

Dan Woynillowicz, deputy director of Clean Energy Canada, which co-chaired the B.C. government’s Climate Solutions and Clean Growth Advisory Council, says B.C. typically exports power to other jurisdictions during peak demand.

Gas-fired plants and hydro power can generate electricity quickly, while coal-fired power plants take longer to ramp up and wind power is variable, Woynillowicz notes.

“When you need power fast and there aren’t many sources that can supply it you’re willing to pay more for it.”

Woynillowicz says “the odds are high” that B.C. power exports are displacing dirty power.

Elsewhere in Canada, analysts warn that Ontario's electricity could get dirtier as policies change, raising similar concerns.

“As a consumer you never know whether you’re getting a clean electron or a dirty electron. You’re just getting an electron.”

Related News