National Grid warns of short supply of electricity over next few days

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

National Grid power supply warning highlights electricity shortage risks amid low wind output, generator outages, and cold weather, reducing capacity margins and grid stability; considering demand response and reserve power to avoid blackout risk.

Key Points

An alert that reduced capacity from low wind and outages requires actions to maintain UK grid stability.

✅ Low wind output and generator outages reduce capacity margins

✅ ESO exploring demand response and reserve generation options

✅ Aim: maintain grid stability and avoid blackout risk

National Grid has warned that Britain’s electricity will be in short supply over the next few days after a string of unplanned power plant outages and unusually low wind speeds this week, as cheap wind power wanes across the system.

The electricity system operator said it will take action to “make sure there is enough generation” during the cold weather spell, including virtual power plants and other demand-side measures, to prevent a second major blackout in as many years.

“Unusually low wind output coinciding with a number of generator outages means the cushion of spare capacity we operate the system with has been reduced,” the company told its Twitter followers.

“We’re exploring measures and actions to make sure there is enough generation available to increase our buffer of capacity.”

A spokeswoman for National Grid said the latest electricity supply squeeze was not expected to be as severe as recorded last month, following reports that the government’s emergency energy plan was not going ahead, and added that the company did not expect to issue an official warning in the next 24 hours.

“We’re monitoring how the situation develops,” she said.

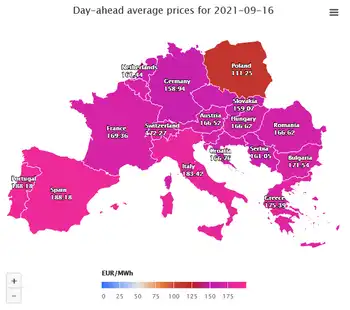

The warning is the second from the electricity system operator in recent weeks. In mid-September the company issued an official warning to the electricity market as peak power prices climbed, that its ‘buffer’ of power reserves had fallen below 500MW and it may need to call on more power plants to help prevent a blackout. The notice was later withdrawn.

Concerns over National Grid’s electricity supplies have been relatively rare in recent years. It was forced in November 2015 to ask businesses to cut their demand as a “last resort” measure to keep the lights on after a string of coal plant breakdowns.

But since then, National Grid’s greater challenge has been an oversupply of electricity, partly due to record wind generation, which has threatened to overwhelm the grid during times of low electricity demand.

National Grid has already spent almost £1bn on extra measures to prevent blackouts over the first half of the year by paying generators to produce less electricity during the coronavirus lockdown, as daily demand fell.

The company paid wind farms to turn off, and EDF Energy to halve the nuclear generation from its Sizewell B nuclear plant, to avoid overwhelming the grid when demand for electricity fell by almost a quarter from last year.

The electricity supply squeeze comes a little over a year after National Grid left large parts of England and Wales without electricity after the biggest blackout in a decade left a million homes in the dark. National Grid blamed a lightning strike for the widespread power failure.

Similar supply strains have recently caused power cuts in China, underscoring how weather and generation mix can trigger blackouts.