Fish boom prompts energy conglomerate to spend $14.5M to bury subsea cables

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Maritime Link Cable Burial safeguards 200-kV subsea cables in the Cabot Strait as Emera and Nova Scotia Power trench lines to mitigate bottom trawling risks from a redfish boom, ensuring Muskrat Falls hydro delivery.

Key Points

Trenching Cabot Strait subsea power cables to prevent redfish-driven bottom trawling and ensure Muskrat Falls power.

✅ $14.492M spent trenching 59 km at 400 m depth

✅ Protects 200-kV, 170-km subsea interconnects from trawls

✅ Driven by Gulf redfish boom; DFO and UARB consultations

The parent company of Nova Scotia Power disclosed this week to the Utility and Review Board, amid Site C dam watchdog attention to major hydro projects, that it spent almost $14,492,000 this summer to bury its Maritime Links cables lying on the floor of the Cabot Strait between Newfoundland and Cape Breton.

It's a fish story no one saw coming, at least not Halifax-based energy conglomerate Emera.

The parent company of Nova Scotia Power disclosed this week to the Utility and Review Board that it spent almost $14,492,000 this summer to bury its Maritime Link cables lying on the floor of the Cabot Strait between Newfoundland and Cape Breton.

The cables were protected because an unprecedented explosion in the redfish population in the Gulf of St Lawrence is about to trigger a corresponding boom in bottom trawling in the area.

Also known as ocean perch, redfish were not on anyone's radar when the $1.5-billion Maritime Link was designed and built to carry Muskrat Falls hydroelectricity from Newfoundland to Nova Scotia.

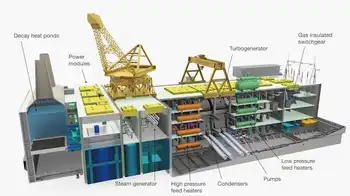

The two 200-kilovolt electrical submarine cables spanning the Cabot Strait are the longest in North America, compared with projects like the New England Clean Power Link planned further south. They are each 170 kilometres long and weigh 5,500 tonnes.

Nova Scotia Power customers are paying for the Maritime Link in return for a minimum of 20 per cent of the electricity generated by Muskrat Falls over 35 years.

The electricity is supposed to start sending first electricity through the Maritime Link in mid-2020.

First time cost disclosed

In August, the company buried 59 kilometres of subsea cables one metre below the bottom at depths of 400 metres.

"These cables had not been previously trenched due to the absence of fishing activities at those depths when the cables were originally installed," spokesperson Jeff Myrick wrote in an email to CBC News in October.

Ratepayers will get the bill next year, as utilities also face risks like copper theft that can drive costs in the region. Until now, the company had declined to release costs relating to protecting the Maritime Link.

The bill will be presented to regulators, a process that has affected projects such as a Manitoba Hydro line to Minnesota, when the company applies to recover Maritime Link costs from Nova Scotia Power ratepayers in 2020.

Myrick said the company was acting after consultation with the Department of Fisheries and Oceans.

Unexpected consequences

After years of overfishing in the 1980s and early 1990s, redfish quotas were slashed and a moratorium imposed on some redfish.

Confusingly, there are actually two redfish species in the Gulf of St. Lawrence.

But very strong recent year classes, that have coincided with warming waters in the gulf, as utilities adapt to climate change considerations grow, have produced redfish in massive numbers.

After years of overfishing, the redfish population is now booming in the Gulf of St. Lawrence. (Submitted by Marine Institute)

There is now believed to be three-million tonnes of redfish in the Gulf of St Lawrence.

The Department of Fisheries and Oceans is expected to increase quotas in the coming years and the fishing industry is gearing up in a big way.

Earlier this month, Scotia Harvest announced it will begin construction of a new $14-million fish plant in Digby next spring in part to process increased redfish catches.