A towering problem

By Knight Ridder Tribune

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The latest proposal is part of a three-phased project that would raise the towers 30 feet taller to add a second 115-kilovolt line from Stevensburg to East Chandler Street. It would impact about seven miles encompassing Culpeper National Cemetery, a row of eight houses on the edge of town near railroad tracks, a new subdivision called Mountain Brook Estates, development along Route 3, vacant lots and county farmland.

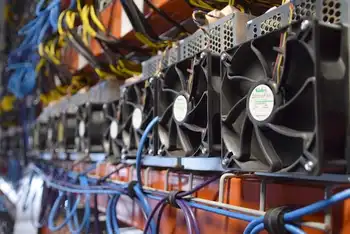

The Richmond-based power company says upgrading the line is critical to serve future development, specifically Terremark Worldwide, Inc. - a high-tech data center locating in Culpeper County that could require 20 times more energy than an average offic building.

Dominion's use permit request to construct new utility poles is just part of the project. The lines would feed into a new substation, proposed by Rappahannock Electric Cooperative. A substation is an energy distribution system that reduces power voltage to make it safe for residential, commercial and industrial consumption.

REC says it has the power in its existing facilities to serve Terremark as it undergoes the first phase of construction. But at full build out, Terremark would require capacity for more power. Planning Director John Egertson supports both the substation and new power lines, pending input from the public and impacted landowners.

Culpeper County's Planning Commission will facilitate a public hearing for those who wish to comment. Serving more customers Dominion spokeswoman Le-Ha Anderson said the line is not upgrading in volts but rather capacity. The existing towers carry 115 kilovolts.

Dominion plans to replace these wires with thicker ones to carry the same voltage. A second 115kv line would also be added to the same poles, creating a double circuit. Thicker lines allow for more electricity to push through the wires, which allows Dominion to serve more customers. The National Electric Safety Code requires adequate space between each line for safety reasons, which is why Dominion must raise the towers from 50 feet to 80 feet tall.

Anderson said Dominion would remove the current wooden H-frame structures and replace them with 80-feet tall steel towers that look similar to telephone poles. Since the poles would be taller, more space is required between each one, which means Dominion could replace the lines with fewer towers than currently exist. Dominion only needs county approval to proceed with its project. It would like to begin construction in November and complete it by March 2008. The State Corporation Commission - the agency tasked with approving new transmission lines - only gets involved when lines contain 138 kilovolts or more.

Dominion is currently going through the SCC process for its proposed 500kv line that would run th ough Culpeper County's Jefferson District as part of Dominion's 240-mile long line to serve northern Virginia.

With Culpeper named the sixth fastest growing county in the state, according to a University of Virginia study released in January, Dominion says it is experiencing an increase in demand for electricity. Dominion serves about 3,900 customers in Culpeper County. Two of those customers also provide power, including the Town of Culpeper and Rappahannock Electric Cooperative.

Dominion brings electricity via transmission lines to the town and provides electric transportation for REC. Terremark would be a direct customer of REC, which Anderson said accelerated the need for the power upgrade. The new lines and substation would also serve future development in the county's Technology Zone around McDevitt Drive.

"Eventually because of all the growth we would need to do some upgrades," she said. "But because of Terremark we really had to." Robert Ellis, REC's vice president of engineering and operations, said REC would like to build the proposed Mountain Run substation by early next year.

"It will aid us to serve additional economic growth in that area," Ellis said, adding that substations are designed for future expansion and are usually built to last about 25 years.

"We have the responsibility to provide electrical service in our territory and ultimately we will need a large substation to serve all of that growth." Over the last six months, Ellis said REC has been searching for a good site and, now that one is secured, it needs county approval to proceed with the substation. He added that it would locate off McDevitt Drive, out of sight and landscaped, in a corner adjacent to the town's wastewater treatment plant.

Once REC's new substation is built, Anderson said Dominion would then build two more transmission lines. One would run from the Mountain Run facility to its substation in Remington. The second line would run from Mountain Run to its Oak Green substation in Locust Grove. Both would contain 115 kilovolts and would span about five miles. These lines would also require county approval. This would constitute phase two of the project, which Dominion would like begun by March 2008.

The final phase of the three-pronged project would entail a permanent one-mile line from Mountain Run to Culpeper. When Dominion rebuilds the 115kv line, Anderson said it would initially be on a temporary line.

In Egertson's staff report, he says the impacts are moderate.

"Except for re-routing the line slightly to access a new substation," the document reads, "the line follows existing power line right-of-way and does not require expansion of the right-of-way."

The property owner impacted by the slight departure from the existing right-of-way to access the substation has cooperated in choosing the location for both the line and the REC substation, according to the report. This specific piece of property contains about 150 acres and is currently vacant, though could become a site for future development.

The report also states that the "proposal provides for critical utility infrastructure for the Technology Zone area and is vital for additional economic growth." Egertson said he feels Dominion and REC have justified the need for the new lines and substation. While he prefers underground lines, he does not think it's practical for the county to push for that.

"They have some pretty good reasons why they don't want to do that," Egertson said, "cost, they don't have underground rights so they'd have to renegotiate the entire easement, and they don't have time to do that." Dominion says the cost of burying lines is five to 10 times higher than above-ground lines.

Underground lines make power outages harder to identify, links from overhead to underground involve several unsightly poles and the underground lines must be patrolled twice per week, which is an imposition on property owners, the report states.

Egertson is anxious to hear what the public has to say regarding the project. "But from a planner's standpoint sitting on the sideline it seems to me that they've justified the need," he said. "And although they are taller poles, there will be fewer of them, so I'm hoping the landowners affected will actually see that as a benefit."