Monopoly feared in wind generation

By Toronto Star

Arc Flash Training - CSA Z462 Electrical Safety

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Lewis had come to Peterborough to apply for wind power sites on Ontario Crown land. He had arrived 11 hours before the provincial Ministry of Natural Resources would begin accepting applications – at 8 a.m., Wednesday, Feb. 20.

He found himself just fifth in line, and under previous ministry rules he would have had an excellent chance to get the sites where his two-year-old Environmental Electric Co. Inc. planned to erect wind turbines to generate electricity.

But the ministry changed the rules in January. It created a winner-take-all process that could allow the first in line – Toronto-based SkyPower Corp. – to virtually control all the remaining locations in Ontario where wind power might be effective and profitable.

The stakes are high. Control of these sites potentially means millions in profits as Ontario switches its power sources from traditional to renewable.

Just before the ministry office opened, SkyPower's plan became clear to those shivering in the line when a car pulled up and handed over five file boxes to the company's line-sitters. Lewis estimated they contained at least 200 application forms, enough for sites totalling nearly one million hectares. In one chunk, the area would be bigger than Algonquin Provincial Park.

"We thought, 'uh oh, (the ministry) made a big mistake here,'" Lewis says. "They opened it up to a land rush.... It allows one company to monopolize all the Crown land."

Officials are now assessing applications, which cost $1,000 each.

About 87 per cent of Ontario – or roughly 94 million hectares, mainly in the North – is Crown land, but only a small fraction of that is suitable for wind power. The recent opening also included applications for offshore sites in Lakes Ontario, Erie and Huron.

With most of the likely sites on private land already taken, this opening of the provincially owned Crown land was "probably one of the last opportunities to get the better sites" that are left, says Gary Pundsack, senior business development manager with Invenergy, which sat sixth in line and had been seeking 13 sites for development.

Lewis fears a monopoly will stifle innovation and lead to higher prices.

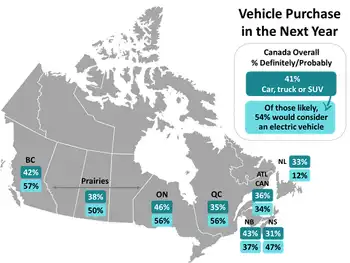

The effort to get sites, though, also signals that wind energy has moved from the fringe of electricity generation on to the main stage. In fact, it's attracting billions of dollars in investment across Canada, says the Canadian Wind Energy Association, based in Calgary.

No one is suggesting SkyPower did anything illegal or unethical. Criticism centres on the government policy and a result that few appear to have foreseen.

"I don't think anyone anticipated someone would submit a large number of applications," says Pundsack.

SkyPower president Kerry Adler says with evident pride that his company did, indeed, grab the front of the line and "made a large number of applications.... We took advantage of a great opportunity, as everyone had an opportunity to do." Neither he nor the ministry would reveal how many applications SkyPower filed or how much land they cover.

A team of 12 company staff spent a long time scouting sites, Adler says. Before the opening, "several members of our management team spent the night in parkas and sleeping bags. Whether we secured the windiest areas, that's competition at its finest."

Back in 2004, the province announced it would, from time to time, accept applications for wind power sites on its unoccupied Crown land. Applicants would be allowed to bid on blocks covering about 4,400 hectares – with a limit of three applications per company.

Trouble was, some applicants set up new companies, lots of them, to get around the restriction, says David Bauer, spokesperson for Natural Resources Minister Donna Cansfield.

The solution, quietly unveiled in January, was to remove the limit and assess applications on a first-come, first-served basis. The earliest application for any piece of land would take precedence: Competitors would get a crack at the property only if the ministry rejected the original bid – a decision based on whether the applicant has the technical and financial strength to go through the approvals and construction process.

Industry observers say that isn't much of a hurdle for SkyPower, which Adler calls, "one of the leading renewable energy companies in Canada."

Applicants need deep pockets and a lot of expertise because approval simply allows them to begin a process of testing wind potential and securing environmental and other approvals that can take up to six years before construction begins.

The ministry has no policy on whether the sites should go to one or several companies, Bauer says.