Eco fee adds to HST pain in Ontario

By National Post

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

So-called eco fees for thousands of new products came into effect on the same day as the HST. Unlike the unpopular new value-added tax, however, provincial authorities did virtually nothing to publicize the changes.

A government-issued list of new initiatives going into effect July 1 did not include the eco fees.

“People do not know about this,” said Conservative MPP Toby Barrett, who was informed of the changes by a local hardware store owner in his riding who called him over the weekend. “No question they were caught off guard. And I’ll be darned if I can find any information about this.”

A spokeswoman for Stewardship Ontario, the agency overseeing the new levies, said a $2.5-million media campaign to publicize the changes only began once the program went into effect.

“Our thinking is the best time to start with the public education campaign is when you actually have a program in place,” said Amanda Harper Sevonty. “If you do it farther out and they can’t get involved in recycling, I’m not sure how effective it would be.”

Liberal Environment Minister John Gerretsen was not available for comment.

The changes amount to a second round of products covered under the hazardous and special materials program — an industry-funded disposal and recycling initiative.

The new products include pharmaceuticals, syringes, glues, epoxies, mercury-containing devices and other corrosive, flammable and toxic materials.

The first round of products, which came into effect in 2008, covered paints, solvents, batteries, pesticides and pressurized containers.

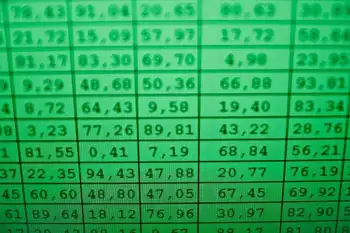

Eco fees on the next round of products range between two cents and several dollars per product. Camping fuel, propane, butane and household caulking are on the lower-cost end of the scale. They cost two cents per litre.

Fire extinguishers, however, are more expensive. Their price will jump between $2.22 and $6.66 per unit.

Ironically, compact fluorescent light CFL bulbs will be taxed at 22¢ per bulb, while old, incandescent, halogen and gas discharge bulbs are exempt. The McGuinty Liberals banned incandescent bulbs in favour of the more energy-efficient CFL bulbs by 2012.

However, each CFL bulb contains mercury, which could leak into the ground if disposed incorrectly.

Harper Sevonty said the eco fees are not strictly a tax. Stewardship Ontario charges industry based on production numbers. Industry is then left to recoup the new costs on their own.

“How they choose to manage that is not up to us,” she said. “We have no authority over that whatsoever.”

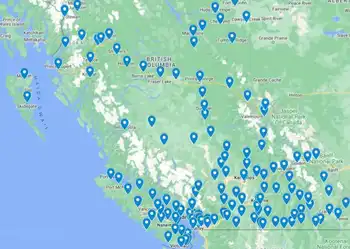

Under the program, 92 special municipal disposal sites exist throughout the province. A range of retailers also participate for specific products.

While some of the hazardous materials — such as paint and batteries — are recycled, others are not. Pesticides, solvents and fertilizers are treated, solidified and then sent to a landfill site.