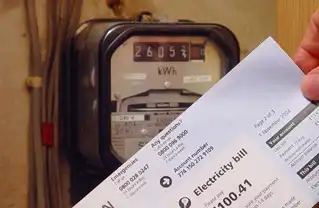

America looks to solar as power costs soar

By Reuters

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

After decades on the fringe, solar power is closing in on America's mainstream as surging fossil fuel prices and mounting concern over climate change spur states, businesses and homeowners into a quickening embrace with alternative energy.

Panels bolted to roofs to convert sunlight into electricity are still too expensive in most regions to compete with cheaper, less environmentally friendly fuels like coal without generous subsidies. Solar's high costs have kept the resource out of reach for many residences and businesses.

But not for long, industry analysts and scientists say.

The tipping point at which the world's cleanest, most renewable resource is cost-competitive with other sources of energy on electricity grids could happen within two to five years in some U.S. regions and countries if the price of fossil fuels continues to rise at its current pace, they add.

"In the long run - as in two to three years - you should see competitiveness especially with the grid in a number of regions in the world," said Vishal Shah, an analyst who tracks the industry at U.S. investment bank Lehman Brothers.

Tom Werner, chief executive of SunPower Corp, the largest North American solar company by sales, sees such "grid parity" for solar power in the United States and elsewhere happening in about five years, or possibly as soon as 2010.

"That's actually more aggressive than what we would say previously, and that's because the cost of electricity is going up faster than we had ever modeled," Werner said an interview at the Reuters Global Energy Summit.

"It is becoming more and more clear it is a real possibility, and we believe, a reality," he said.

Richard Feldt, chief executive of U.S. solar panel maker Evergreen Solar Inc, calls grid parity the industry's "Holy Grail" and sees it happening in about five years. "It's not far away," he said in an interview.

Suntech Power Holdings Co Ltd, one of the largest of a growing number of Chinese solar companies, sees the same five-year timeline, thanks to increasing supplies of silicon that will help drive down costs.

In the United States, much depends on November's U.S. presidential and congressional elections.

A Democratic win of the White House, and possibly greater Democratic control of Congress, could spur aggressive U.S. measures to limit climate-warming emissions of carbon dioxide -including legislation opposed by President George W. Bush that would cap emissions from 86 percent of U.S. facilities.

If passed, such cap-and-trade provisions would make it costlier to emit carbon into the atmosphere and discourage the burning of fossil fuels. The economics of solar and other cleaner energy sources would be more competitive.

Democrat Barack Obama wants to require U.S. utilities to generate 25 percent of their electricity from renewable sources like solar by 2025. Republican John McCain has campaigned on his support for alternative energy sources but Democrats have questioned his voting record on those issues in Congress.

"Obama or McCain would be better than Bush," said Feldt.

Although solar power is easily installed, building solar panels is expensive because of tight supplies of silicon, their costliest element. Most industry analysts expect a constraint on silicon supplies to end within two years. But they are divided on whether this would help or harm the industry.

Some say a drop in silicon prices would tip the scales from boom to bust by dramatically boosting supply of photovoltaic panels that make up 90 percent of sales in the industry.

Such panels use refined crystalline silicon. But rival technologies are emerging such as thin-film panels that require almost no silicon, raising the possibility of a costly battle in the industry over which type of solar power will dominate.

"The solar industry will look very different just two years from now," said Ted Sullivan, a senior analyst at Lux Research, a New York market consultancy.

He said he expects "a shake-out among companies that aren't prepared to thrive in this new environment - particularly crystalline silicon players that haven't invested in new thin-film technologies."

Those concerns have helped to cool red-hot solar panel stocks, a volatile sector that also faces uncertainty over whether the U.S. Congress will renew tax incentives that expire at the end of the year.

Shares in California-based SunPower Corp are down nearly 60 percent this year, Colorado-based Ascent Solar Technologies Inc has shed 50 percent and Evergreen has lost about 40 percent of its value this year.

That compares to a heady 2007 when industry leader SunPower rose 253 percent from the start of last year to the end, Ascent surged 785 percent and Evergreen shot up 134 percent.

Some analysts urge investors to look beyond volatility in the near term to a promising future for solar in energy-thirsty nations such as the United States, which could overtake Germany as the world's top solar market within four years, according to the European Photovoltaic Industry Association, a lobby body.

"While silicon oversupply in mid-2009 is likely to pressure companies' margins, we believe investors at some point will become comfortable with solar's improving costs," said Ronan Wolfsdorf, a solar and renewable energy analyst at consultants Macroenergy Monitor in Cambridge, Massachusetts.

"The solar market needs to cross this great divide, and a lot of that has to do with cost. But one thing to remember is that tougher regulations on emissions of carbon into the atmosphere are going to translate into higher prices for electricity produced by conventional sources," he said.

"That will make solar more competitive in the long run."

Under laws in 25 U.S. states and Washington D.C., solar and other clean energy sources such as wind must constitute up to 30 percent of a utility's energy portfolio in five to 15 years. Just 10 states had such requirements in 2003.

And some businesses are bringing solar to the masses. Engineers at computer maker Apple applied for a patent for solar panels that would power mobile devices like its popular iPod digital media player without plugging them in.

The 2007 World Series-winning Red Sox baseball club became the first professional sports team to go solar in May, installing solar hot water panels that will replace a third of the gas used to heat water at Boston's historic Fenway Park.

The United States - the world's fourth-largest solar power market after Germany, Japan and Spain - saw nearly 150 megawatts of solar capacity come online in 2007, up 45 percent from 2006, for a total of 750 megawatts, according to the Solar Energy Industries Association, a U.S. trade group.

That is about enough to power about 550,000 homes.

If its subsidies continue, the United States could generate as much power from solar panels as two-and-a-half typical nuclear reactors in four years - or about 2.55 gigawatts, according to the European Photovoltaic Industry Association's data.

That association sees global nuclear capacity reaching 44 gigawatts in four years - the equivalent to the power capacity of 44 nuclear reactors.