Second-Largest UK Grid Operator advancing electricity networks modernization, smart grid deployment, renewable integration, and resilient distribution, leveraging acquisitions, data analytics, and infrastructure upgrades to boost reliability, efficiency, and service quality across regions and energy sector.

Key Points

A growing electricity networks operator advancing smart grids, renewable integration, and reliability.

✅ Expanded via acquisitions and regional growth

✅ Investing in smart grid, data analytics, automation

✅ Enhancing reliability, resilience, renewable integration

In a significant shift within the UK’s energy sector, a major company has recently ascended to become the second-largest electricity networks operator in the country. This milestone marks a pivotal moment in the industry, reflecting ongoing changes and competitive dynamics in the energy landscape, such as the shift toward an independent system operator in Great Britain. The company's ascent underscores its growing influence and its role in shaping the future of energy distribution across the UK.

The company, whose identity is a result of strategic acquisitions and operational expansions, now holds a substantial position within the electricity networks sector. This new ranking is the result of a series of investments and strategic moves aimed at strengthening its network capabilities and, amid efforts to fast-track grid connections across the UK, expanding its geographical reach. By achieving this status, the company is set to play a crucial role in managing and maintaining the electricity infrastructure that serves millions of households and businesses across the UK.

The rise to the second-largest position follows a period of significant growth and transformation for the company. Recent acquisitions have enabled it to enhance its network infrastructure, integrate advanced technologies, adopting a more digital grid approach, and improve service delivery. These developments come at a time when the UK is undergoing a significant transition in its energy sector, driven by the need for modernization, sustainability, and resilience in response to evolving energy demands.

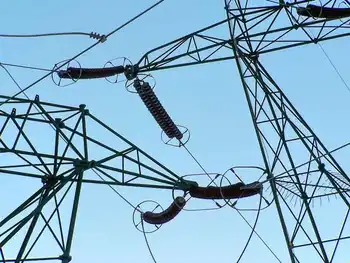

One of the key factors contributing to the company's new status is its focus on upgrading and expanding its electricity networks. Investments in modernizing infrastructure, such as the commissioning of a 2GW substation to boost capacity, incorporating smart grid technologies, and enhancing operational efficiencies have been central to its strategy. By leveraging cutting-edge technology and data analytics, the company is able to optimize network performance, reduce outages, and improve overall reliability.

The company’s expansion into new regions has also played a crucial role in its growth. By extending its network coverage, including assets like the London electricity tunnel that enhance supply routes, the company has been able to provide electricity to a larger customer base, increasing its market share and influence in the sector. This expansion not only enhances its position as a major player in the industry but also supports the broader goal of ensuring reliable and efficient electricity distribution across the UK.

The shift to becoming the second-largest operator also reflects broader trends in the UK energy sector. The industry is experiencing a period of consolidation and transformation, driven by regulatory changes, technological advancements, and the push towards decarbonization, with similar momentum seen in British Columbia's clean energy shift that underscores global trends. The company’s ascent is indicative of these broader dynamics, as firms adapt to new challenges and opportunities in a rapidly evolving market.

In addition to operational and strategic advancements, the company’s rise is aligned with the UK’s broader energy goals. The government has set ambitious targets for reducing carbon emissions and increasing the use of renewable energy sources. As a major electricity networks operator, the company is positioned to support these goals by integrating renewable energy into the grid, including projects like the Scotland-to-England subsea link that carry remote generation, enhancing energy efficiency, and contributing to the transition towards a low-carbon energy system.

The company’s new status also brings with it a range of responsibilities and opportunities. As one of the largest operators in the sector, it will have a significant role in shaping the future of electricity distribution in the UK. This includes addressing challenges such as grid reliability, energy security, and the integration of emerging technologies. The company’s ability to manage these responsibilities effectively will be crucial in ensuring that it continues to deliver value to customers and stakeholders.

The transition to becoming the second-largest operator is not without its challenges. The company will need to navigate a complex regulatory environment, manage stakeholder expectations, and address any operational issues that may arise from its expanded network. Additionally, the competitive nature of the energy sector means that the company will need to continuously innovate and adapt to maintain its position and drive further growth.

In summary, the company’s achievement of becoming the second-largest electricity networks operator in the UK represents a significant milestone in the energy sector. Through strategic acquisitions, infrastructure investments, and operational enhancements, the company has strengthened its position and expanded its reach. This development highlights the evolving landscape of the UK energy sector and underscores the importance of modernization and innovation in meeting the country’s energy needs. As the company moves forward, it will play a key role in shaping the future of electricity distribution and supporting the UK’s energy transition goals.

Related News